Question: Need help with problem 3e. Problem 3 (20%) A stock price is currently $50. The risk-free interest rate is 5% per annum with contin- uous

Need help with problem 3e.

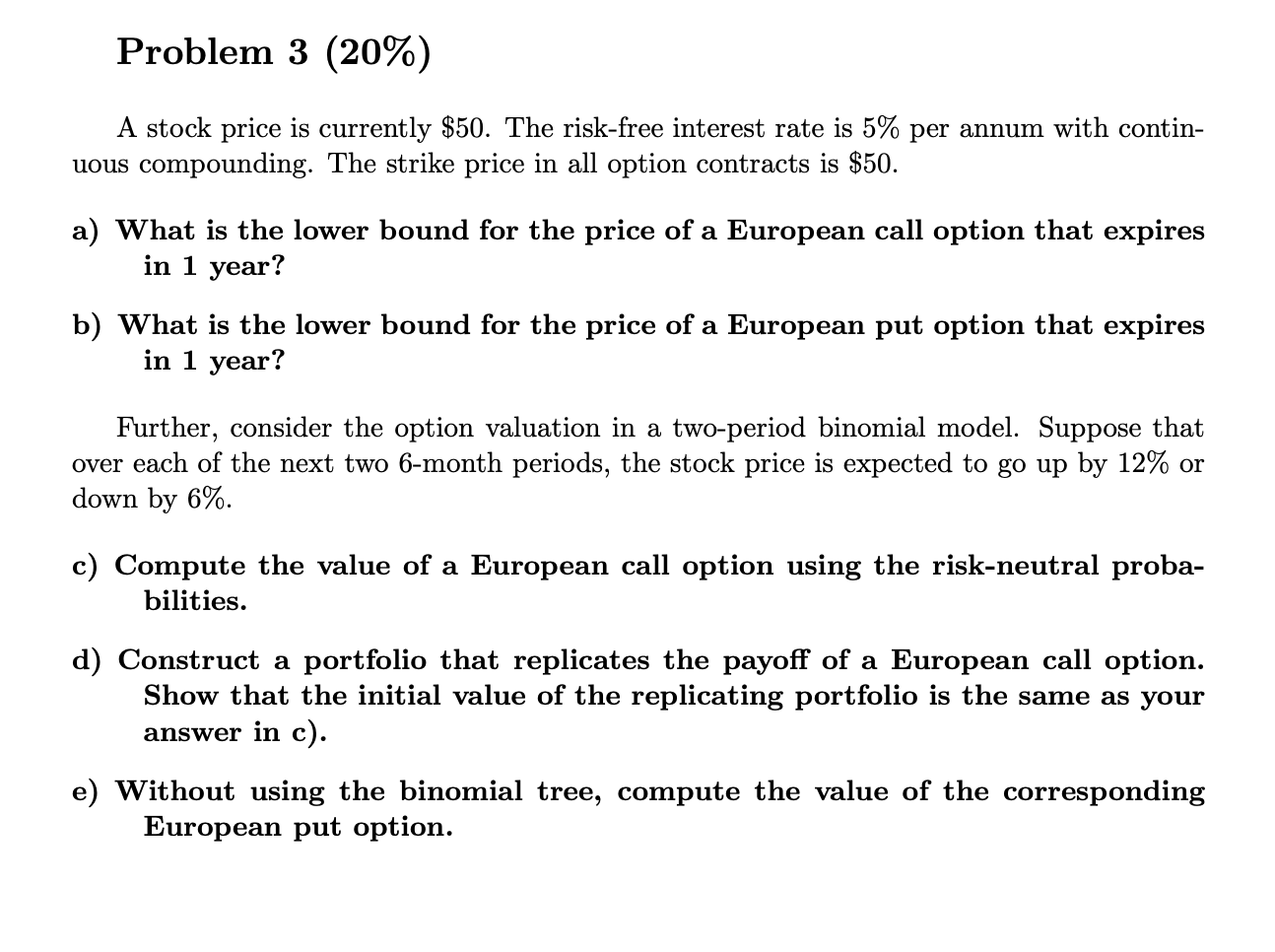

Problem 3 (20%) A stock price is currently $50. The risk-free interest rate is 5% per annum with contin- uous compounding. The strike price in all option contracts is $50. a) What is the lower bound for the price of a European call option that expires in 1 year? b) What is the lower bound for the price of a European put option that expires in 1 year? Further, consider the option valuation in a two-period binomial model. Suppose that over each of the next two 6-month periods, the stock price is expected to go up by 12% or down by 6%. c) Compute the value of a European call option using the risk-neutral proba- bilities. d) Construct a portfolio that replicates the payoff of a European call option. Show that the initial value of the replicating portfolio is the same as your answer in c). e) Without using the binomial tree, compute the value of the corresponding European put option. Problem 3 (20%) A stock price is currently $50. The risk-free interest rate is 5% per annum with contin- uous compounding. The strike price in all option contracts is $50. a) What is the lower bound for the price of a European call option that expires in 1 year? b) What is the lower bound for the price of a European put option that expires in 1 year? Further, consider the option valuation in a two-period binomial model. Suppose that over each of the next two 6-month periods, the stock price is expected to go up by 12% or down by 6%. c) Compute the value of a European call option using the risk-neutral proba- bilities. d) Construct a portfolio that replicates the payoff of a European call option. Show that the initial value of the replicating portfolio is the same as your answer in c). e) Without using the binomial tree, compute the value of the corresponding European put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts