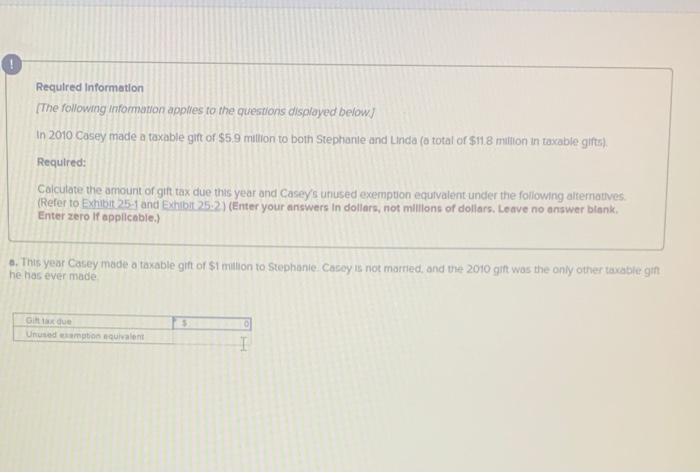

Question: need help with part a second part unused exemption Requtred information (The following information applies to the questions displayed below] In 2010 Casey made a

![following information applies to the questions displayed below] In 2010 Casey made](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbcdb933fbc_23266fbcdb8bad3d.jpg)

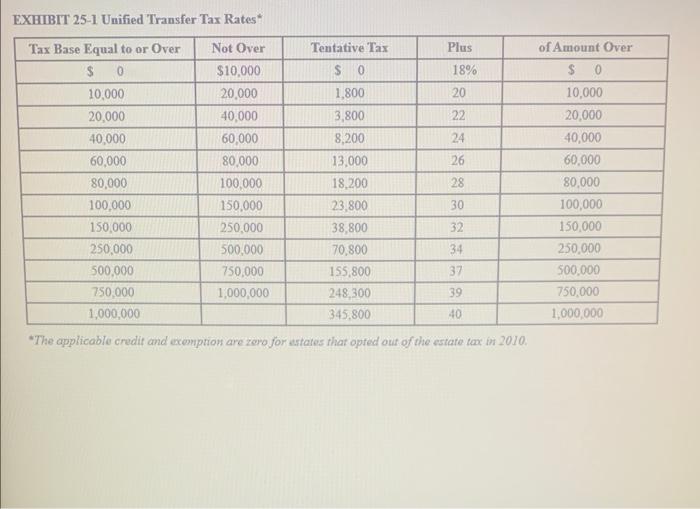

Requtred information (The following information applies to the questions displayed below] In 2010 Casey made a taxable gift of $5.9 miltion to both Stephanle and Linda (o total of $11.8 millon in taxable gits). Required: Calculate the amount of git tax due this year and Casey's unused exemption equivalent under the following altematives. (Refer to Exhibit 25-1 and Exhbit 25.2) (Enter your answers in dollars, not millions of dollars, Leave no answer blank, Enter zero If applicabie.) 6. This year Casey made a taxable git of $1 milion to Stephanie. Casoy is not married, and the 2010 gift was the only other taxable git he has ever made Type here to search EXHIBIT 25-1 Unified Transfer Tax Rates* "The applicable credit and exenption are zero jor estates that opfed out of the estate tax in 2010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts