Question: Need help with knowing how to do the math Please use the following information to answer the next three questions: A currency speculator expects the

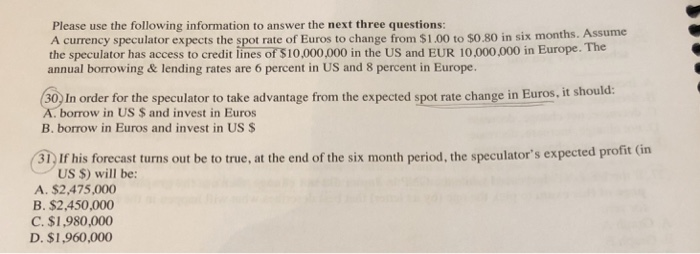

Please use the following information to answer the next three questions: A currency speculator expects the spot rate of Euros to change from $1.00 to $0.80 in six months. Assume the speculator has access to credit lines of $10,000,000 in the US and EUR 10,000.000 in Europe. The annual borrowing& lending rates are 6 percent in US and 8 percent in Europe. (30) In order for the speculator to take advantage from the expected spot rate change in Euros. A. borrow in US $ and invest in Euros B. borrow in Euros and invest in US $ 31) If his forecast turns out be to true, at the end of the six month period, the speculator's expected profit (in A. $2,475,000 US $) will be: B. $2,450,000 C. $1,980,000 D. $1,960,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts