Question: Required: a. Compute the gain or loss recognized by F and V. b. Compute the gain or loss recognized by SWS Inc. c. Compute the

Required:

a. Compute the gain or loss recognized by F and V.

b. Compute the gain or loss recognized by SWS Inc.

c. Compute the basis of the stock received by F and V.

d. Compute the bases of the assets received by SWS Inc.

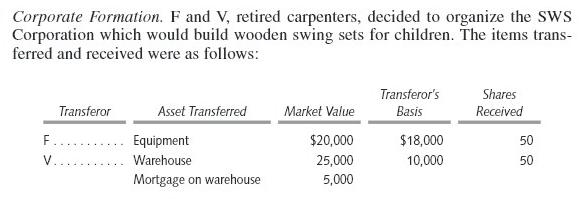

Corporate Formation. F and V, retired carpenters, decided to organize the SWS Corporation which would build wooden swing sets for children. The items trans- ferred and received were as follows: F V. Transferor Asset Transferred Equipment Warehouse Mortgage on warehouse Market Value $20,000 25,000 5,000 Transferor's Basis $18,000 10,000 Shares Received 50 50

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts