Question: need help with please Asset A has an expected rate of return of 5% with a standard deviation of 2%. Asset B has an expected

need help with please

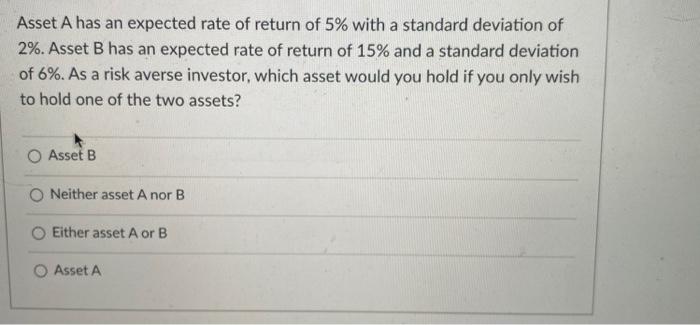

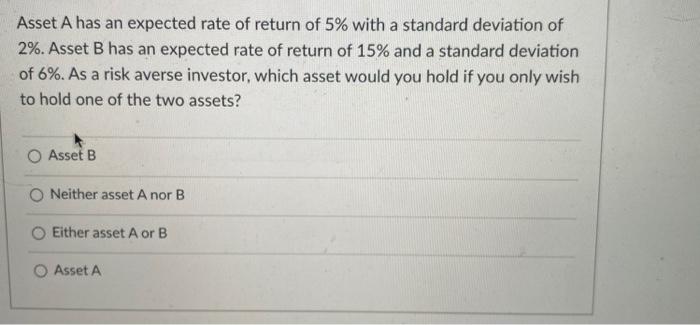

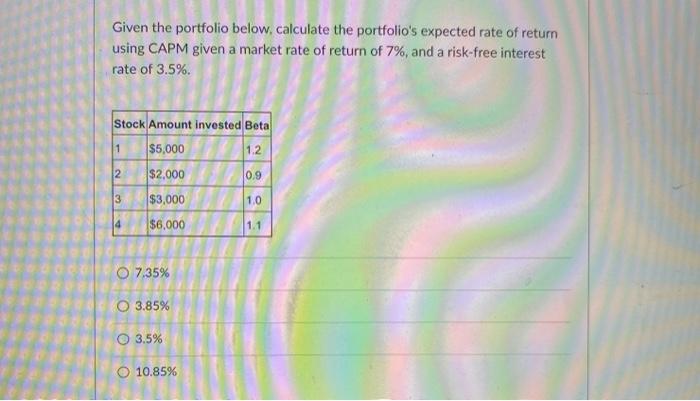

Asset A has an expected rate of return of 5% with a standard deviation of 2%. Asset B has an expected rate of return of 15% and a standard deviation of 6%. As a risk averse investor, which asset would you hold if you only wish to hold one of the two assets? Asset B Neither asset A nor B O Either asset A or B Asset A Given the portfolio below. calculate the portfolio's expected rate of return using CAPM given a market rate of return of 7%, and a risk-free interest rate of 3.5%. Stock Amount invested Beta 1 $5,000 1.2 N $2,000 0.9 3 $3,000 1.0 4 $6,000 1.1 O 7.35% O 3.85% O 3.5% 10.85%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock