Question: need help with Question 'd' and 'e' 3. The continuously compounded yield curve is given as follows: Maturity (years) Yield 0.5 5% 5.5% 1.5 6%

need help with Question 'd' and 'e'

need help with Question 'd' and 'e'

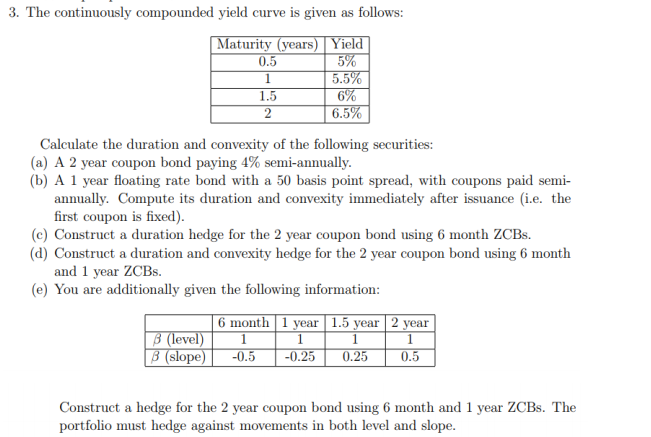

3. The continuously compounded yield curve is given as follows: Maturity (years) Yield 0.5 5% 5.5% 1.5 6% 6.5% 1 2 Calculate the duration and convexity of the following securities: (a) A 2 year coupon bond paying 4% semi-annually. (b) A 1 year floating rate bond with a 50 basis point spread, with coupons paid semi- annually. Compute its duration and convexity immediately after issuance (i.e. the first coupon is fixed). (c) Construct a duration hedge for the 2 year coupon bond using 6 month ZCBs. (d) Construct a duration and convexity hedge for the 2 year coupon bond using 6 month and 1 year ZCBs. (e) You are additionally given the following information: 6 month 1 year 1.5 year 2 year B (level) 1 1 1 1 B (slope) -0.5 -0.25 0.25 0.5 Construct a hedge for the 2 year coupon bond using 6 month and 1 year ZCBs. The portfolio must hedge against movements in both level and slope. 3. The continuously compounded yield curve is given as follows: Maturity (years) Yield 0.5 5% 5.5% 1.5 6% 6.5% 1 2 Calculate the duration and convexity of the following securities: (a) A 2 year coupon bond paying 4% semi-annually. (b) A 1 year floating rate bond with a 50 basis point spread, with coupons paid semi- annually. Compute its duration and convexity immediately after issuance (i.e. the first coupon is fixed). (c) Construct a duration hedge for the 2 year coupon bond using 6 month ZCBs. (d) Construct a duration and convexity hedge for the 2 year coupon bond using 6 month and 1 year ZCBs. (e) You are additionally given the following information: 6 month 1 year 1.5 year 2 year B (level) 1 1 1 1 B (slope) -0.5 -0.25 0.25 0.5 Construct a hedge for the 2 year coupon bond using 6 month and 1 year ZCBs. The portfolio must hedge against movements in both level and slope

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts