Question: Need help with problem #3! Thank you & will thumbs up for quick responce! Problem 1. (40 Points) Today the spot exehange rate E$/Y is

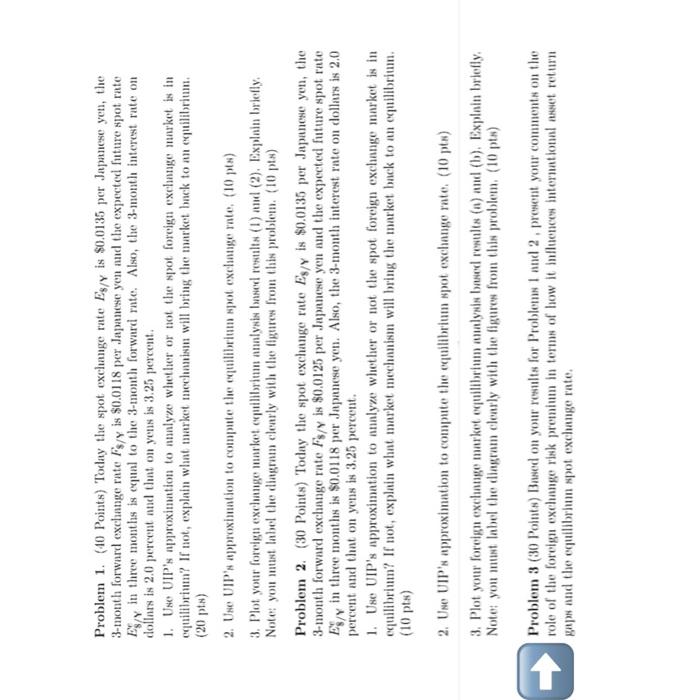

Problem 1. (40 Points) Today the spot exehange rate E$/Y is $0.0135 per Japanese yen, the 3-month forward exchange rate F$/Y is $0.0118 per Japanese yen and the expected future spot rate E8/Yc in three months is equal to the 3-month forward rate. Also, the 3-month interest rate on dollars is 2.0 percent and that on yens is 3.25 percent. 1. Use UIP's upproximation to mulyze whether or not the spot foreign exchange market is in equilibrium? If not, explain what market mechnuisun will bring the market back to an equilibriun. (20pt) 2. Use UIP's approximation to compute the equilibrium spot exchange rate. (10 pts) 3. Plot your foreign exehuuge unarket efuilibriuu aunlysis based results (1) aud (2). Explain briefly. Note: you unst label the diagran clearly with the figures from this problen. (10 pts) Problem 2. (30 Points) Today the spot exchange rate E8/Y is $0.0135 per Japanese yen, the 3-mouth forward exchange rate FY/Y is $0.0125 per Japanese yen and the expected future spot rate E8/Yr in three months is $0.0118 per Japanese yen. Also, the 3-mouth interest rate on dollars is 2.0 percent and that on yens is 3.25 percent. 1. Use UIP's approximation to annlyze whether or not the spot foreign exchange murket is in equilibrium? If not, explain what market mechanism will bring the market back to an equilibriun. (10pts) 2. Use UIP's approximation to compute the equilibrium spot exchange rate. (10 pts) 3. Plot your foreign exchange market equilibrium aualysis besed resulis (a) amd (b). Explain briefly. Note: you must label the diagram cleaty with the figures from this problem. (10 pts) Problem 3 (30 Points) Bused on your results for Problems 1 and 2 , present your comments on the role of the foreign exehunge risk premium in terms of how it inlluences international asset return gaps and the equilibriun spot exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts