Question: The highlighted part is the answer. I wanted to know how it got the answers (the working). Question Three In parts (i)-(v) draw a CIRCLE

The highlighted part is the answer. I wanted to know how it got the answers (the working).

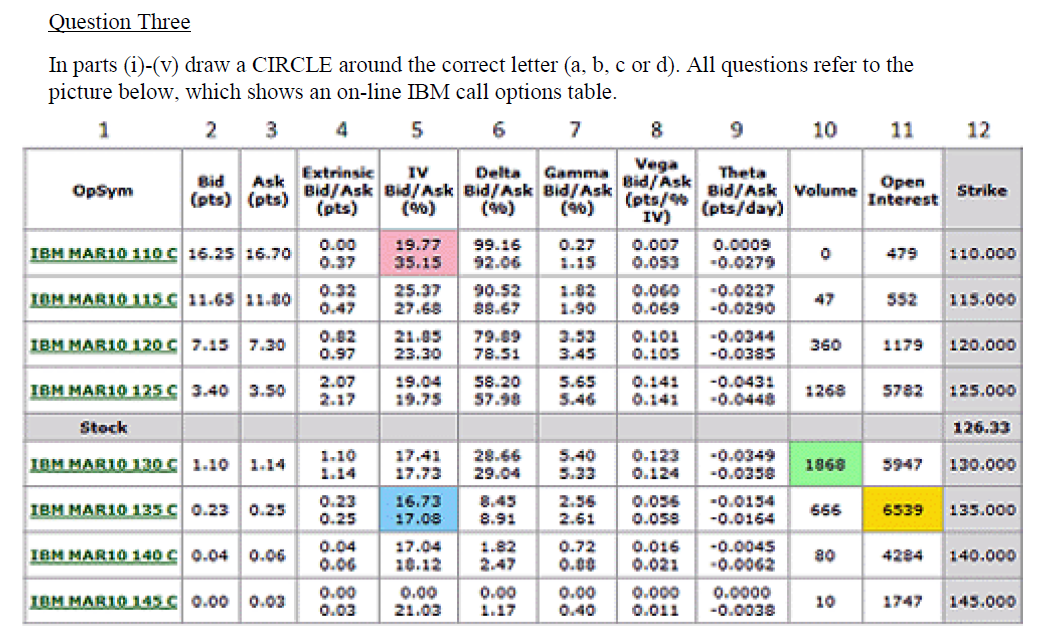

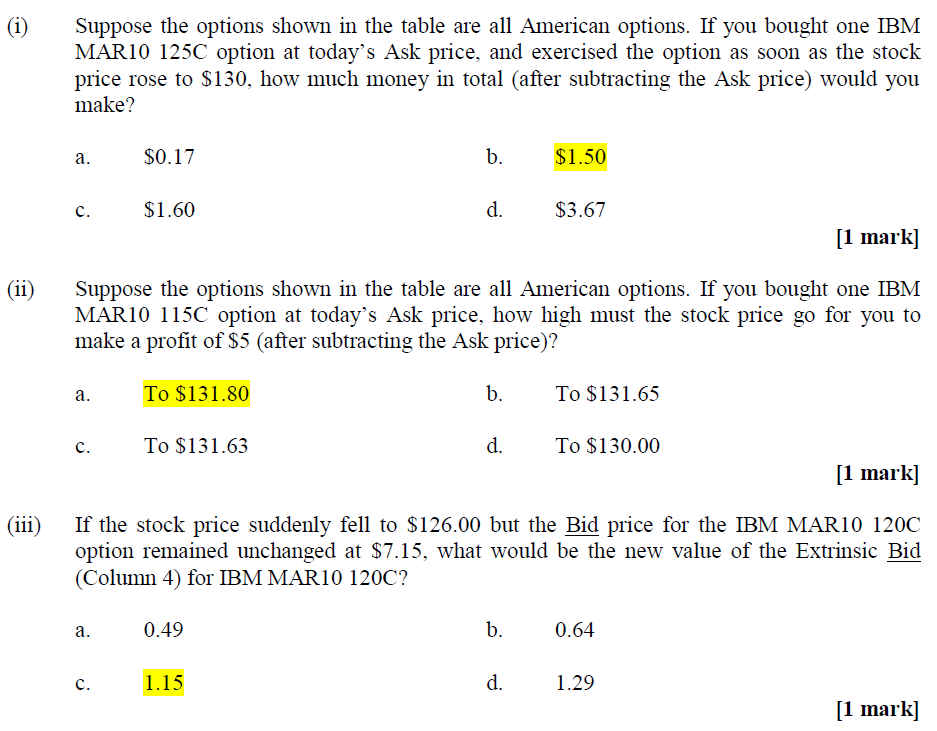

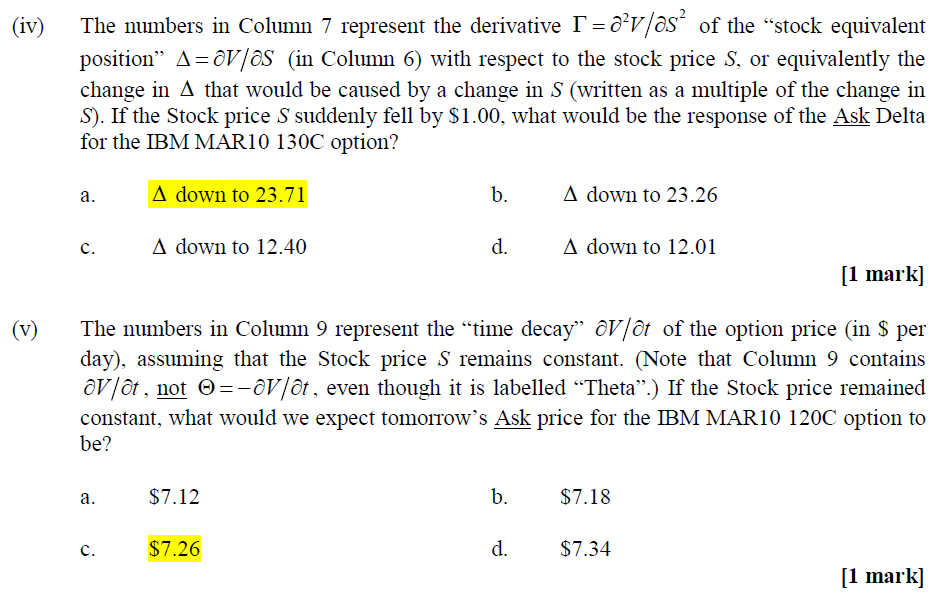

Question Three In parts (i)-(v) draw a CIRCLE around the correct letter (a, b, c or d). All questions refer to the picture below, which shows an on-line IBM call options table. 1 2 3 4 5 6 7 9 10 11 12 OpSym Bid Ask (pts) (pts) Extrinsic TV Gamma Bid/Ask Bid/ Ask Bid/Ask Bid/ Ask (pts) (9) (96) Theta Bid/ Ask Volume (pts/day) Open Interest Strike 0.00 0.37 99.16 IBM MAR10 110 C 16.25 16.70 0.27 1.15 Vega Bid/ Ask (pts/90 IV) 0.007 0.053 0.060 0.069 0.101 0.105 0.0009 -0.0279 o 479 19.77 35.15 25.37 27.68 110.000 IOM MARIO 1156 11.65 11.00 0.32 0.47 47 SS2 1.90 115.000 -0.0290 90.52 88.67 79.89 78.51 IBM MAR10 120 C 7.15 7.30 0.82 0.97 3.45 360 1179 120.000 23.30 29.04 19.75 2.07 2.17 0.141 58.20 57.98 IBM MAR 10 125 C 3.40 3.50 -0.0385 -0.0431 -0.0440 5.65 S.46 1268 5782 125.000 Stock 126.33 IBM MARILO 1306 1.10 1.14 1.10 17.41 17.73 0.123 1968 5947 130.000 0.23 IBM MAR10 135 C 0.23 0.25 16.73 17.08 565 6539 0.25 8.91 135.000 5.40 5.33 2.55 2.61 0.72 0.00 0.00 0.40 -0.0349 -0.0358 -0.0154 -0.0164 -0.0045 -0.0062 0.0000 -0.0038 17.04 1.82 IBM MAR10 140 C 0.04 0.06 0.036 0.053 0.016 0.021 0.000 0.011 80 4284 0.04 0.06 0.00 0.03 140.000 IOM MAR10 145.0 0.00 0.03 0.00 21.03 0.00 1.17 10 1747 149.000 (1) Suppose the options shown in the table are all American options. If you bought one IBM MAR10 125C option at today's Ask price, and exercised the option as soon as the stock price rose to $130, how much money in total (after subtracting the Ask price) would you make? a. $0.17 b. $1.50 c. $1.60 d. $3.67 [1 mark] Suppose the options shown in the table are all American options. If you bought one IBM MAR10 115C option at today's Ask price, how high must the stock price go for you to make a profit of $5 (after subtracting the Ask price)? a. To $131.80 b. To $131.65 c. To $131.63 d. To $130.00 [1 mark] (111) If the stock price suddenly fell to $126.00 but the Bid price for the IBM MAR10 120C option remained unchanged at $7.15, what would be the new value of the Extrinsic Bid (Column 4) for IBM MAR10 120C? a. 0.49 b. 0.64 c. 1.15 d. 1.29 [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts