Question: need help with part (iii) Version Question Three In parts -iii) draw a CIRCLE around the correct letter (a, b, c ord). Questions (1)-(i) refer

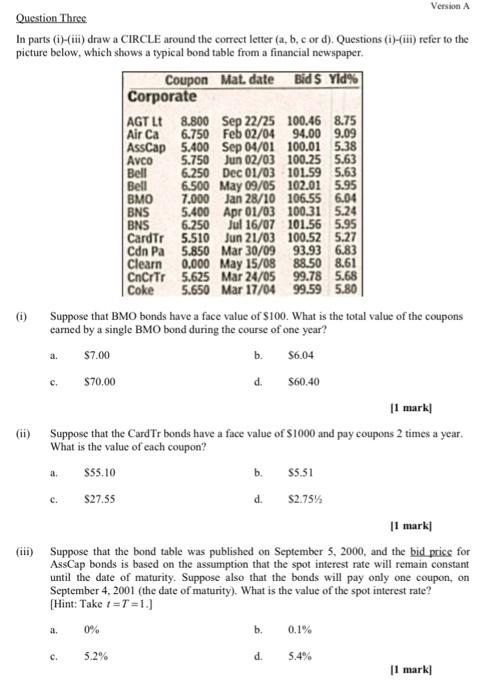

Version Question Three In parts -iii) draw a CIRCLE around the correct letter (a, b, c ord). Questions (1)-(i) refer to the picture below, which shows a typical bond table from a financial newspaper Coupon Mat. date Bid $ Yld% Corporate AGT LE 8.800 Sep 22/25 100.46 8.75 Air Ca 6.750 Feb 02/04 94.00 9.09 AssCap 5.400 Sep 04/01 100.01 5.38 Avco 5.750 Jun 02/03 100.25 5.63 Bell 6.250 Dec 01/03 101.595.63 Bell 6.500 May 09/05 102.01 5.95 BMO 7.000 Jan 28/10 106.55 6.04 BNS 5.400 Apr 01/03 100.31 5.24 BNS 6.250 Jul 16/07 101.56 5.95 CardTr 5.510 Jun 21/03 100.525.27 Cdn Pa 5.850 Mar 30/09 93.93 6.83 Clearn 0.000 May 15/08 88.50 8.61 CnCrTr 5.625 Mar 24/05 99.78 5.68 Coke 5.650 Mar 17/04 99.59 5.80 (i) Suppose that BMO bonds have a face value of $100. What is the total value of the coupons earned by a single BMO bond during the course of one year? $7.00 b. $6.04 $70,00 d. $60.40 11 mark (ii) Suppose that the Card Tr bonds have a face value of $1000 and pay coupons 2 times a year. What is the value of each coupon? $55.10 b. $5.51 $27.55 d. $2.75% 11 mark! (iii) Suppose that the bond table was published on September 5, 2000, and the bid price for AssCap bonds is based on the assumption that the spot interest rate will remain constant until the date of maturity. Suppose also that the bonds will pay only one coupon, on September 4. 2001 (the date of maturity). What is the value of the spot interest rate? (Hint: Take 1 =T=1. a. 0% b. 0.1% c. 5.2% d. 5.4% [1 mark! Version Question Three In parts -iii) draw a CIRCLE around the correct letter (a, b, c ord). Questions (1)-(i) refer to the picture below, which shows a typical bond table from a financial newspaper Coupon Mat. date Bid $ Yld% Corporate AGT LE 8.800 Sep 22/25 100.46 8.75 Air Ca 6.750 Feb 02/04 94.00 9.09 AssCap 5.400 Sep 04/01 100.01 5.38 Avco 5.750 Jun 02/03 100.25 5.63 Bell 6.250 Dec 01/03 101.595.63 Bell 6.500 May 09/05 102.01 5.95 BMO 7.000 Jan 28/10 106.55 6.04 BNS 5.400 Apr 01/03 100.31 5.24 BNS 6.250 Jul 16/07 101.56 5.95 CardTr 5.510 Jun 21/03 100.525.27 Cdn Pa 5.850 Mar 30/09 93.93 6.83 Clearn 0.000 May 15/08 88.50 8.61 CnCrTr 5.625 Mar 24/05 99.78 5.68 Coke 5.650 Mar 17/04 99.59 5.80 (i) Suppose that BMO bonds have a face value of $100. What is the total value of the coupons earned by a single BMO bond during the course of one year? $7.00 b. $6.04 $70,00 d. $60.40 11 mark (ii) Suppose that the Card Tr bonds have a face value of $1000 and pay coupons 2 times a year. What is the value of each coupon? $55.10 b. $5.51 $27.55 d. $2.75% 11 mark! (iii) Suppose that the bond table was published on September 5, 2000, and the bid price for AssCap bonds is based on the assumption that the spot interest rate will remain constant until the date of maturity. Suppose also that the bonds will pay only one coupon, on September 4. 2001 (the date of maturity). What is the value of the spot interest rate? (Hint: Take 1 =T=1. a. 0% b. 0.1% c. 5.2% d. 5.4% [1 mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts