Question: Need help with Question 4 a) and Question 5 Check my wor 4 The Reynolds Company buys from its suppliers on terms of 4/10, net

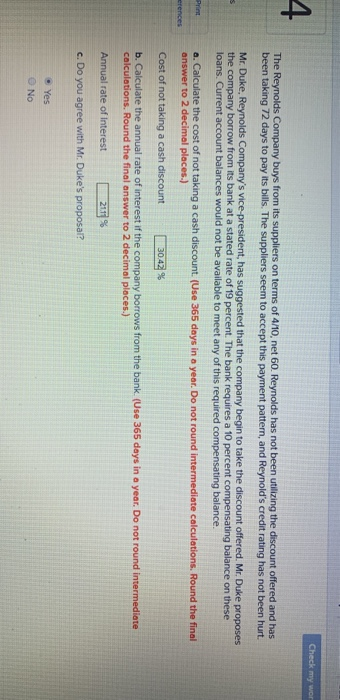

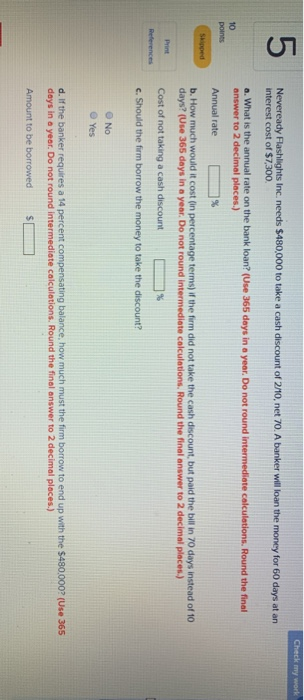

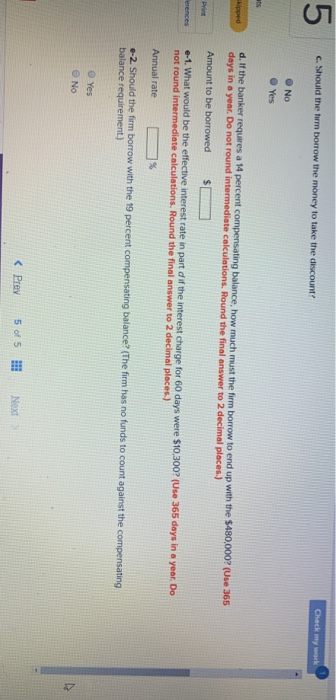

Check my wor 4 The Reynolds Company buys from its suppliers on terms of 4/10, net 60. Reynolds has not been utilizing the discount offered and has been taking 72 days to pay its bills. The suppliers seem to accept this payment pattern, and Reynold's credit rating has not been hurt Mr. Duke, Reynolds Company's vice-president, has suggested that the company begin to take the discount offered. Mr. Duke proposes the company borrow from its bank at a stated rate of 19 percent. The bank requires a 10 percent compensating balance on these loans. Current account balances would not be available to meet any of this required compensating balance. a. Calculate the cost of not taking a cash discount. (Use 365 days in a year. Do not round intermediate calculations. Round the finel answer to 2 decimal places.) Print erences Cost of not taking a cash discount 30.42% b. Calculate the annual rate of interest if the company borrows from the bank. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Annual rate of Interest 2111 % c. Do you agree with Mr. Duke's proposal? Yes O No Check my work 5 Neveready Flashlights Inc. needs $480,000 to take a cash discount of 2/10, net 70. A banker will loan the money for 60 days at an interest cost of $7,300 a. What is the annual rate on the bank loan? (Use 365 deys in a year. Do not round interrmediete calculations. Round the final answer to 2 decimal places.) 10 points Annual rate % Skipped b. How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 70 days instead of 10 days? (Use 365 days in a year. Do not round intermediate colculations. Round the final answer to 2 decimal places) Print Cost of not taking a cash discount % References c. Should the firm borrow the money to take the discount? No Yes d. If the banker requires a 14 percent compensating balance, how much must the firm borrow to end up with the $480.000? (Use 365 days in a year. Do not round intermediate calculations. Round the finel answer to 2 decimal places.) Amount to be borrowed 7 Check my wrk 5 c. Should the trm borrow the money to take the discount O No Yes ts d. If the banker requires a 14 percent compensating balance, how much must the firm borrow to end up with the $480,000? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places) kipped Amount to be borrowed Print e-1. What would be the effective interest rate in part dif the interest charge for 60 days were $10,300? (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places) erences Annual rate % e-2. Should the firm borrow with the 19 percent compensating balance? (The firm has no funds to count against the compensating balance requirement.) O Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts