Question: Need help with P9-2B. please use this worksheet. P9-2B In recent years, Darnell Company purchased three machines. Because of Compute depreciation heavy turnover in the

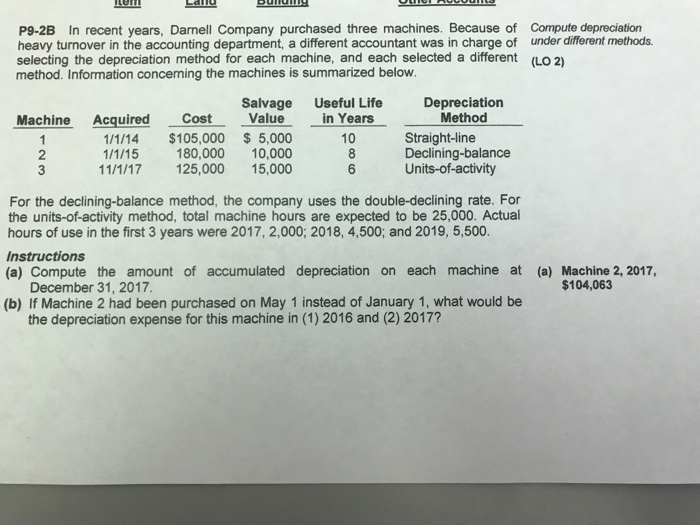

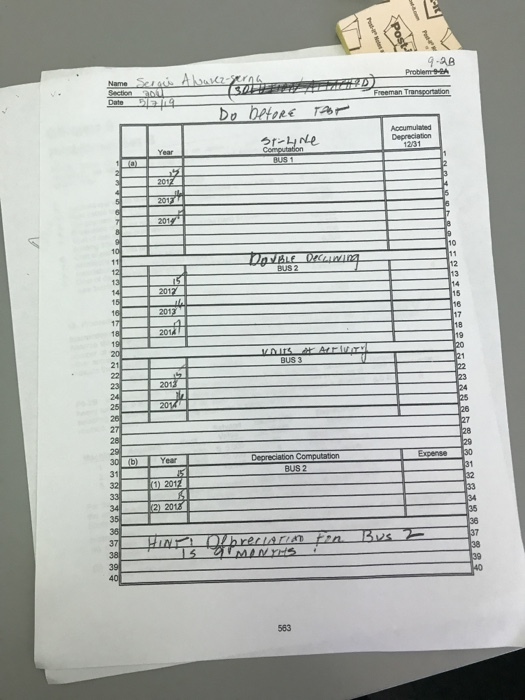

P9-2B In recent years, Darnell Company purchased three machines. Because of Compute depreciation heavy turnover in the accounting department, a different accountant was in charge of under different methods. selecting the depreciation method for each machine, and each selected a different (LO 2) method. Information concerning the machines is summarized below. Salvage Useful Life Depreciation Machine AcquiredCostValue in YearsMethod 1/1/14 $105,000 5,000 80,000 10,000 11/1/17 125,000 15,000 10 Straight-line Declining-balance Units-of-activity 2 For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total machine hours are expected to be 25,000. Actual hours of use in the first 3 years were 2017, 2,000; 2018, 4,500; and 2019, 5,500. Instructions (a) Compute the amount of accumulated depreciation on each machine at (a) Machine 2,2017 $104,063 December 31, 2017 (b) If Machine 2 had been purchased on May 1 instead of January 1, what would be the depreciation expense for this machine in (1) 2016 and (2) 2017? 9-38 201 BUS 2 BUS Year BUS 2 201 20 563

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts