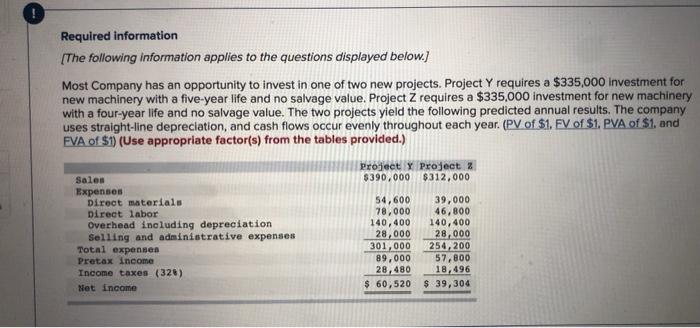

Question: need help with Q4!! ! Required information [The following information applies to the questions displayed below.) Most Company has an opportunity to invest in one

need help with Q4!!

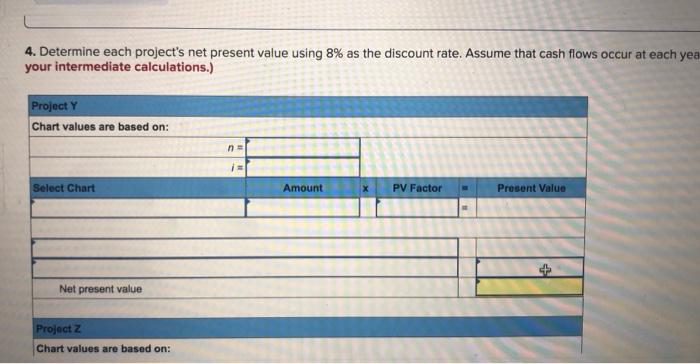

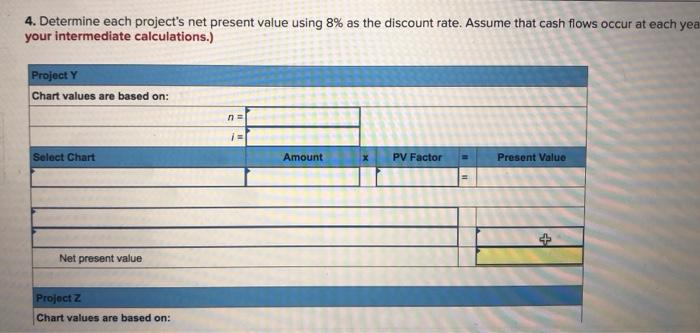

need help with Q4!!! Required information [The following information applies to the questions displayed below.) Most Company has an opportunity to invest in one of two new projects. Project Y requires a $335,000 investment for new machinery with a five-year life and no salvage value. Project Z requires a $335,000 investment for new machinery with a four-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project Project % $390,000 $312,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (326) Net Income 54,600 78,000 140,400 28,000 301,000 89,000 28,480 $ 60,520 39,000 46,800 140,400 28,000 254,200 57,800 18,496 $ 39,304 4. Determine each project's net present value using 8% as the discount rate. Assume that cash flows occur at each yea your intermediate calculations.) Project Y Chart values are based on: n. i Select Chart Amount PV Factor Present Value Net present value Project 2 Chart values are based on: 4. Determine each project's net present value using 8% as the discount rate. Assume that cash flows occur at each yea your intermediate calculations.) Project Y Chart values are based on: no 1 Select Chart Amount PV Factor Present Value Net present value Project Z Chart values are based on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts