Question: need help with question 2-32 b. Compute the gain or loss recognized by SWS Inc. c. Compute the basis of the stock received by F

need help with question 2-32

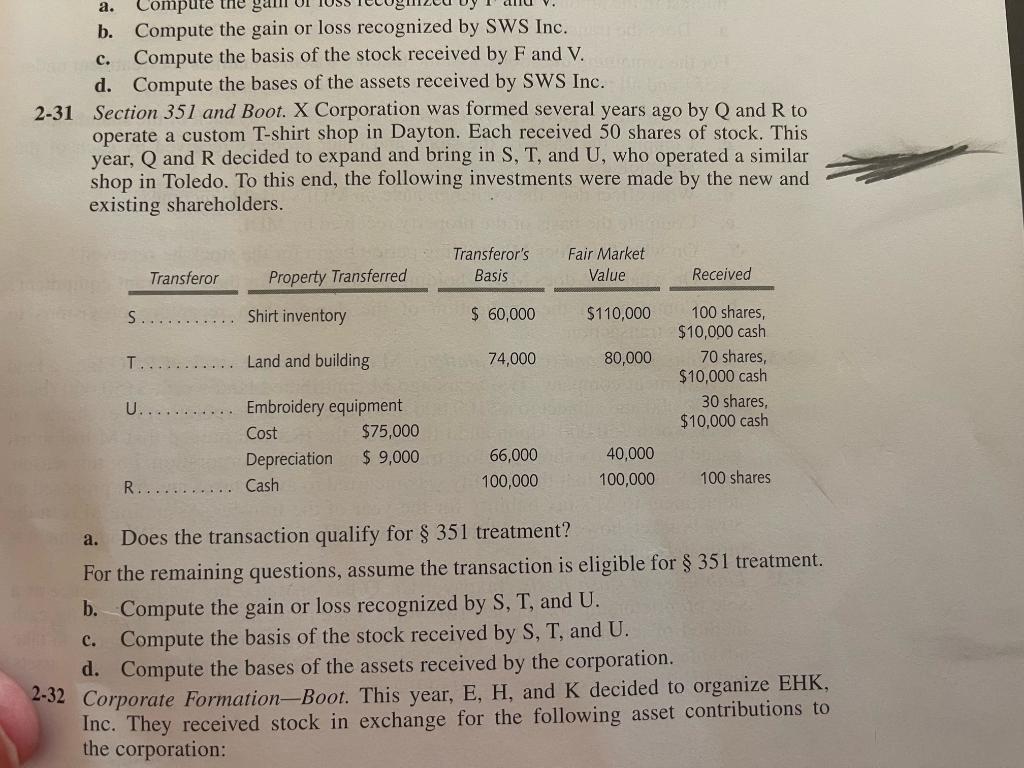

b. Compute the gain or loss recognized by SWS Inc. c. Compute the basis of the stock received by F and V. d. Compute the bases of the assets received by SWS Inc. 2-31 Section 351 and Boot. X Corporation was formed several years ago by Q and R to operate a custom T-shirt shop in Dayton. Each received 50 shares of stock. This year, Q and R decided to expand and bring in S,T, and U, who operated a similar shop in Toledo. To this end, the following investments were made by the new and existing shareholders. a. Does the transaction qualify for 351 treatment? For the remaining questions, assume the transaction is eligible for 351 treatment. b. Compute the gain or loss recognized by S,T, and U. c. Compute the basis of the stock received by S,T, and U. d. Compute the bases of the assets received by the corporation. 2-32 Corporate Formation-Boot. This year, E, H, and K decided to organize EHK, Inc. They received stock in exchange for the following asset contributions to the corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts