Question: Problem 24-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data

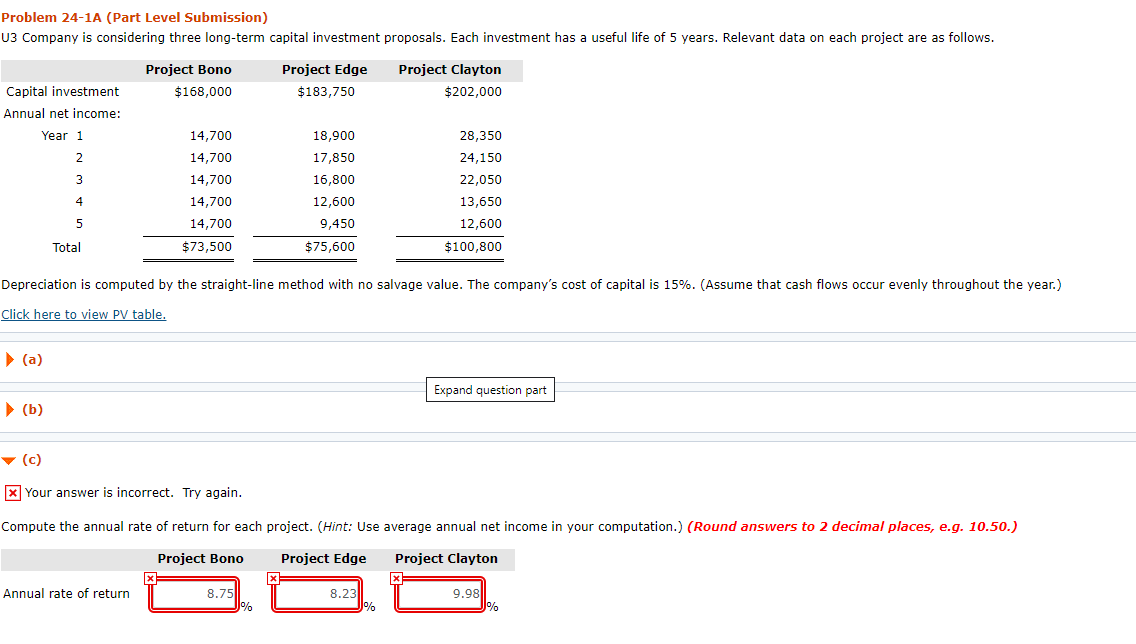

Problem 24-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Edge Project Bono Project Clayton Capital investment $168,000 $183,750 $202,000 Annual net income: Year 1 14,700 18,900 28,350 17,850 14,700 24,150 16,800 22,050 3 14,700 13,650 14,700 12,600 14,700 9,450 12,600 $73,500 $75,600 $100,800 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. > (a) Expand question part > (b) v (c) X Your answer is incorrect. Try again. Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers to 2 decimal places, e.g. 10.50.) Project Clayton Project Bono Project Edge Annual rate of return 8.75 8.23 9.98 % J%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts