Question: This is not a question but can you please let me know the theory behind it Suppose you want to invest in a project that

This is not a question but can you please let me know the theory behind it

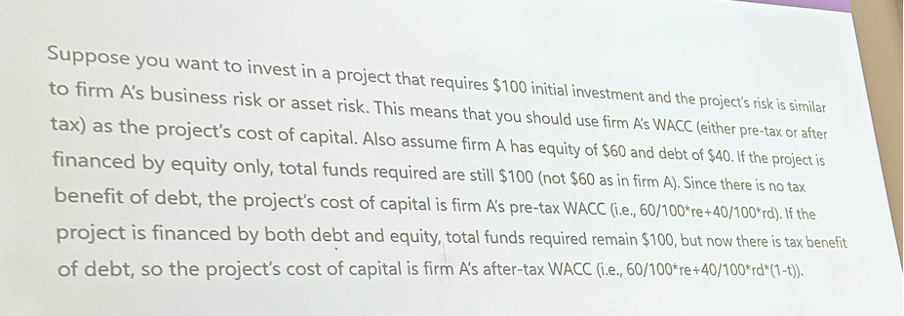

Suppose you want to invest in a project that requires \\( \\$ 100 \\) initial investment and the project's risk is similar to firm A's business risk or asset risk. This means that you should use firm A's WACC (either pre-tax or after tax) as the project's cost of capital. Also assume firm \\( A \\) has equity of \\( \\$ 60 \\) and debt of \\( \\$ 40 \\). If the project is financed by equity only, total funds required are still \\( \\$ 100 \\) (not \\( \\$ 60 \\) as in firm A). Since there is no tax benefit of debt, the project's cost of capital is firm A's pre-tax WACC (i.e., 60/100*re+40/100*rd). If the project is financed by both debt and equity, total funds required remain \\( \\$ 100 \\), but now there is tax benefit of debt, so the project's cost of capital is firm A's after-tax WACC (i.e., \\( 60 / 100^{*} r e+40 / 100^{*} d^{*}(1-t) \\) )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts