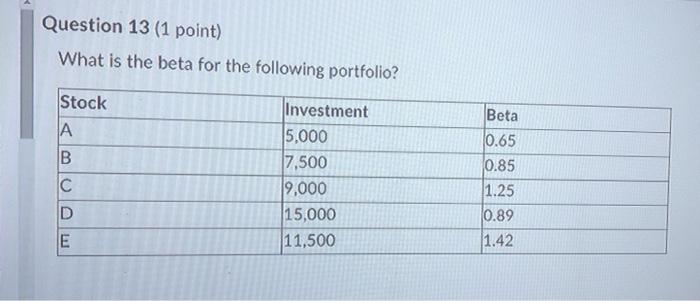

Question: need help with question 13 and14 Question 13 (1 point) What is the beta for the following portfolio? Stock A B Investment 5.000 7,500 9,000

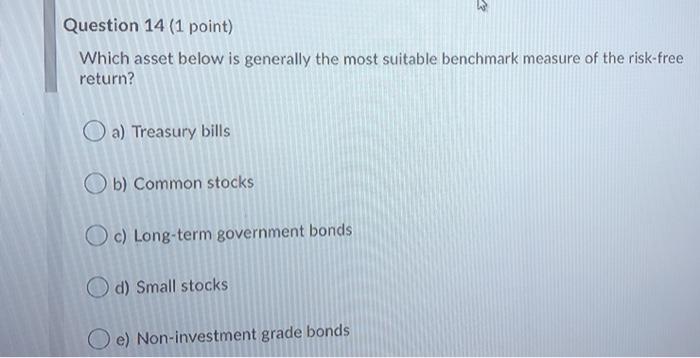

Question 13 (1 point) What is the beta for the following portfolio? Stock A B Investment 5.000 7,500 9,000 15,000 11,500 IC Beta 0.65 0.85 1.25 0.89 1.42 E Question 14 (1 point) Which asset below is generally the most suitable benchmark measure of the risk-free return? a) Treasury bills Ob) Common stocks O c) Long-term government bonds Od) Small stocks Oe) Non-investment grade bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts