Question: Need Help with letters H-K This Mini Case is available in MyFinanceLab Note: Although not absolutely necessary, you are advised to use a computer spread

Need Help with letters H-K

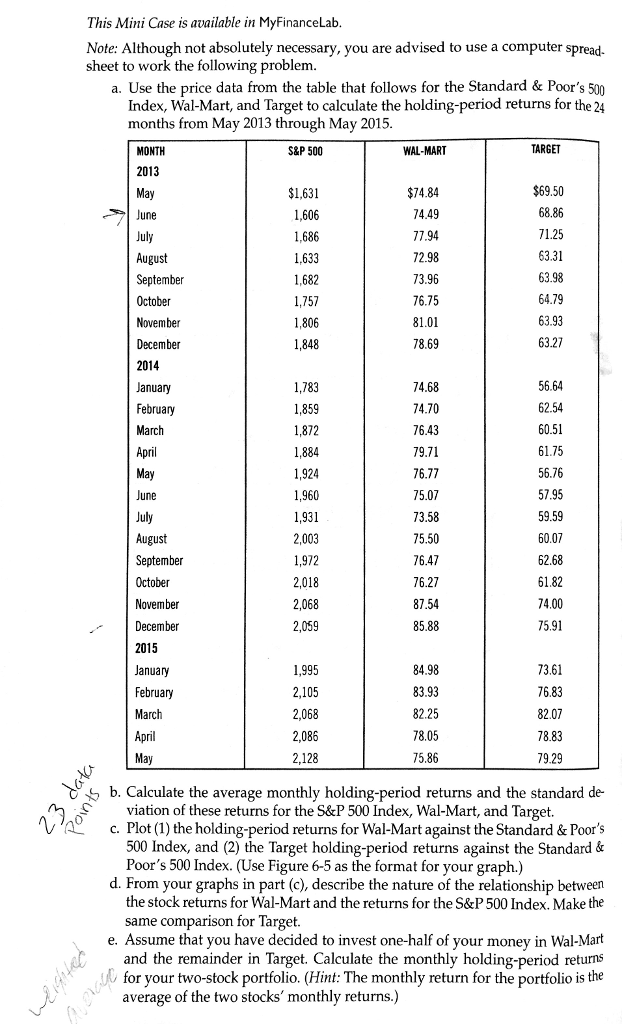

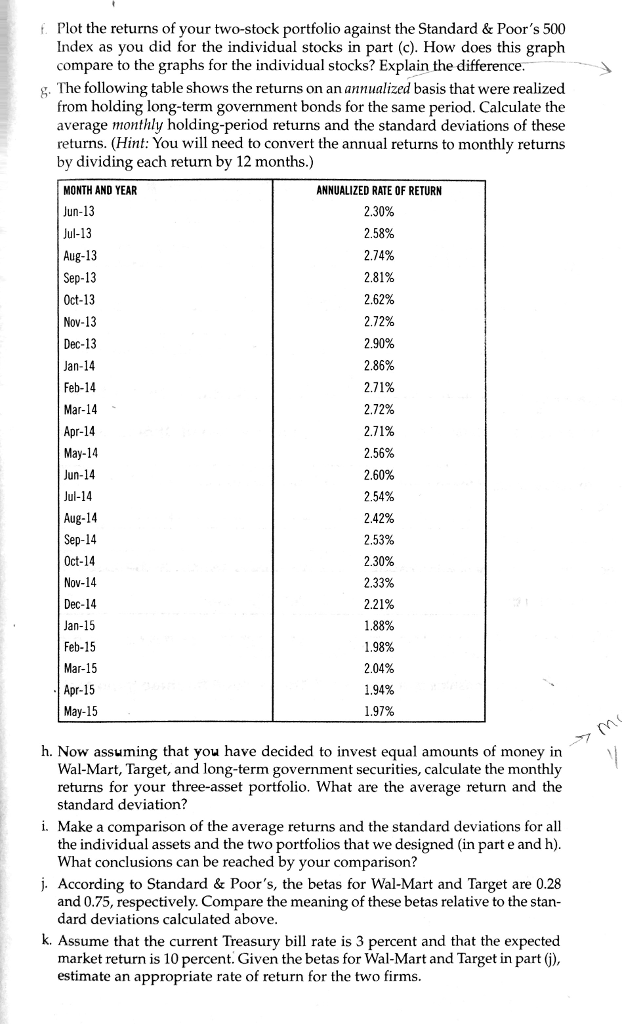

This Mini Case is available in MyFinanceLab Note: Although not absolutely necessary, you are advised to use a computer spread sheet to work the following problem a. Use the price data from the table that follows for the Standard & Poor's 500 Index, Wal-Mart, and Target to calculate the holding-period returns for the 24 months from May 2013 through May 2015 TARGET MONTH 2013 Ma June S&P 500 WAL-MART $1,631 1,606 $69.50 68.86 $74.84 74.49 77.94 72.98 73.96 76.75 81.01 78.69 63.31 63.98 64.79 August September October November December 2014 1,806 1,848 63.27 74.68 74.70 76.43 79.71 76.77 56.64 62.54 60.51 61.75 56.76 57.95 59.59 60.07 62.68 61.82 74.00 75.91 February 1,872 arc April ay une 1,924 1,931 2,003 1,972 2,018 73.58 75.50 August September 76.27 87.54 85.88 November December 2015 January February March 2,105 2,068 2,086 2,128 84.98 83.93 82.25 78.05 75.86 76.83 82.07 78.83 79.29 ril Ma b. Calculate the average monthly holding-period returns and the standard de- c. Plot (1) the holding-period returns for Wal-Mart against the Standard & Poor's d. From your graphs in part (c), describe the nature of the relationship between e. Assume that you have decided to invest one-half of your money in Wal-Mart f viation of these returns for the S&P 500 Index, Wal-Mart, and Target. 500 Index, and (2) the Target holding-period returns against the Standard & Poor's 500 Index. (Use Figure 6-5 as the format for your graph.) the stock returns for Wal-Mart and the returns for the S&P 500 Index. Make the same comparison for Target. and the remainder in Target. Calculate the monthly holding-period returns for your two-stock portfolio. (Hint: The monthly return for the portfolio is the average of the two stocks' monthly returns.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts