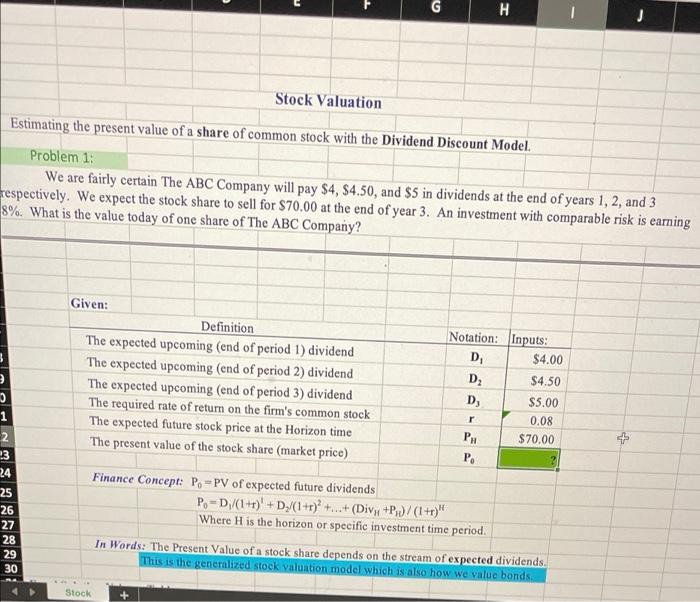

Question: Need help with only the highlighted protion with the question marks in the boxes! G H J Stock Valuation Estimating the present value of a

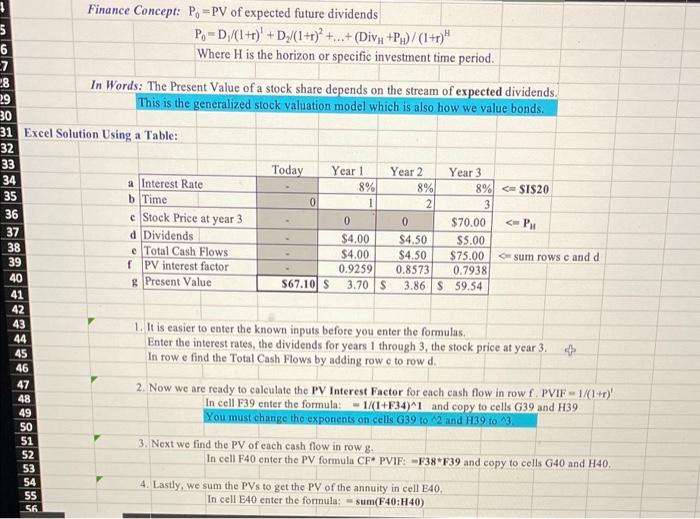

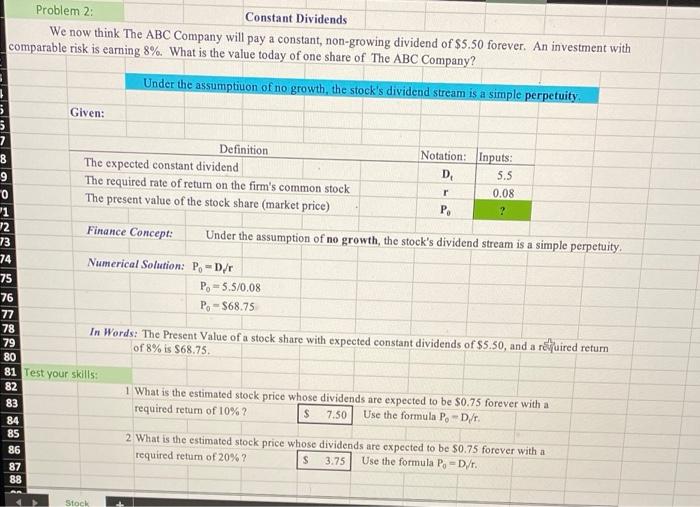

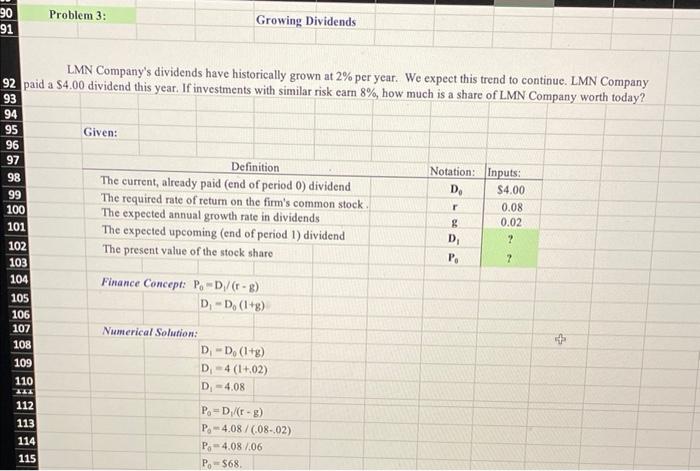

G H J Stock Valuation Estimating the present value of a share of common stock with the Dividend Discount Model Problem 1: We are fairly certain The ABC Company will pay $4, $4.50, and $5 in dividends at the end of years 1, 2, and 3 respectively. We expect the stock share to sell for $70.00 at the end of year 3. An investment with comparable risk is earning 8%. What is the value today of one share of The ABC Company? Given: Definition Notation: Inputs: The expected upcoming (end of period 1) dividend D $4.00 The expected upcoming (end of period 2) dividend D $4.50 The expected upcoming (end of period 3) dividend D, $5.00 The required rate of retum on the firm's common stock The expected future stock price at the Horizon time PH $70.00 The present value of the stock share (market price) P. Finance Concept: Po = PV of expected future dividends Po - D//(1++)' + D/(1+r)? +...+(Div, +Px)/ (1+r)" Where H is the horizon or specific investment time period. r 0.08 + 1 2 13 24 25 26 27 28 29 30 + In Words: The Present Value of a stock share depends on the stream of expected dividends. This is the generalized stock valuation model which is also how we value bonds Stock +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts