Question: Need Help with Question 2. Just take question two as a three year depreciation to zero salvage value. 1. Machines A and B produce the

Need Help with Question 2. Just take question two as a three year depreciation to zero salvage value.

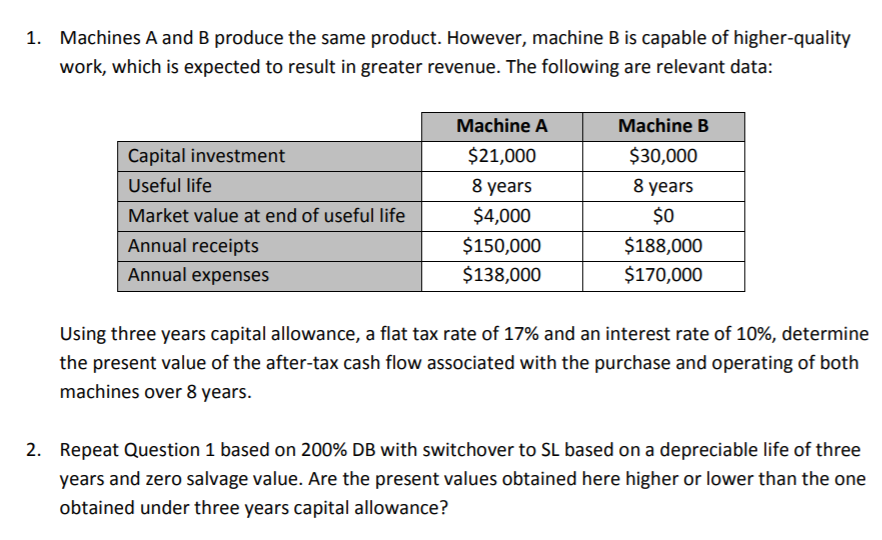

1. Machines A and B produce the same product. However, machine B is capable of higher-quality work, which is expected to result in greater revenue. The following are relevant data: Machine B $30,000 8 years Capital investment Useful life Market value at end of useful life Annual receipts Annual expenses Machine A $21,000 8 years $4,000 $150,000 $138,000 SO $188,000 $170,000 Using three years capital allowance, a flat tax rate of 17% and an interest rate of 10%, determine the present value of the after-tax cash flow associated with the purchase and operating of both machines over 8 years. Repeat Question 1 based on 200% DB with switchover to SL based on a depreciable life of three years and zero salvage value. Are the present values obtained here higher or lower than the one obtained under three years capital allowance? 1. Machines A and B produce the same product. However, machine B is capable of higher-quality work, which is expected to result in greater revenue. The following are relevant data: Machine B $30,000 8 years Capital investment Useful life Market value at end of useful life Annual receipts Annual expenses Machine A $21,000 8 years $4,000 $150,000 $138,000 SO $188,000 $170,000 Using three years capital allowance, a flat tax rate of 17% and an interest rate of 10%, determine the present value of the after-tax cash flow associated with the purchase and operating of both machines over 8 years. Repeat Question 1 based on 200% DB with switchover to SL based on a depreciable life of three years and zero salvage value. Are the present values obtained here higher or lower than the one obtained under three years capital allowance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts