Question: Need Help with part c only You would like to be holding a protective put position on the stock of XYZ Co. to lock in

Need Help with part c only

Need Help with part c only

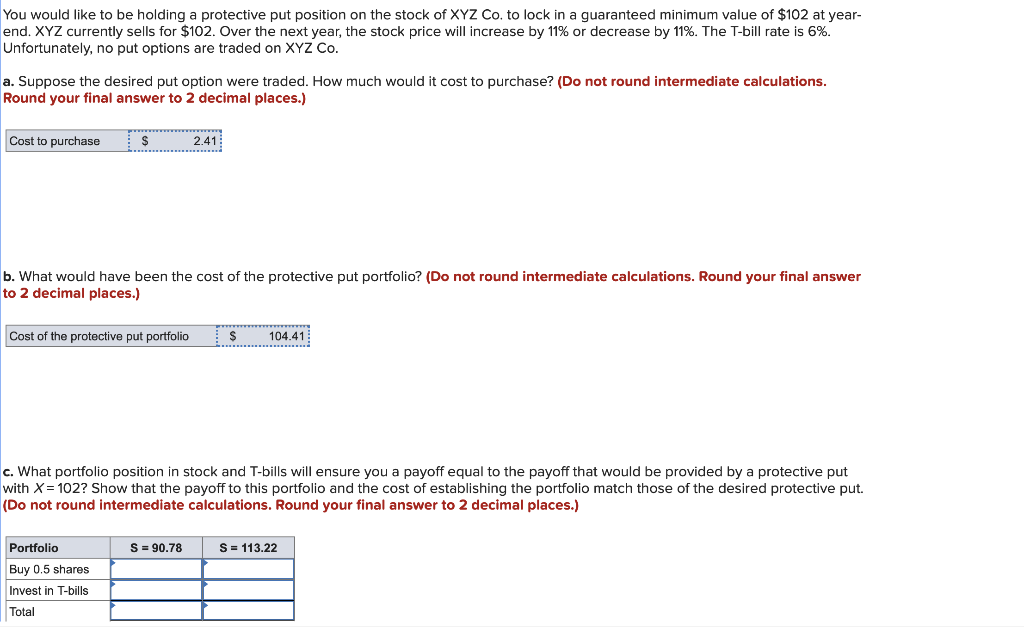

You would like to be holding a protective put position on the stock of XYZ Co. to lock in a guaranteed minimum value of $102 at yearend. XYZ currently sells for $102. Over the next year, the stock price will increase by 11% or decrease by 11%. The T-bill rate is 6%. Unfortunately, no put options are traded on XYZ Co. a. Suppose the desired put option were traded. How much would it cost to purchase? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) b. What would have been the cost of the protective put portfolio? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) c. What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X=102 ? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts