Question: Need help with last questions also not sure if 10-17 are correct please advise Thank you. 12. When comparing the assets on the balance sheet

Need help with last questions also not sure if 10-17 are correct please advise

Thank you.

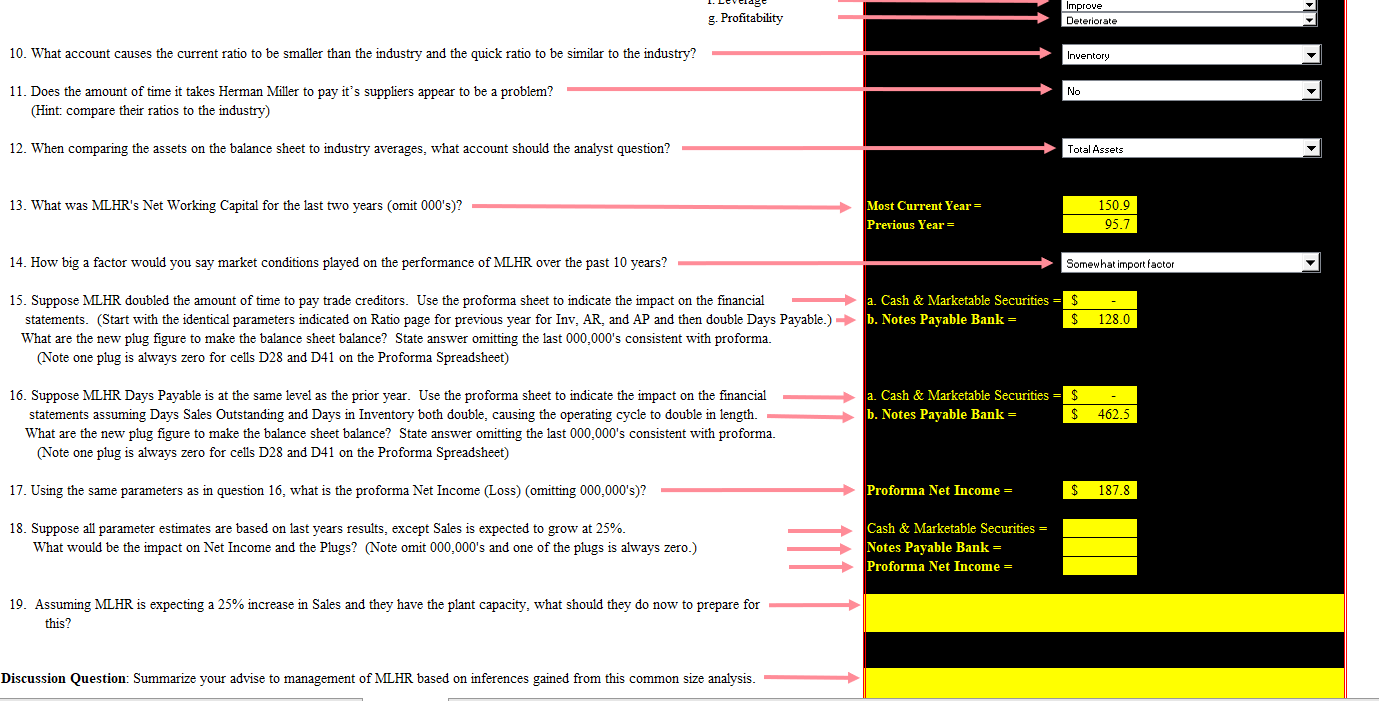

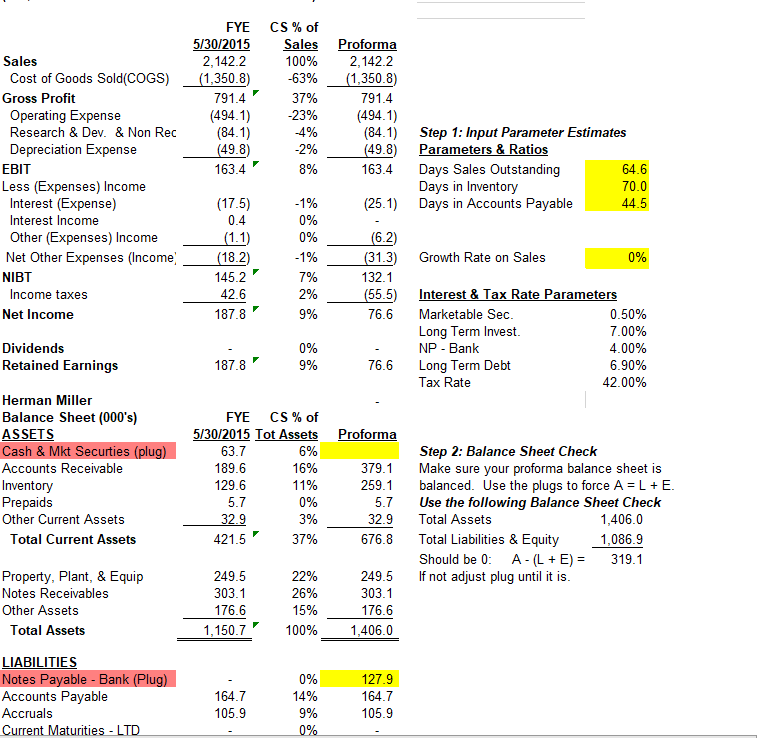

12. When comparing the assets on the balance sheet to industry averages, what account should the analyst question? 13. What was MLHR's Net Working Capital for the last two years (omit 000 's)? 14. How big a factor would you say market conditions played on the performance of MLHR over the past 10 years? 15. Suppose MLHR doubled the amount of time to pay trade creditors. Use the proforma sheet to indicate the impact on the financial statements. (Start with the identical parameters indicated on Ratio page for previous year for Inv, AR, and AP and then double Days Payable.) What are the new plug figure to make the balance sheet balance? State answer omitting the last 000,000 's consistent with proforma. (Note one plug is always zero for cells D28 and D41 on the Proforma Spreadsheet) 16. Suppose MLHR Days Payable is at the same level as the prior year. Use the proforma sheet to indicate the impact on the financial statements assuming Days Sales Outstanding and Days in Inventory both double, causing the operating cycle to double in length. What are the new plug figure to make the balance sheet balance? State answer omitting the last 000,000 's consistent with proforma. (Note one plug is always zero for cells D28 and D41 on the Proforma Spreadsheet) 17. Using the same parameters as in question 16, what is the proforma Net Income (Loss) (omitting 000,000's)? 18. Suppose all parameter estimates are based on last years results, except Sales is expected to grow at 25%. What would be the impact on Net Income and the Plugs? (Note omit 000,000's and one of the plugs is always zero.) 19. Assuming MLHR is expecting a 25% increase in Sales and they have the plant capacity, what should they do now to prepare for this? Step 1: Input Parameter Estimates Parameters \& Ratios Growth Rate on Sales Step 2: Balance Sheet Check Make sure your proforma balance sheet is balanced. Use the plugs to force A=L+E. Use the following Balance Sheet Check Total Assets 1,406.0 Total Liabilities \& Equity Should be 0: A(L+E)=319.11,086.9 If not adjust plug until it is. 12. When comparing the assets on the balance sheet to industry averages, what account should the analyst question? 13. What was MLHR's Net Working Capital for the last two years (omit 000 's)? 14. How big a factor would you say market conditions played on the performance of MLHR over the past 10 years? 15. Suppose MLHR doubled the amount of time to pay trade creditors. Use the proforma sheet to indicate the impact on the financial statements. (Start with the identical parameters indicated on Ratio page for previous year for Inv, AR, and AP and then double Days Payable.) What are the new plug figure to make the balance sheet balance? State answer omitting the last 000,000 's consistent with proforma. (Note one plug is always zero for cells D28 and D41 on the Proforma Spreadsheet) 16. Suppose MLHR Days Payable is at the same level as the prior year. Use the proforma sheet to indicate the impact on the financial statements assuming Days Sales Outstanding and Days in Inventory both double, causing the operating cycle to double in length. What are the new plug figure to make the balance sheet balance? State answer omitting the last 000,000 's consistent with proforma. (Note one plug is always zero for cells D28 and D41 on the Proforma Spreadsheet) 17. Using the same parameters as in question 16, what is the proforma Net Income (Loss) (omitting 000,000's)? 18. Suppose all parameter estimates are based on last years results, except Sales is expected to grow at 25%. What would be the impact on Net Income and the Plugs? (Note omit 000,000's and one of the plugs is always zero.) 19. Assuming MLHR is expecting a 25% increase in Sales and they have the plant capacity, what should they do now to prepare for this? Step 1: Input Parameter Estimates Parameters \& Ratios Growth Rate on Sales Step 2: Balance Sheet Check Make sure your proforma balance sheet is balanced. Use the plugs to force A=L+E. Use the following Balance Sheet Check Total Assets 1,406.0 Total Liabilities \& Equity Should be 0: A(L+E)=319.11,086.9 If not adjust plug until it is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts