Question: Need Help with Part c Question 2 On January 1, 20X1, BL Inc. entered into a 10-year lease for an office building requiring annual year-end

Need Help with Part c

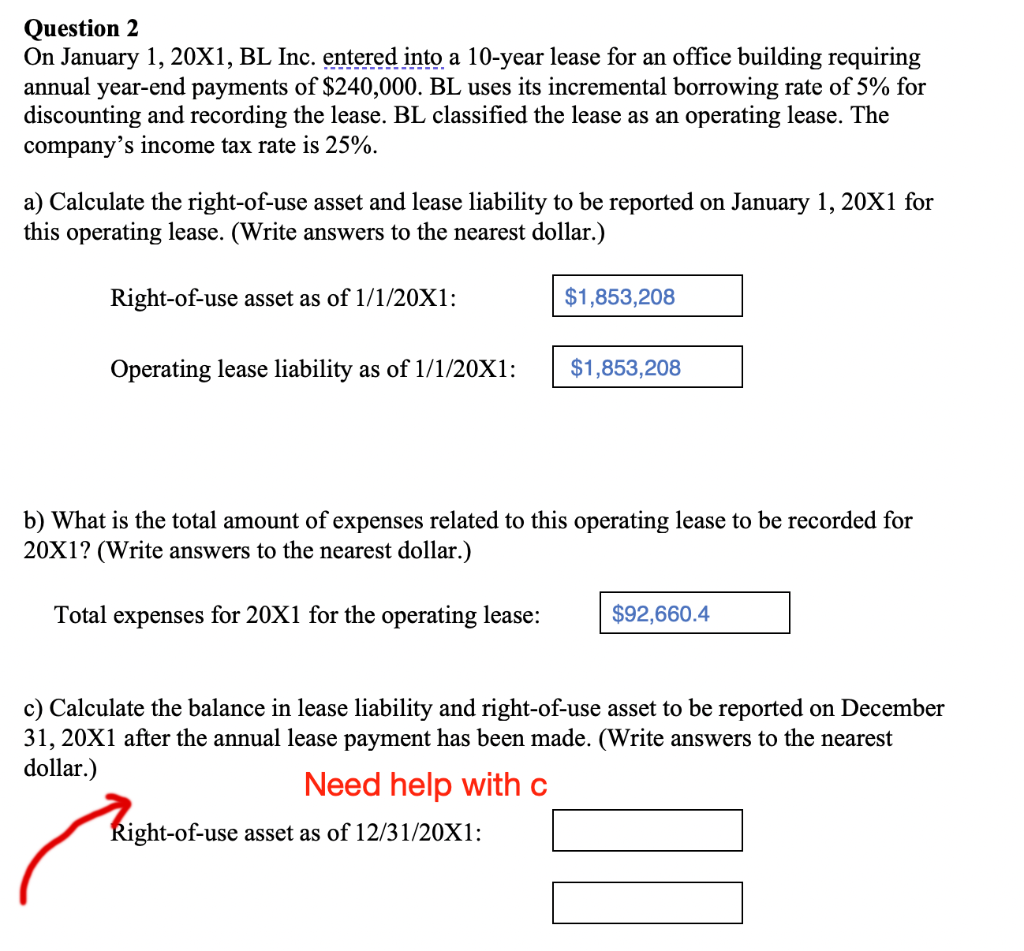

Question 2 On January 1, 20X1, BL Inc. entered into a 10-year lease for an office building requiring annual year-end payments of $240,000. BL uses its incremental borrowing rate of 5% for discounting and recording the lease. BL classified the lease as an operating lease. The company's income tax rate is 25%. a) Calculate the right-of-use asset and lease liability to be reported on January 1, 20X1 for this operating lease. (Write answers to the nearest dollar.) Right-of-use asset as of 1/1/20X1: $1,853,208 Operating lease liability as of 1/1/20X1: $1,853,208 b) What is the total amount of expenses related to this operating lease to be recorded for 20X1? (Write answers to the nearest dollar.) Total expenses for 20X1 for the operating lease: $92,660.4 c) Calculate the balance in lease liability and right-of-use asset to be reported on December 31, 20X1 after the annual lease payment has been made. (Write answers to the nearest dollar.) Need help with c Right-of-use asset as of 12/31/20X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts