Question: need help with question 4 and 5 D Question 4 1 pts Danks Corporation purchased a patent for $405.000 on September 1, 2019. It had

need help with question 4 and 5

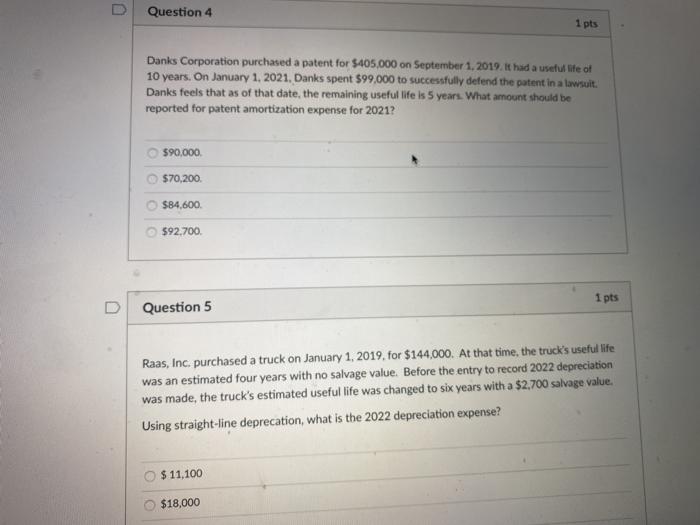

need help with question 4 and 5D Question 4 1 pts Danks Corporation purchased a patent for $405.000 on September 1, 2019. It had a useful life of 10 years. On January 1, 2021. Danks spent $99,000 to successfully defend the patent in a lawsuit. Danks feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2021? 590,000 $70,200 $84,600 $92,700 1 pts Question 5 Raas, Inc. purchased a truck on January 1, 2019 for $144,000. At that time, the truck's useful life was an estimated four years with no salvage value. Before the entry to record 2022 depreciation was made, the truck's estimated useful life was changed to six years with a $2,700 salvage value. Using straight-line deprecation, what is the 2022 depreciation expense? $ 11,100 $18,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts