Question: Need help with just overall checking my work and making sure everything is correct as well as help with the last part. Thank you! Question

Need help with just overall checking my work and making sure everything is correct as well as help with the last part. Thank you!

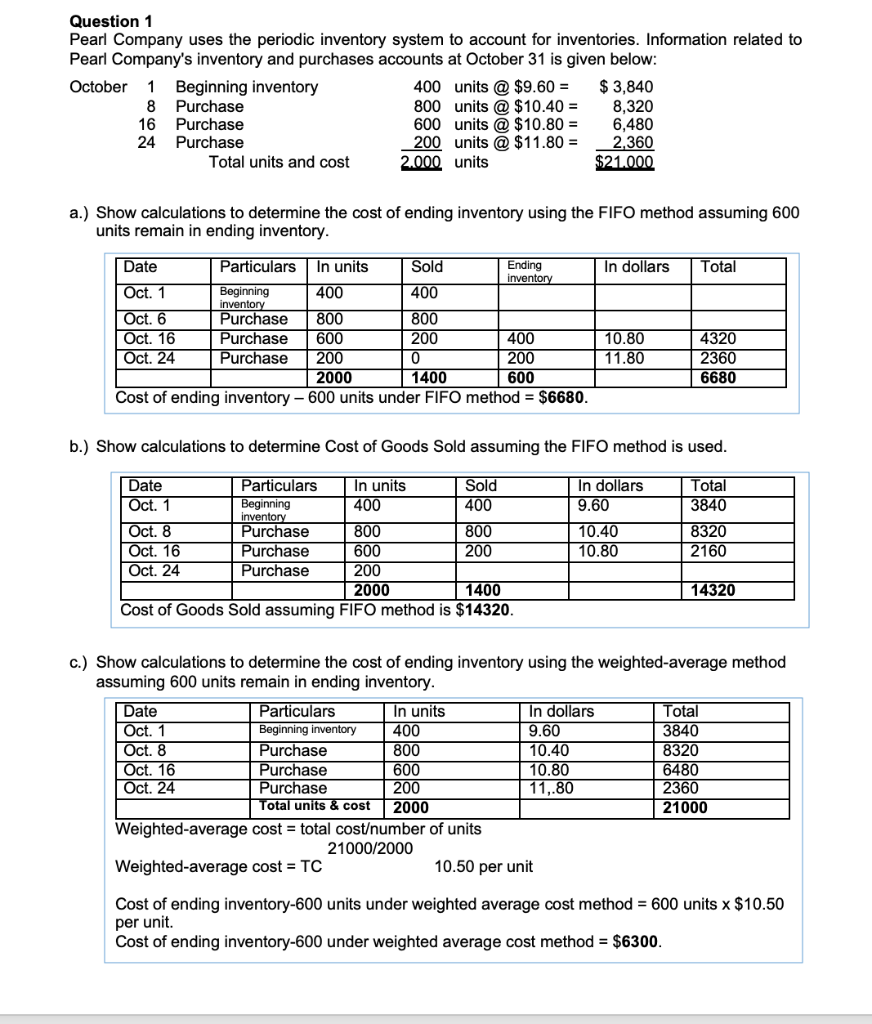

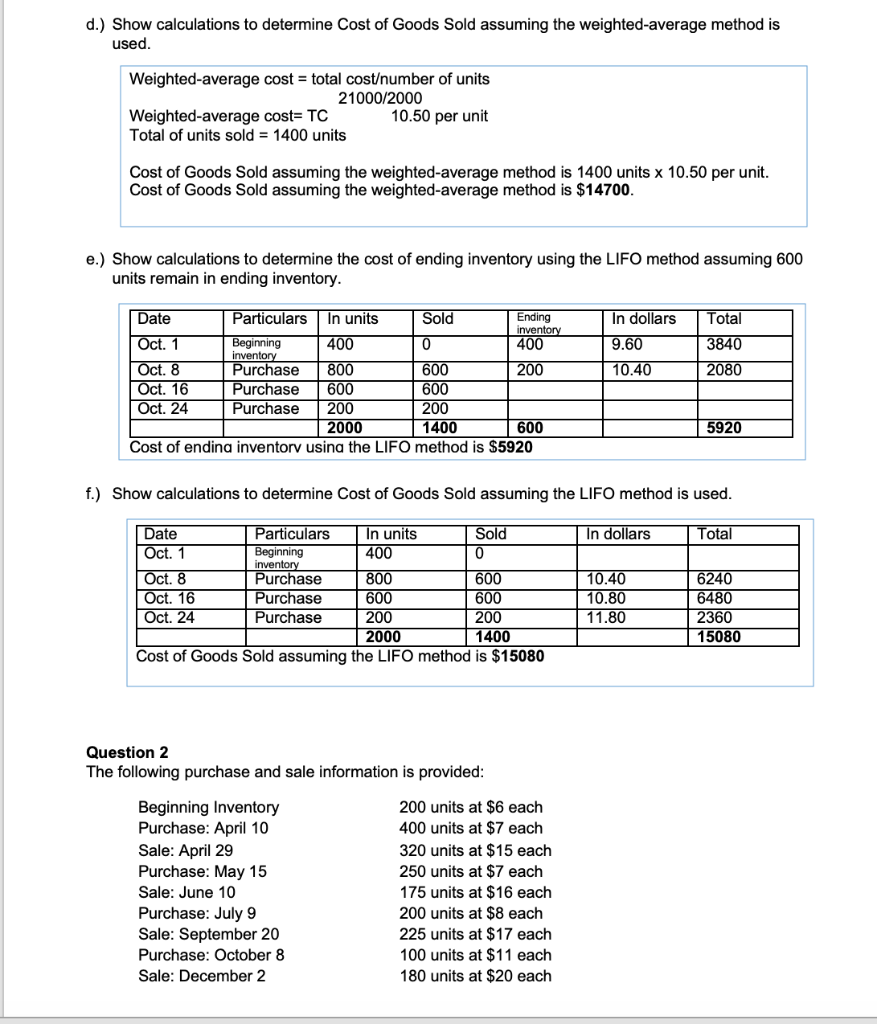

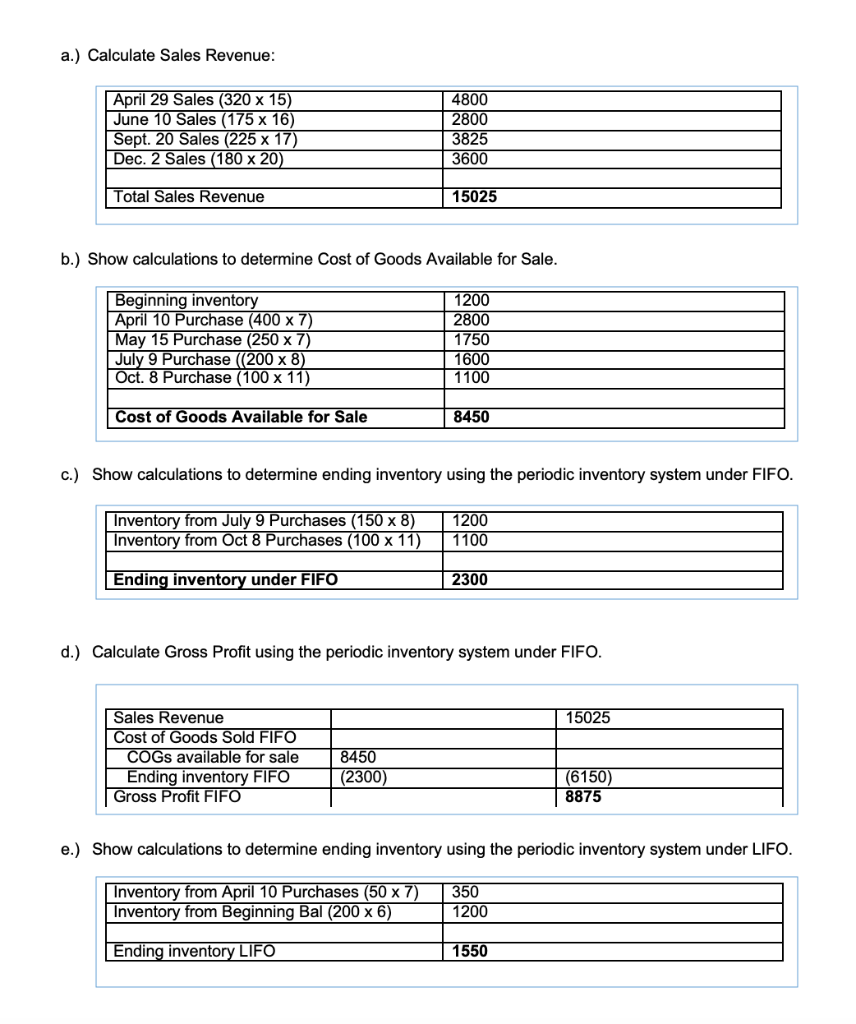

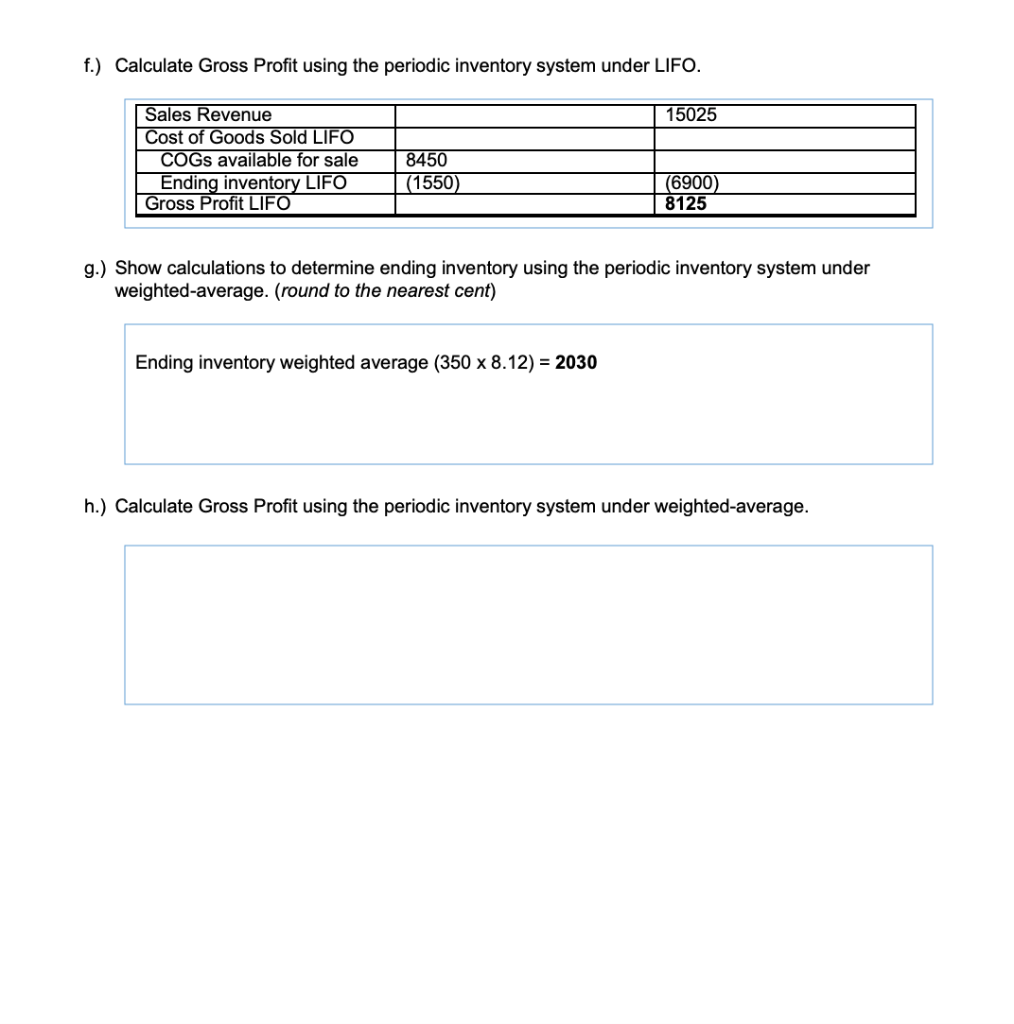

Question 1 Pearl Company uses the periodic inventory system to account for inventories. Information related to Pearl Company's inventory and purchases accounts at October 31 is given below: October 1 Beginning inventory 400 units @ $9.60 = $ 3,840 8 Purchase 800 units @ $10.40 = 8,320 16 Purchase 600 units @ $10.80 = 6,480 24 Purchase 200 units @ $11.80 = 2,360 Total units and cost 2.000 units $21.000 Ending a.) Show calculations to determine the cost of ending inventory using the FIFO method assuming 600 units remain in ending inventory. Date Particulars In units Sold In dollars Total inventory Oct. 1 Beginning 400 400 inventory Oct. 6 Purchase 800 800 Oct. 16 Purchase 600 200 400 10.80 4320 Oct. 24 Purchase 200 0 200 11.80 2360 2000 1400 600 6680 Cost of ending inventory - 600 units under FIFO method = $6680. b.) Show calculations to determine Cost of Goods Sold assuming the FIFO method is used. Sold Total In dollars 9.60 3840 Date Particulars In units Oct. 1 Beginning 400 400 inventory Oct. 8 Purchase 800 800 Oct. 16 Purchase 600 200 Oct. 24 Purchase 200 2000 1400 Cost of Goods Sold assuming FIFO method is $14320. 10.40 10.80 8320 2160 14320 c.) Show calculations to determine the cost of ending inventory using the weighted average method assuming 600 units remain in ending inventory. Date Particulars In units In dollars Total Oct. 1 Beginning inventory 400 9.60 3840 Oct. 8 Purchase 800 10.40 8320 Oct. 16 Purchase 600 10.80 6480 Oct. 24 Purchase 200 11,.80 2360 Total units & cost 2000 21000 Weighted average cost = total costumber of units 21000/2000 Weighted average cost = TC 10.50 per unit Cost of ending inventory-600 units under weighted average cost method = 600 units x $10.50 per unit. Cost of ending inventory-600 under weighted average cost method = $6300. d.) Show calculations to determine Cost of Goods Sold assuming the weighted average method is used. Weighted average cost = total costumber of units 21000/2000 Weighted average cost= TC 10.50 per unit Total of units sold = 1400 units Cost of Goods Sold assuming the weighted average method is 1400 units x 10.50 per unit. Cost of Goods Sold assuming the weighted average method is $14700. e.) Show calculations to determine the cost of ending inventory using the LIFO method assuming 600 units remain in ending inventory. In dollars Total 400 9.60 10.40 3840 2080 Date Particulars In units Sold Ending inventory Oct. 1 Beginning 400 0 inventory Oct. 8 Purchase 800 600 200 Oct. 16 Purchase 600 600 Oct. 24 Purchase 200 200 2000 1400 600 Cost of ending inventory using the LIFO method is $5920 5920 f.) Show calculations to determine Cost of Goods Sold assuming the LIFO method is used. Date In dollars Total Particulars In units Sold Oct. 1 Beginning 400 0 inventory Oct. 8 Purchase 800 600 Oct. 16 Purchase 600 600 Oct. 24 Purchase 200 200 2000 1400 Cost of Goods Sold assuming the LIFO method is $15080 10.40 10.80 11.80 6240 6480 2360 15080 Question 2 The following purchase and sale information is provided: Beginning Inventory 200 units at $6 each Purchase: April 10 400 units at $7 each Sale: April 29 320 units at $15 each Purchase: May 15 250 units at $7 each Sale: June 10 175 units at $16 each Purchase: July 9 200 units at $8 each Sale: September 20 225 units at $17 each Purchase: October 8 100 units at $11 each Sale: December 2 180 units at $20 each a.) Calculate Sales Revenue: April 29 Sales (320 x 15) June 10 Sales (175 x 16) Sept. 20 Sales (225 x 17) Dec. 2 Sales (180 x 20 4800 2800 3825 3600 Total Sales Revenue 15025 b.) Show calculations to determine Cost of Goods Available for Sale. Beginning inventory April 10 Purchase (400 x 7) May 15 Purchase (250 x 7) July 9 Purchase (200 x 8) Oct. 8 Purchase (100 x 11) 1200 2800 1750 1600 1100 Cost of Goods Available for Sale 8450 c.) Show calculations to determine ending inventory using the periodic inventory system under FIFO. Inventory from July 9 Purchases (150 x 8) Inventory from Oct 8 Purchases (100 x 11) 1200 1100 Ending inventory under FIFO 2300 d.) Calculate Gross Profit using the periodic inventory system under FIFO. 15025 Sales Revenue Cost of Goods Sold FIFO COGs available for sale Ending inventory FIFO Gross Profit FIFO 8450 (2300) ( 6150) 8875 e.) Show calculations to determine ending inventory using the periodic inventory system under LIFO. Inventory from April 10 Purchases (50 x 7) Inventory from Beginning Bal (200 x 6) 350 1200 Ending inventory LIFO 1550 f.) Calculate Gross Profit using the periodic inventory system under LIFO. 15025 Sales Revenue Cost of Goods Sold LIFO COGs available for sale Ending inventory LIFO Gross Profit LIFO 8450 (1550) (6900) 8125 g.) Show calculations to determine ending inventory using the periodic inventory system under weighted average. (round to the nearest cent) Ending inventory weighted average (350 x 8.12) = 2030 h.) Calculate Gross Profit using the periodic inventory system under weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts