Question: Need help with the attachments below 10 1.8 points EBDOk Hll'it Print Speedy Delivery Systems can buy a piece of equipment that is anticipated to

Need help with the attachments below

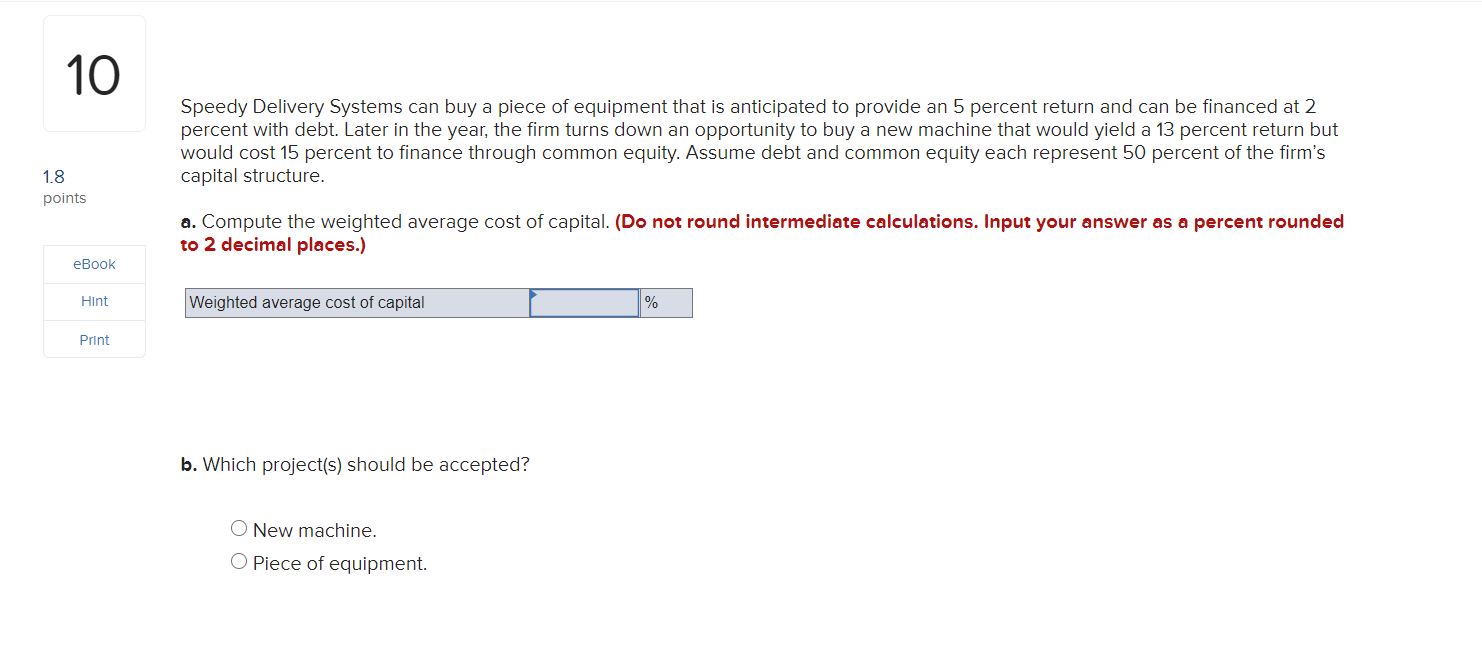

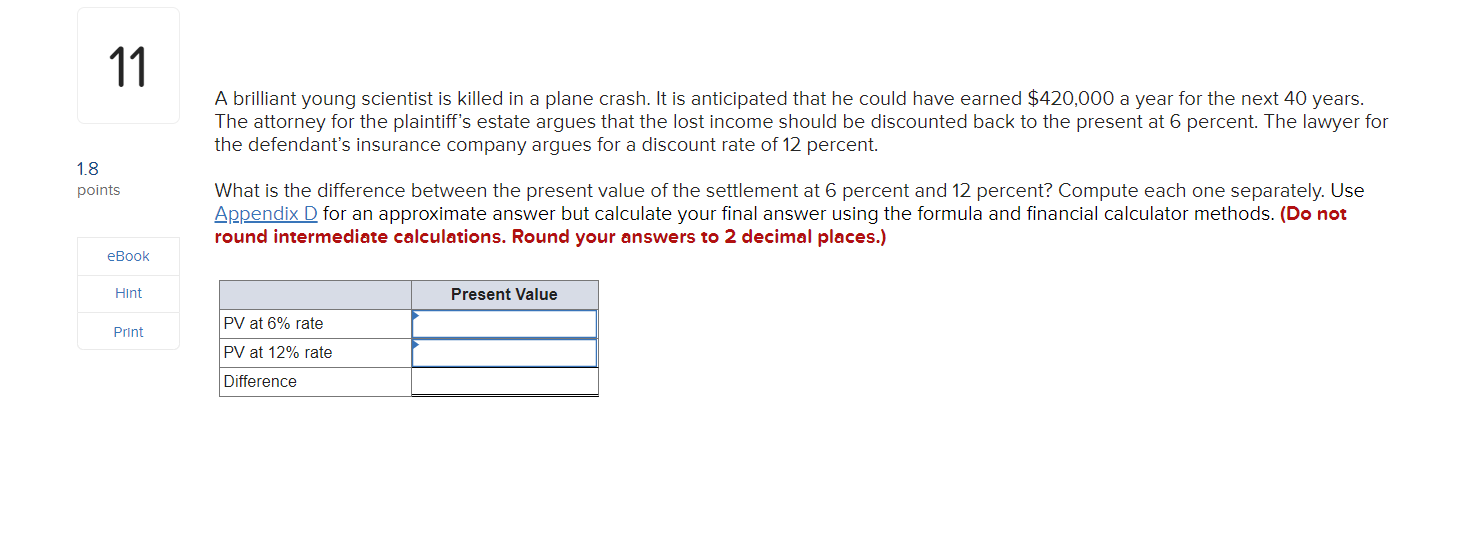

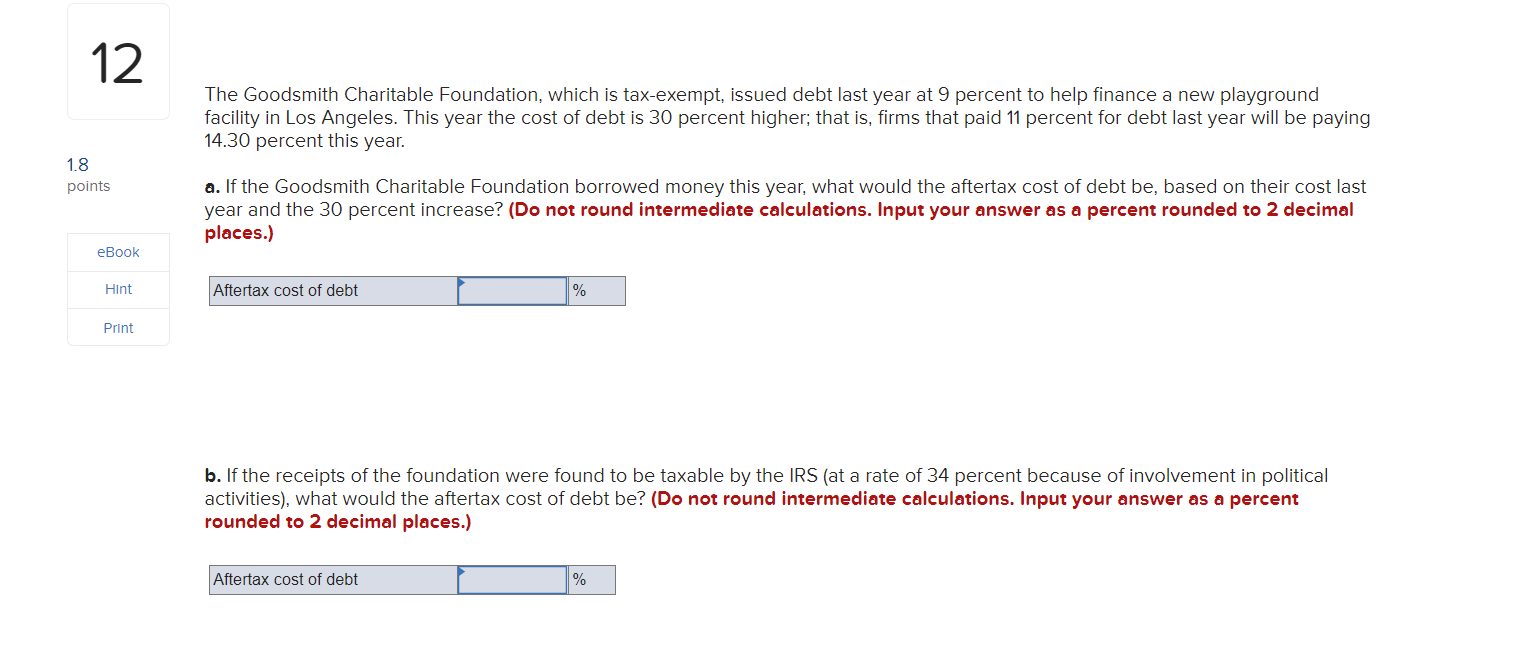

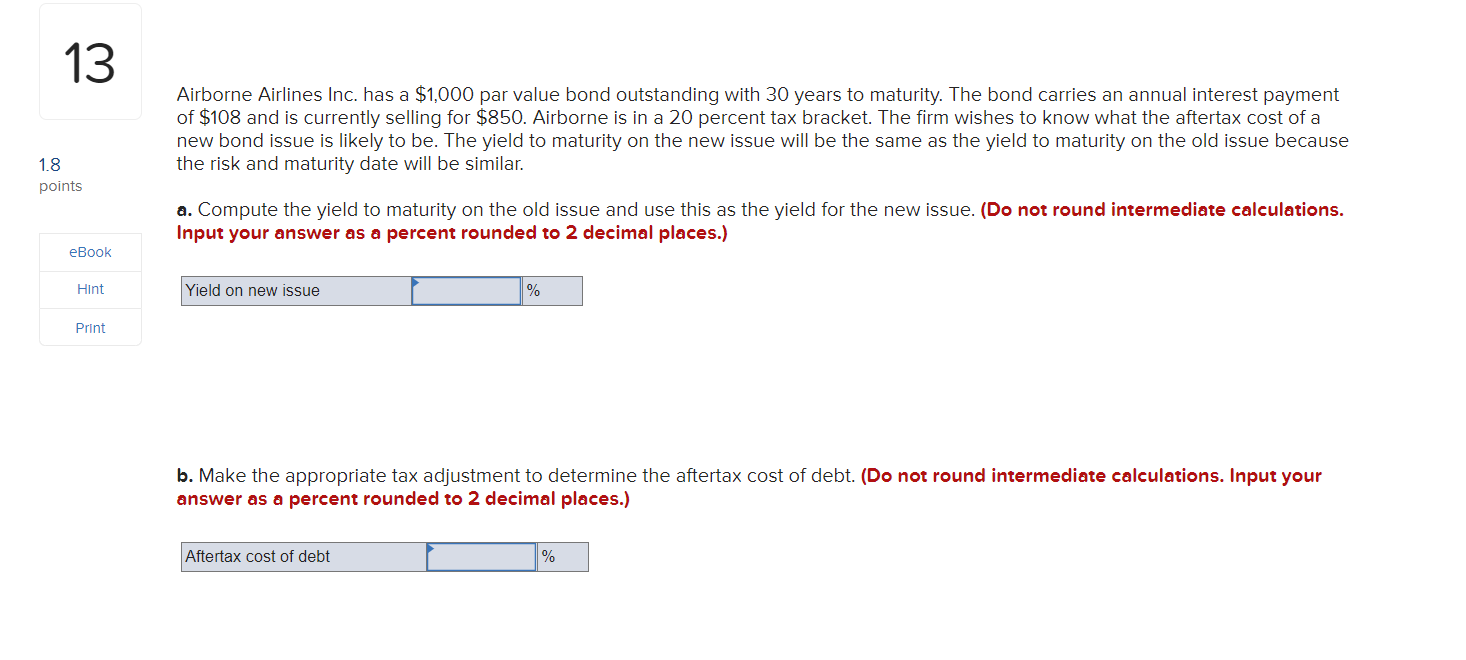

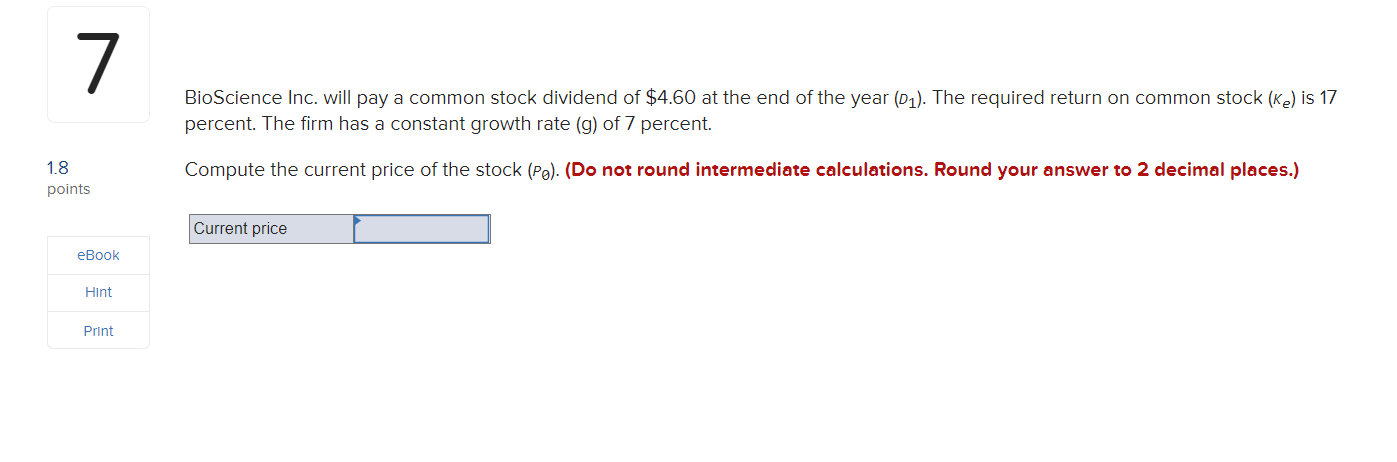

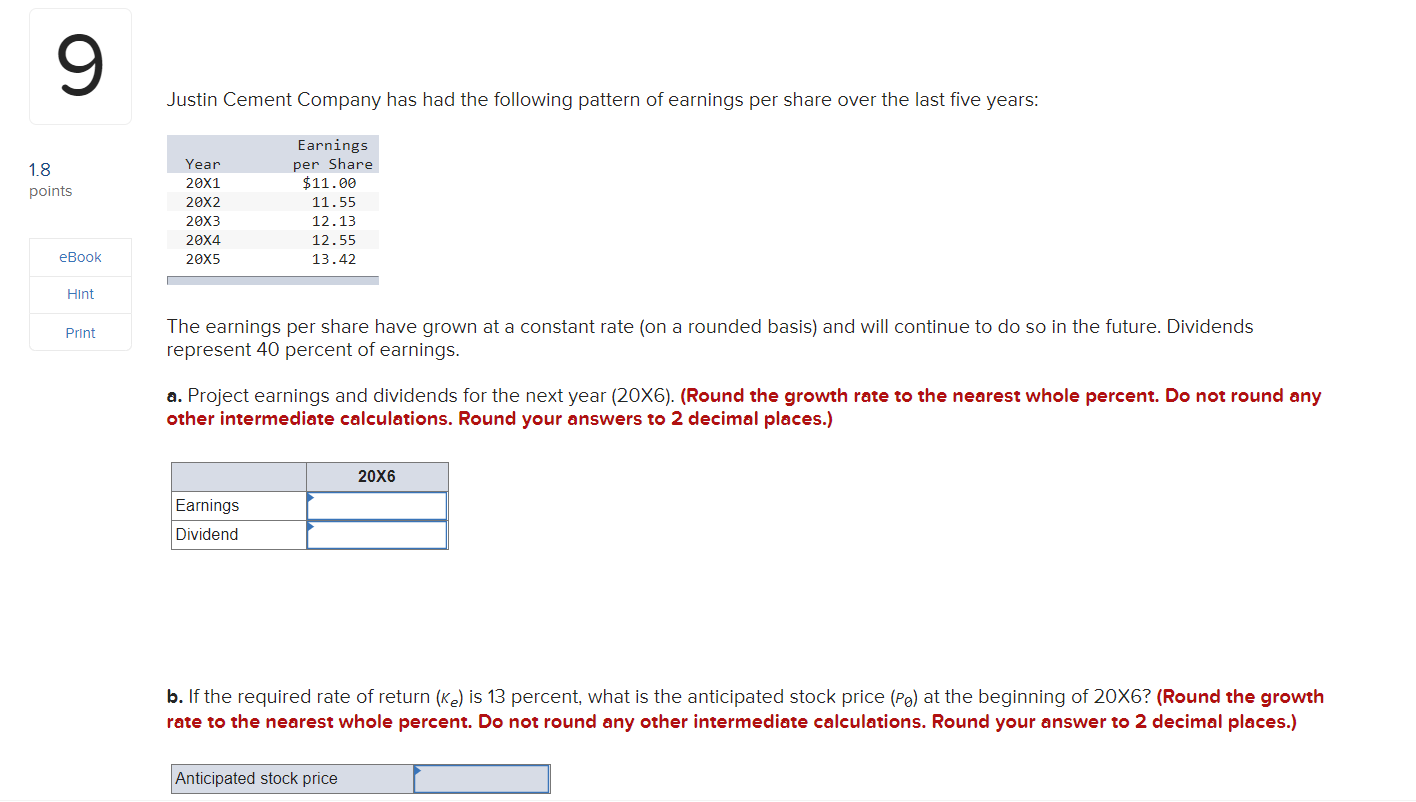

10 1.8 points EBDOk Hll'it Print Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 5 percent return and can be financed at 2 percent with debt. Later in the year, the rm turns down an opportunity to buy a new machine that would yield a 13 percent return but would cost 15 percent to nance through common equity. Assume debt and common equity each represent 50 percent of the firm's capital structure. a. Compute the weighted average cost of capital. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital 'M. b. Which projectls) should be accepted? 0 New machine. 0 Piece of equipment. 11 A brilliant young scientist is killed in a plane crash. It is anticipated that he could have earned $420,000 a year for the next 40 years. The attorney for the plaintiff's estate argues that the lost income should be discounted back to the present at 6 percent. The lawyer for the defendant's insurance company argues for a discount rate of 12 percent. 1.8 Points What is the difference between the present value ofthe settlement at 6 percent and 12 percent? Compute each one separately. Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your answers to 2 decimal places.) EBDOK Hint Present Value Print PV 316% rate PV at 12% rate D iffere nce 12 1.8 points eEook Hll'lt Print The Goodsmith Charitable Foundation. which is taxeexempt, issued debt last year at 9 percent to help nance a new playground facility in Los Angeles. This year the cost of debt is 30 percent higher; that is, firms that paid 11 percent for debt last year will be paying 14.30 percent this year. a. If the Goodsmith Charitable Foundation borrowed money this year, what would the aertax cost of debt be, based on their cost last year and the 30 percent increase? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aeax oust of debt % b. If the receipts of the foundation were found to be taxable by the IRS (at a rate of 34 percent because of involvement in political activities), what would the aertax cost of debt be?I (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aerlax oust of debt '36 13 Airborne Airlines Inc. has a $1,000 par value bond outstanding with 30 years to maturity. The bond carries an annual interest payment of $108 and is currently selling for $850. Airborne is in a 20 percent tax bracket. The rm wishes to know what the aertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because 18 the risk and maturity date will be similar. points a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) eBook Print b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aertax cost of debt I '55 BioScience Inc. will pay a common stock dividend of $4.60 at the end of the year (D1). The required return on common stock (Ke) is 17 percent. The firm has a constant growth rate (g) of 7 percent. 1.8 Compute the current price of the stock (Po). (Do not round intermediate calculations. Round your answer to 2 decimal places.) points Current price eBook Hint Print1.8 points EEDOK Hll'it F'l'ir'll Justin Cement Company has had the following pattern of earnings per share over the last ve years: Earnings Year per Share 29x1. $11 .68 29x2 11 . 55 29x3 12 . 13 20x4 12 . 55 29x5 13 .42 ' The earnings per share have grown at a constant rate (on a rounded basis) and will continue to do so in the future. Dividends represent 40 percent of earnings. a. Project earnings and dividends for the next year (2OX6). (Round the growth rate to the nearest whole percent. Do not round any other intermediate calculations. Round your answers to 2 decimal places.) Earnings Dividend b. If the required rate of return (Kg) is 13 percent, what is the anticipated stock price (PB) at the beginning of 20X6? (Round the growth rate to the nearest whole percent. Do not round any other intermediate calculations. Round your answer to 2 decimal places.) Anticipated stock prioe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts