Question: need help with question 3 and 4 Question 3 (4 points) The Walt Disney Co. currently has outstanding bonds with 18 years to maturity, an

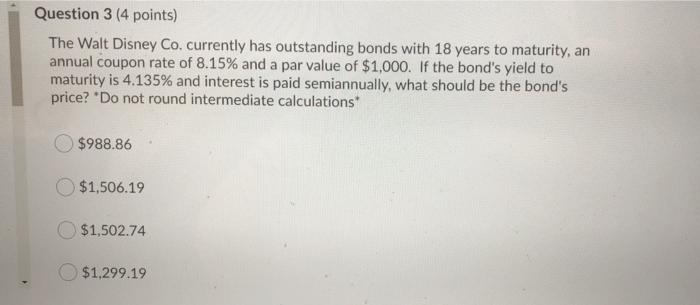

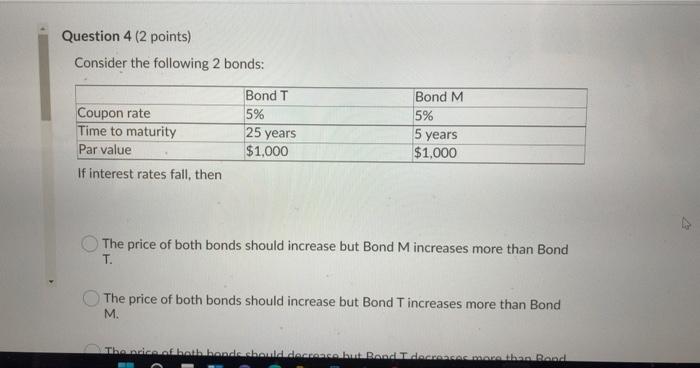

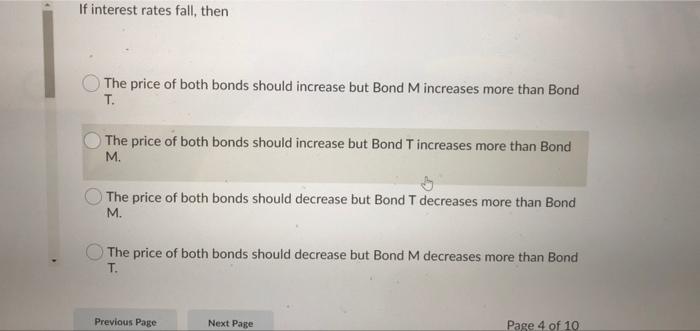

Question 3 (4 points) The Walt Disney Co. currently has outstanding bonds with 18 years to maturity, an annual coupon rate of 8.15% and a par value of $1,000. If the bond's yield to maturity is 4.135% and interest is paid semiannually, what should be the bond's price? "Do not round intermediate calculations $988.86 $1,506.19 $1,502.74 $1.299.19 Question 4 (2 points) Consider the following 2 bonds: Bond T 5% 25 years Coupon rate Time to maturity Par value If interest rates fall, then Bond M 5% 5 years $1,000 $1,000 The price of both bonds should increase but Bond M increases more than Bond T. The price of both bonds should increase but Bond Tincreases more than Bond M The de footh bondebouldedecken Boeddha Band If interest rates fall, then The price of both bonds should increase but Bond M increases more than Bond T. The price of both bonds should increase but Bond Tincreases more than Bond M. The price of both bonds should decrease but Bond T decreases more than Bond M. The price of both bonds should decrease but Bond M decreases more than Bond T. Previous Page Next Page Page 4 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts