Question: need help with requirment 2 please Requirement 2. Compare the companies performance for 2025 and 2024. Make a recommendation to Wonder Wildemeis Company about investing

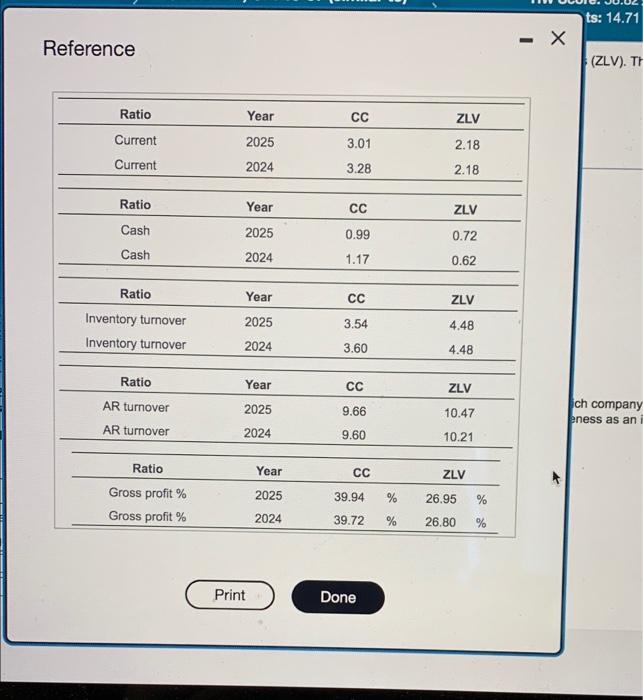

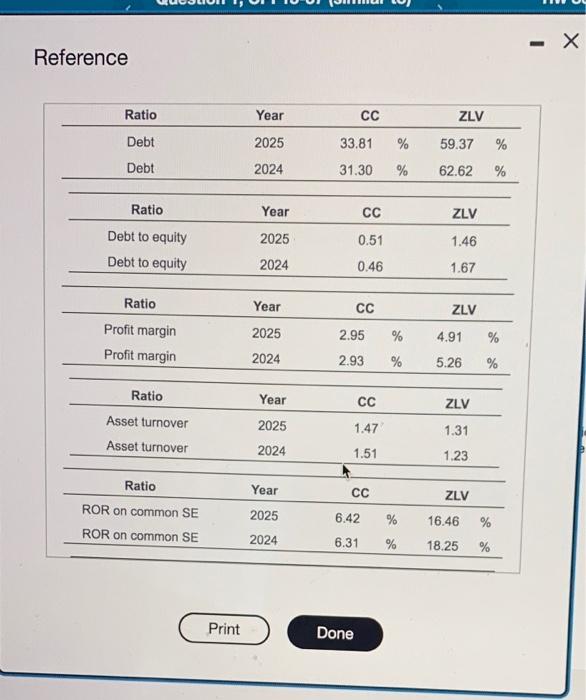

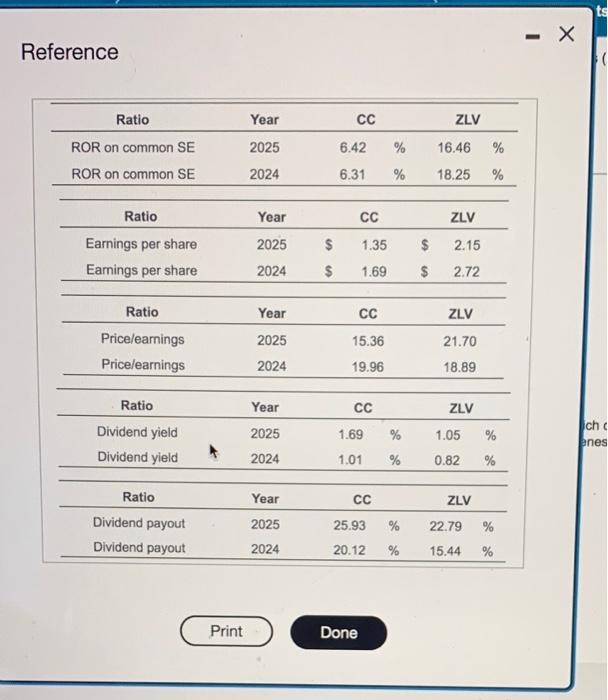

Requirement 2. Compare the companies performance for 2025 and 2024. Make a recommendation to Wonder Wildemeis Company about investing in these companies which company would be a better investment. The Canoe Companys Zone Life Vests? Base your answer on ability to pay curent sabilities, ability to sell merchandise and cofect receivables, ability to pay long-term debt profitability and attractiveness as an investment Start by comparing each company's ability to pay cument liabilities Select the appropriate ratios and identify which company has the stronger natio Beview eration you calculated in Requement 1. Ability to pay current ab investment company Ration Potent with stronger ni Reference Ratio Current Current Ratio Cash Cash Ratio Inventory turnover Inventory turnover Ratio AR turnover AR turnover Ratio Gross profit % Gross profit % Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Print Year 2025 2024 CC 3.01 3.28 CC 0.99 1.17 CC 3.54 3.60 CC 9.66 9.60 CC 39.94 % 39.72 % Done ZLV 2.18 2.18 ZLV 0.72 0.62 ZLV 4.48 4.48 ZLV 10.47 10.21 ZLV 26.95 % 26.80 % X ts: 14.71 (ZLV). Th ich company eness as an i Reference Ratio Debt Debt Ratio Debt to equity Debt to equity Ratio Profit margin Profit margin Ratio Asset turnover Asset turnover Ratio ROR on common SE ROR on common SE Print Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 CC 33.81 % 59.37 % 31.30 % 62.62 % CC ZLV 0.51 1.46 0.46 1.67 CC ZLV 2.95 2.93 CC 1.47 1.51 CC 6.42 6.31 Done % % ZLV % % 4.91 5.26 ZLV 1.31 1.23 ZLV % % 16.46 % 18.25 % - X Reference Ratio ROR on common SE ROR on common SE Ratio Earnings per share Earnings per share Ratio Price/earnings Price/earnings Ratio Dividend yield Dividend yield Ratio Dividend payout Dividend payout 4 Print Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 CC 6.42 % 6.31 % CC 1.35 $ 1.69 $ CC 15.36 19.96 CC 1.69 % 1.01 % CC 25.93 % 20.12 % $ $ Done ZLV 16.46 % 18.25 % ZLV 2.15 2.72 ZLV 21.70 18.89 ZLV 1.05 0.82 ZLV 22.79 15.44 % % % % - X ch c enes Accounts receivable turnover Asset turnover ratio Cash ratio Current ratio Debt ratio Debt to equity ratio Dividend payout Dividend yield Earnings per share Gross profit percentage Inventory turnover Price/earnings ratio Profit margin ratio Rate of return on common stockholders' equity Question cash in trading securities and is considering t 2023: per share your answers as a percentage to two decimal ZLV 22.79 % 15.44 nd 2024. Make a recommendation to Wonder ies, ability to sell merchandise and collect recei Select the appropriate ratios and identify whic stment company onger ratio Requirement 2. Compare the companies performance for 2025 and 2024. Make a recommendation to Wonder Wildemeis Company about investing in these companies which company would be a better investment. The Canoe Companys Zone Life Vests? Base your answer on ability to pay curent sabilities, ability to sell merchandise and cofect receivables, ability to pay long-term debt profitability and attractiveness as an investment Start by comparing each company's ability to pay cument liabilities Select the appropriate ratios and identify which company has the stronger natio Beview eration you calculated in Requement 1. Ability to pay current ab investment company Ration Potent with stronger ni Reference Ratio Current Current Ratio Cash Cash Ratio Inventory turnover Inventory turnover Ratio AR turnover AR turnover Ratio Gross profit % Gross profit % Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Print Year 2025 2024 CC 3.01 3.28 CC 0.99 1.17 CC 3.54 3.60 CC 9.66 9.60 CC 39.94 % 39.72 % Done ZLV 2.18 2.18 ZLV 0.72 0.62 ZLV 4.48 4.48 ZLV 10.47 10.21 ZLV 26.95 % 26.80 % X ts: 14.71 (ZLV). Th ich company eness as an i Reference Ratio Debt Debt Ratio Debt to equity Debt to equity Ratio Profit margin Profit margin Ratio Asset turnover Asset turnover Ratio ROR on common SE ROR on common SE Print Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 CC 33.81 % 59.37 % 31.30 % 62.62 % CC ZLV 0.51 1.46 0.46 1.67 CC ZLV 2.95 2.93 CC 1.47 1.51 CC 6.42 6.31 Done % % ZLV % % 4.91 5.26 ZLV 1.31 1.23 ZLV % % 16.46 % 18.25 % - X Reference Ratio ROR on common SE ROR on common SE Ratio Earnings per share Earnings per share Ratio Price/earnings Price/earnings Ratio Dividend yield Dividend yield Ratio Dividend payout Dividend payout 4 Print Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 Year 2025 2024 CC 6.42 % 6.31 % CC 1.35 $ 1.69 $ CC 15.36 19.96 CC 1.69 % 1.01 % CC 25.93 % 20.12 % $ $ Done ZLV 16.46 % 18.25 % ZLV 2.15 2.72 ZLV 21.70 18.89 ZLV 1.05 0.82 ZLV 22.79 15.44 % % % % - X ch c enes Accounts receivable turnover Asset turnover ratio Cash ratio Current ratio Debt ratio Debt to equity ratio Dividend payout Dividend yield Earnings per share Gross profit percentage Inventory turnover Price/earnings ratio Profit margin ratio Rate of return on common stockholders' equity Question cash in trading securities and is considering t 2023: per share your answers as a percentage to two decimal ZLV 22.79 % 15.44 nd 2024. Make a recommendation to Wonder ies, ability to sell merchandise and collect recei Select the appropriate ratios and identify whic stment company onger ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts