Question: need help with double declining balance method. please show all work On July 1, 2025, Novak Company purchased for $5,040,000 snow-making equipment having an estimated

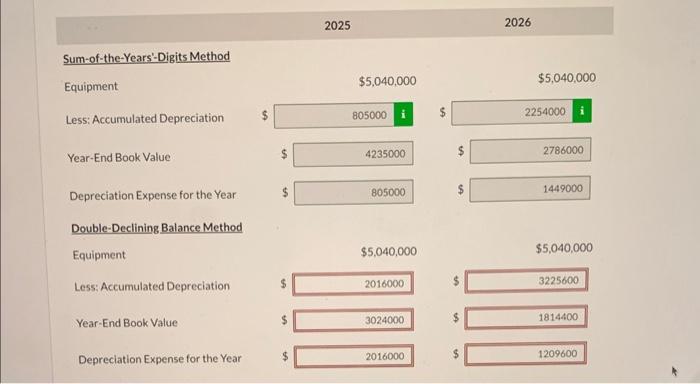

On July 1, 2025, Novak Company purchased for $5,040,000 snow-making equipment having an estimated useful life of 5 years with an estimated salvage value of $210,000. Depreciation is taken for the portion of the year the asset is used. (a) Your answer is partially correct. Complete the form below by determining the depreciation expense and year-end book values for 2025 and 2026 using: 1. Sum-of-the-year'-digits method. 2. Double-declining balance method. Sum-of-the-Years'-Digits Method Equipment 2025 2026 Less: Accumulated Depreciation Year-End Book Value Double-Declining Balance Method Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts