Question: Need help with Part D , pls make sure answer is fully correct 5. Assume that today is July 12. You have been asked to

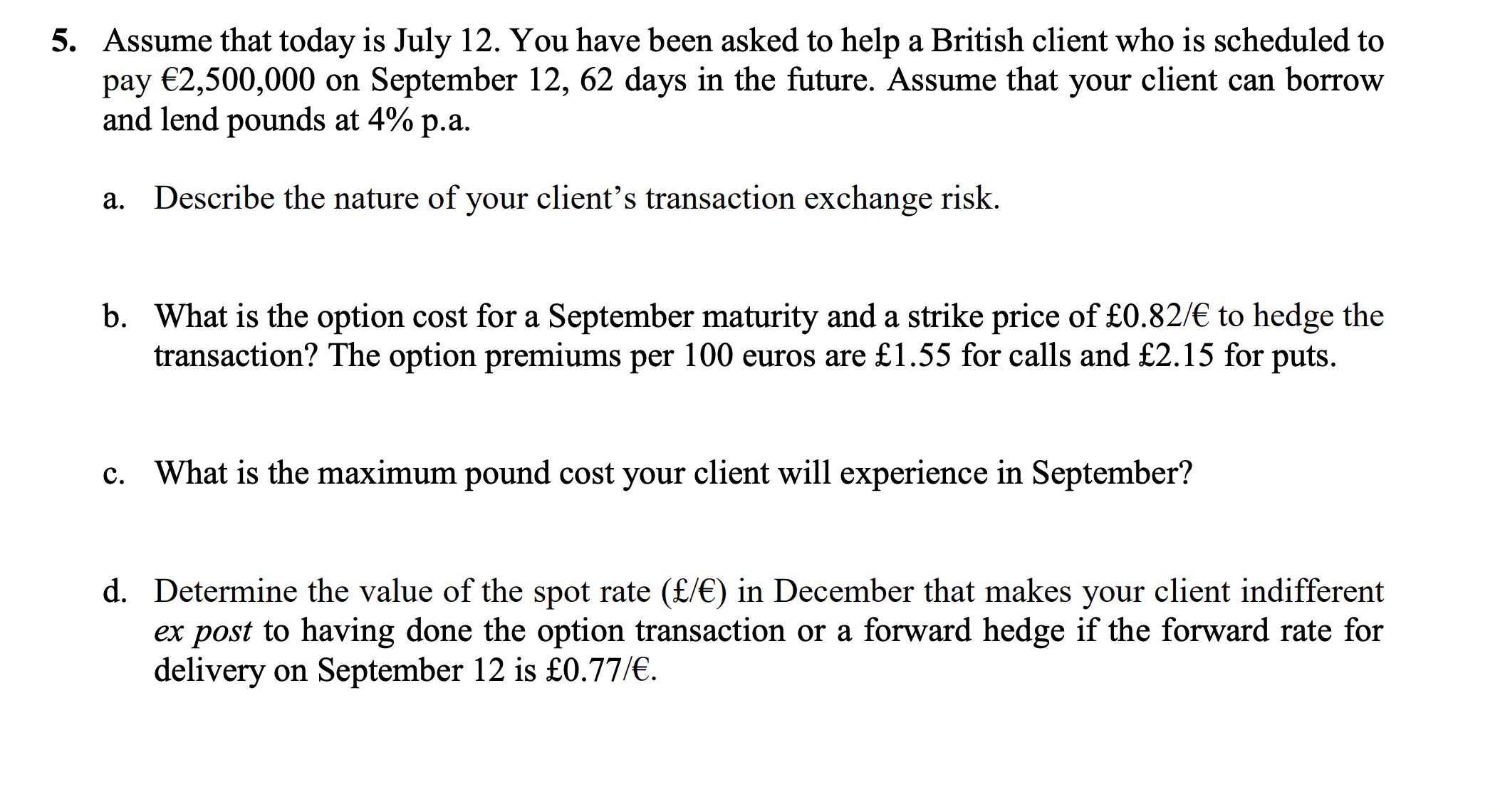

5. Assume that today is July 12. You have been asked to help a British client who is scheduled to pay 2,500,000 on September 12, 62 days in the future. Assume that your client can borrow and lend pounds at 4% p.a. a. b. c. d. Describe the nature of your client's transaction exchange risk. What is the option cost for a September maturity and a strike price of EO.82/ to hedge the transaction? The option premiums per 100 euros are El .55 for calls and 2.15 for puts. What is the maximum pound cost your client will experience in September? Determine the value of the spot rate (E/) in December that makes your client indifferent ex post to having done the option transaction or a forward hedge if the forward rate for delivery on September 12 is 0.77/.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts