Question: Provide a solution for each problem Question 1 1 pts Sanji Corporation purchased a machine on July 1, 2016, for P750,000. The machine was estimated

Provide a solution for each problem

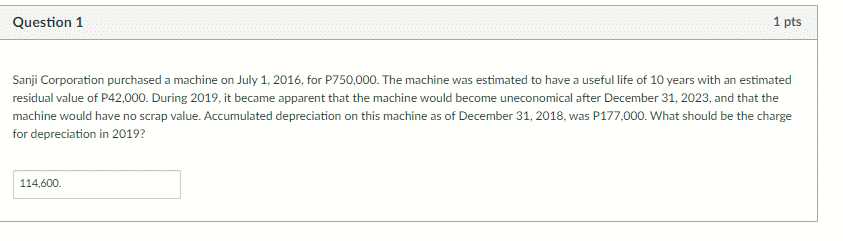

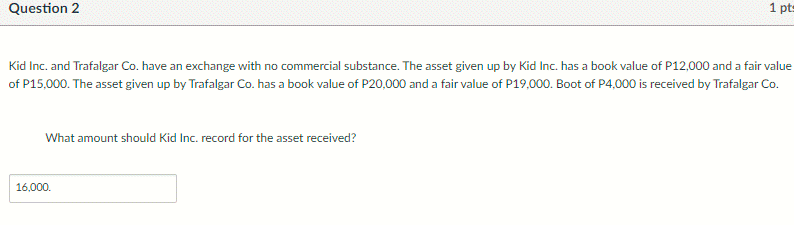

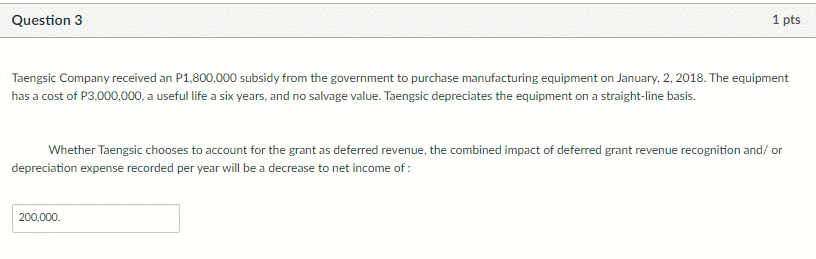

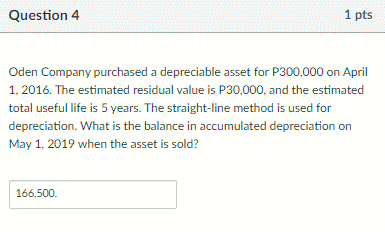

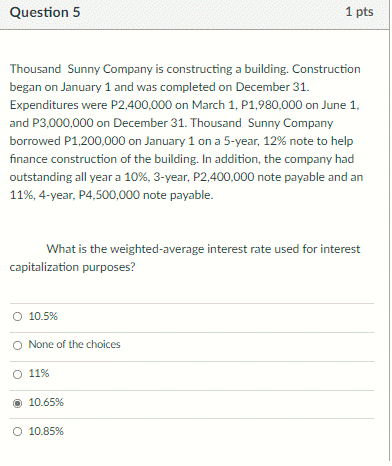

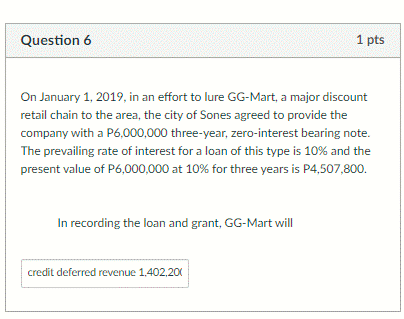

Question 1 1 pts Sanji Corporation purchased a machine on July 1, 2016, for P750,000. The machine was estimated to have a useful life of 10 years with an estimated residual value of P42,000. During 2019, it became apparent that the machine would become uneconomical after December 31, 2023, and that the machine would have no scrap value. Accumulated depreciation on this machine as of December 31, 2018, was P177,000. What should be the charge for depreciation in 2019? 114,600.Question 2 1 pt Kid Inc. and Trafalgar Co. have an exchange with no commercial substance. The asset given up by Kid Inc. has a book value of P12,000 and a fair value of P15,000. The asset given up by Trafalgar Co. has a book value of P20,000 and a fair value of P19,000. Boot of P4,000 is received by Trafalgar Co. What amount should Kid Inc. record for the asset received? 16,000.Question 3 1 pts Taengsic Company received an P1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2018. The equipment has a cost of P3,000,000, a useful life a six years, and no salvage value. Taengsic depreciates the equipment on a straight-line basis. Whether Taengsic chooses to account for the grant as deferred revenue, the combined impact of deferred grant revenue recognition and/ or depreciation expense recorded per year will be a decrease to net income of : 200,000.Question 4 1 pts Oden Company purchased a depreciable asset for P300,000 on April 1, 2016. The estimated residual value is P30,000, and the estimated total useful life is 5 years. The straight-line method is used for depreciation. What is the balance in accumulated depreciation on May 1, 2019 when the asset is sold? 166,500.Question 5 1 pts Thousand Sunny Company is constructing a building. Construction began on January 1 and was completed on December 31. Expenditures were P2,400,000 on March 1, P1,980,000 on June 1, and P3,000,000 on December 31. Thousand Sunny Company borrowed P1,200,000 on January 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 3-year, P2,400,000 note payable and an 11%, 4-year, P4,500,000 note payable. What is the weighted-average interest rate used for interest capitalization purposes? O 10.5% O None of the choices 11% 10.65% O 10.85%Question 6 1 pts On January 1, 2019, in an effort to lure GG-Mart, a major discount retail chain to the area, the city of Sones agreed to provide the company with a P6,000,000 three-year, zero-interest bearing note. The prevailing rate of interest for a loan of this type is 10% and the present value of P6,000,000 at 10% for three years is P4,507,800. In recording the loan and grant, GG-Mart will credit deferred revenue 1,402,20(