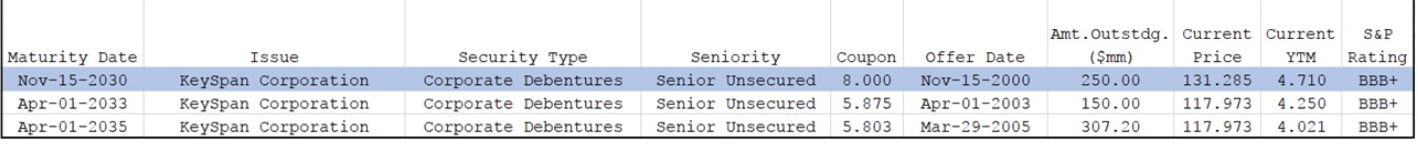

Question: S&P Amt.Outstdg. Current Current (mm) Price Issue Offer Date YTM Rating Seniority Senior Unsecured Coupon 8.000 Nov-15-2000 250.00 131.285 4.710 BBB+ Maturity Date Nov-15-2030 Apr-01-2033

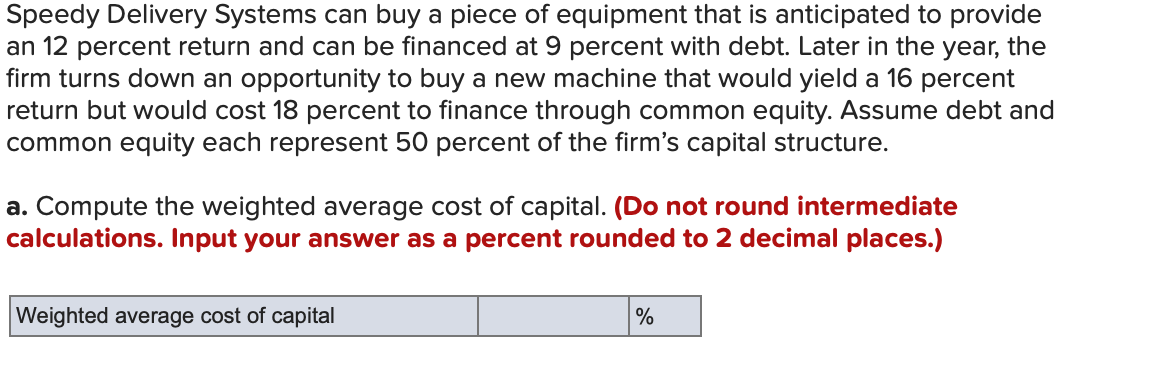

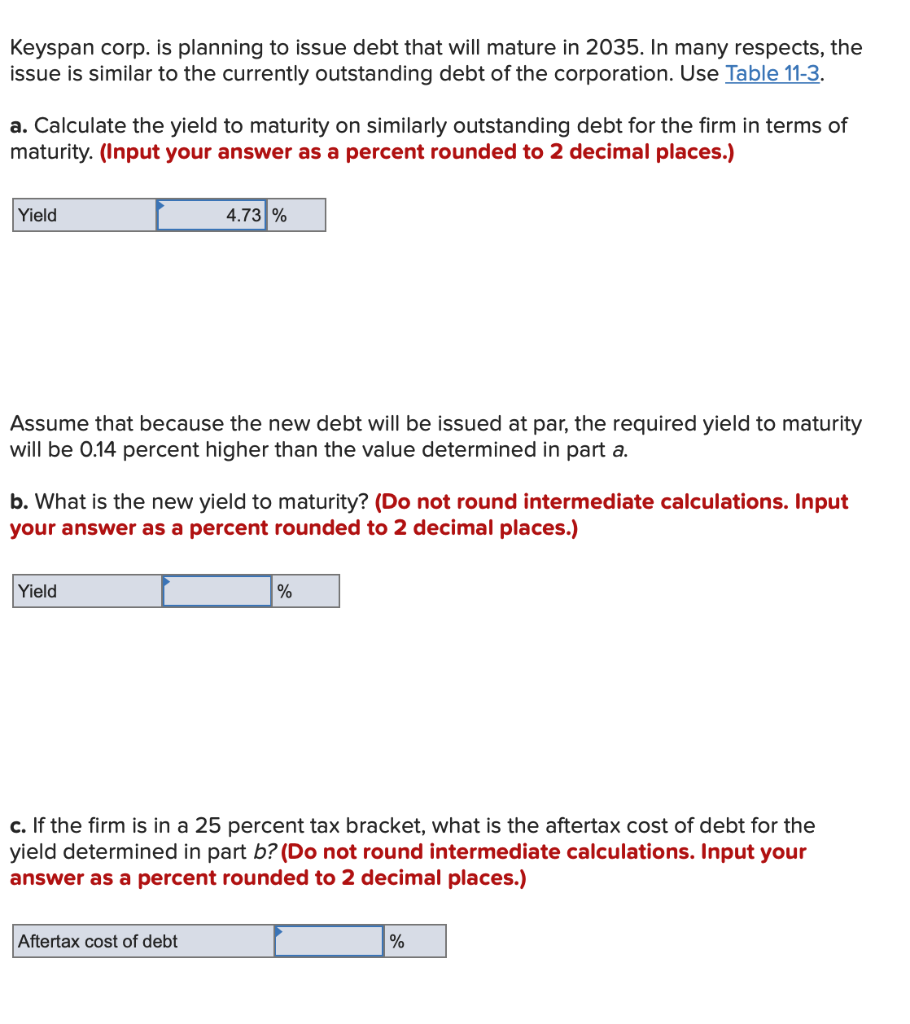

S&P Amt.Outstdg. Current Current (mm) Price Issue Offer Date YTM Rating Seniority Senior Unsecured Coupon 8.000 Nov-15-2000 250.00 131.285 4.710 BBB+ Maturity Date Nov-15-2030 Apr-01-2033 Apr-01-2035 KeySpan Corporation KeySpan Corporation KeySpan Corporation Security Type Corporate Debentures Corporate Debentures Corporate Debentures Senior Unsecured 5.875 Apr-01-2003 150.00 117.973 4.250 BBB+ Senior Unsecured 5.803 Mar-29-2005 307.20 117.973 4.021 BBB+ Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 12 percent return and can be financed at 9 percent with debt. Later in the year, the firm turns down an opportunity to buy a new machine that would yield a 16 percent return but would cost 18 percent to finance through common equity. Assume debt and common equity each represent 50 percent of the firm's capital structure. a. Compute the weighted average cost of capital. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital % Keyspan corp. is planning to issue debt that will mature in 2035. In many respects, the issue is similar to the currently outstanding debt of the corporation. Use Table 11-3. a. Calculate the yield to maturity on similarly outstanding debt for the firm in terms of maturity. (Input your answer as a percent rounded to 2 decimal places.) Yield 4.73% Assume that because the new debt will be issued at par, the required yield to maturity will be 0.14 percent higher than the value determined in part a. b. What is the new yield to maturity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Yield % c. If the firm is in a 25 percent tax bracket, what is the aftertax cost of debt for the yield determined in part b? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aftertax cost of debt % S&P Amt.Outstdg. Current Current (mm) Price Issue Offer Date YTM Rating Seniority Senior Unsecured Coupon 8.000 Nov-15-2000 250.00 131.285 4.710 BBB+ Maturity Date Nov-15-2030 Apr-01-2033 Apr-01-2035 KeySpan Corporation KeySpan Corporation KeySpan Corporation Security Type Corporate Debentures Corporate Debentures Corporate Debentures Senior Unsecured 5.875 Apr-01-2003 150.00 117.973 4.250 BBB+ Senior Unsecured 5.803 Mar-29-2005 307.20 117.973 4.021 BBB+ Speedy Delivery Systems can buy a piece of equipment that is anticipated to provide an 12 percent return and can be financed at 9 percent with debt. Later in the year, the firm turns down an opportunity to buy a new machine that would yield a 16 percent return but would cost 18 percent to finance through common equity. Assume debt and common equity each represent 50 percent of the firm's capital structure. a. Compute the weighted average cost of capital. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital % Keyspan corp. is planning to issue debt that will mature in 2035. In many respects, the issue is similar to the currently outstanding debt of the corporation. Use Table 11-3. a. Calculate the yield to maturity on similarly outstanding debt for the firm in terms of maturity. (Input your answer as a percent rounded to 2 decimal places.) Yield 4.73% Assume that because the new debt will be issued at par, the required yield to maturity will be 0.14 percent higher than the value determined in part a. b. What is the new yield to maturity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Yield % c. If the firm is in a 25 percent tax bracket, what is the aftertax cost of debt for the yield determined in part b? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aftertax cost of debt %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts