Question: Need help with the attachments below 14 1.8 points EEDOk Hli'it F'rlhl Terrier Company is in a 45 percent tax bracket and has a bond

Need help with the attachments below

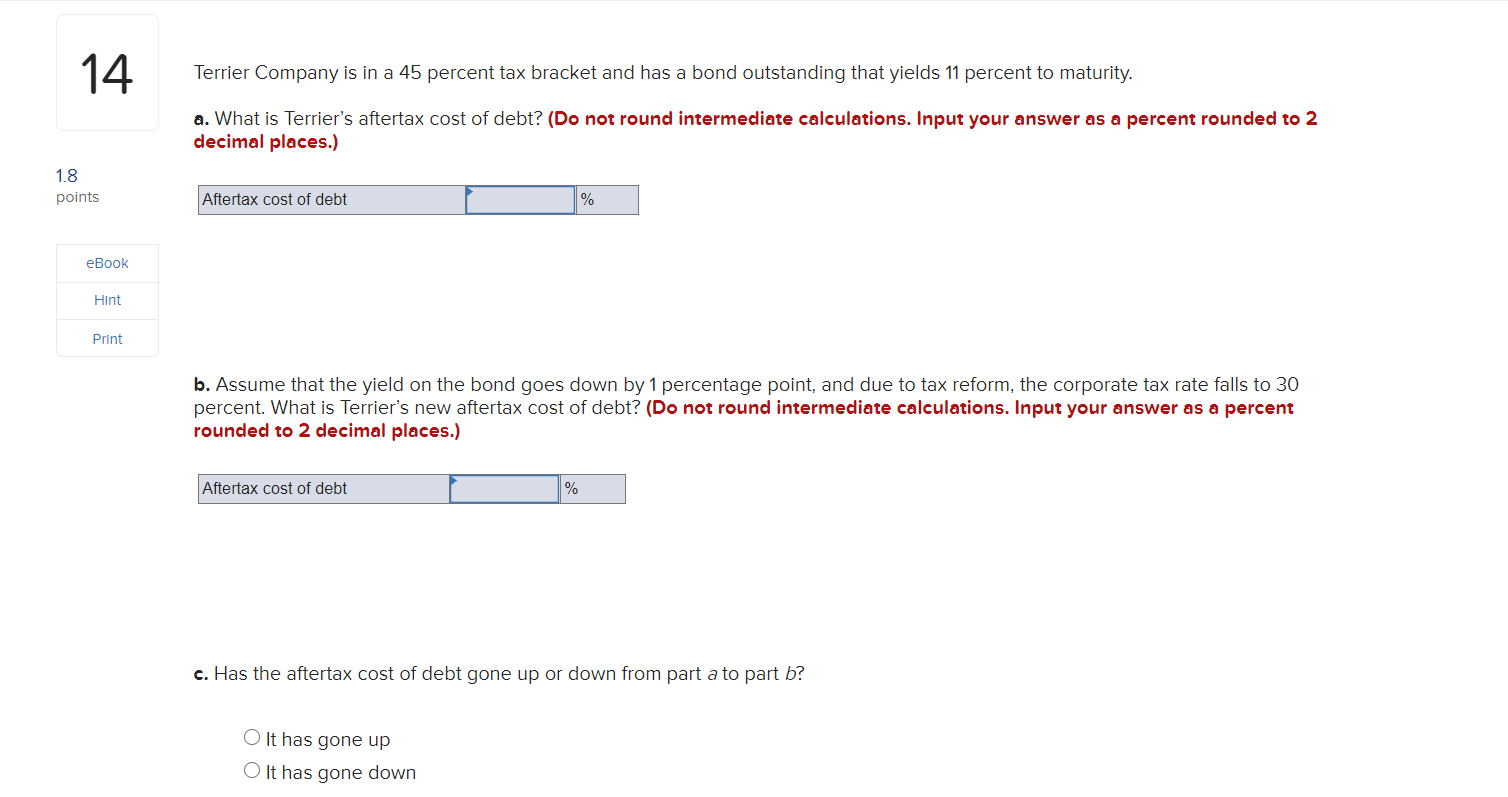

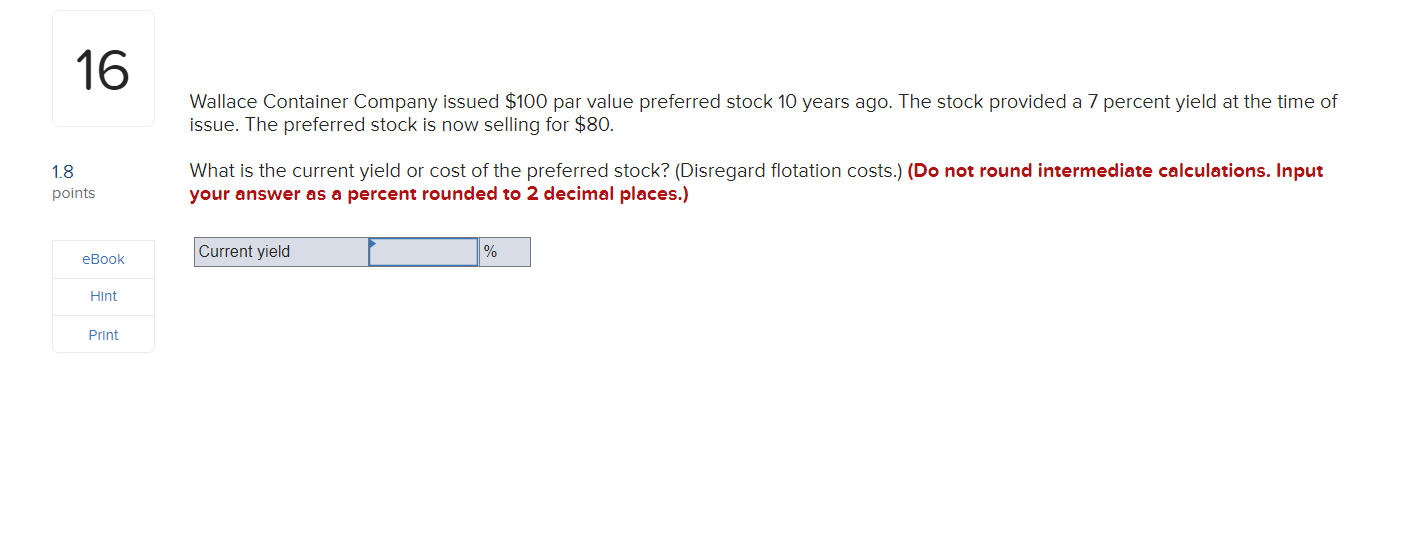

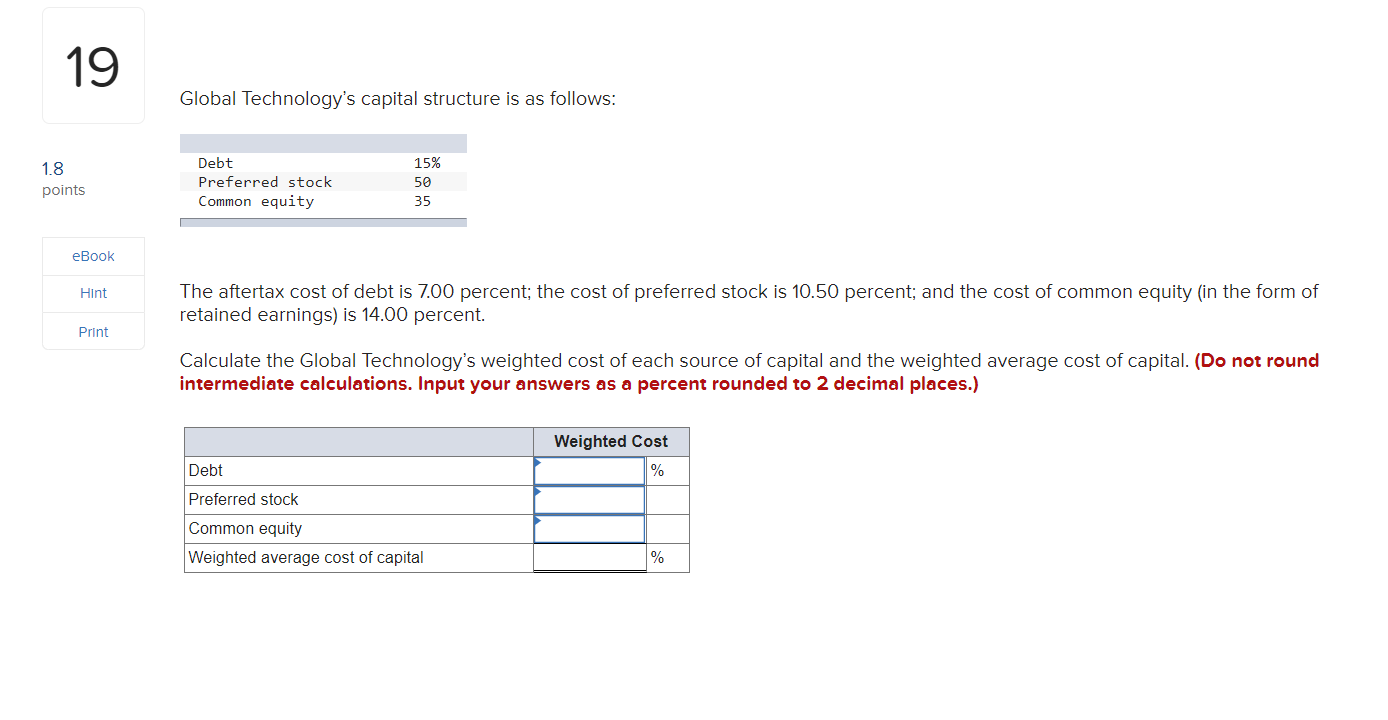

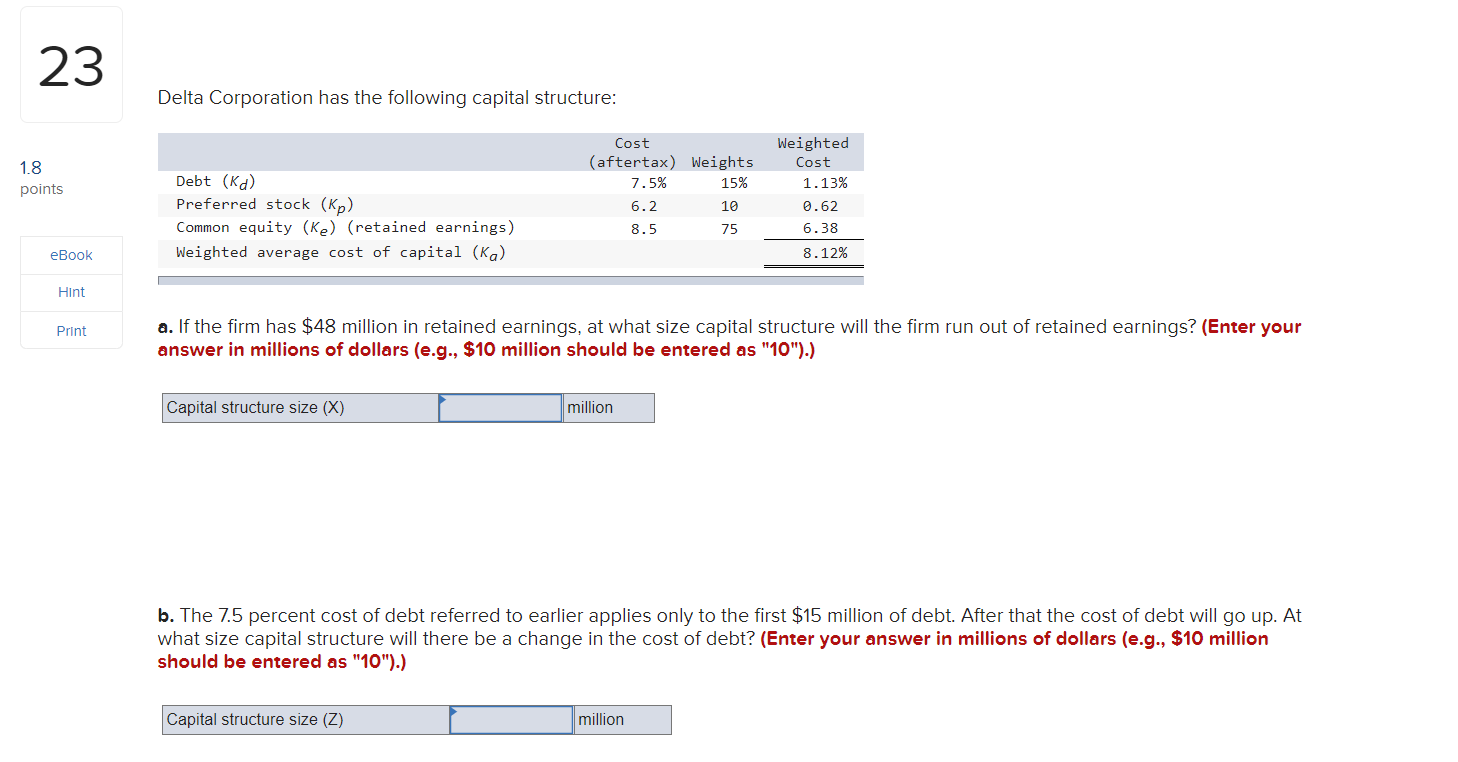

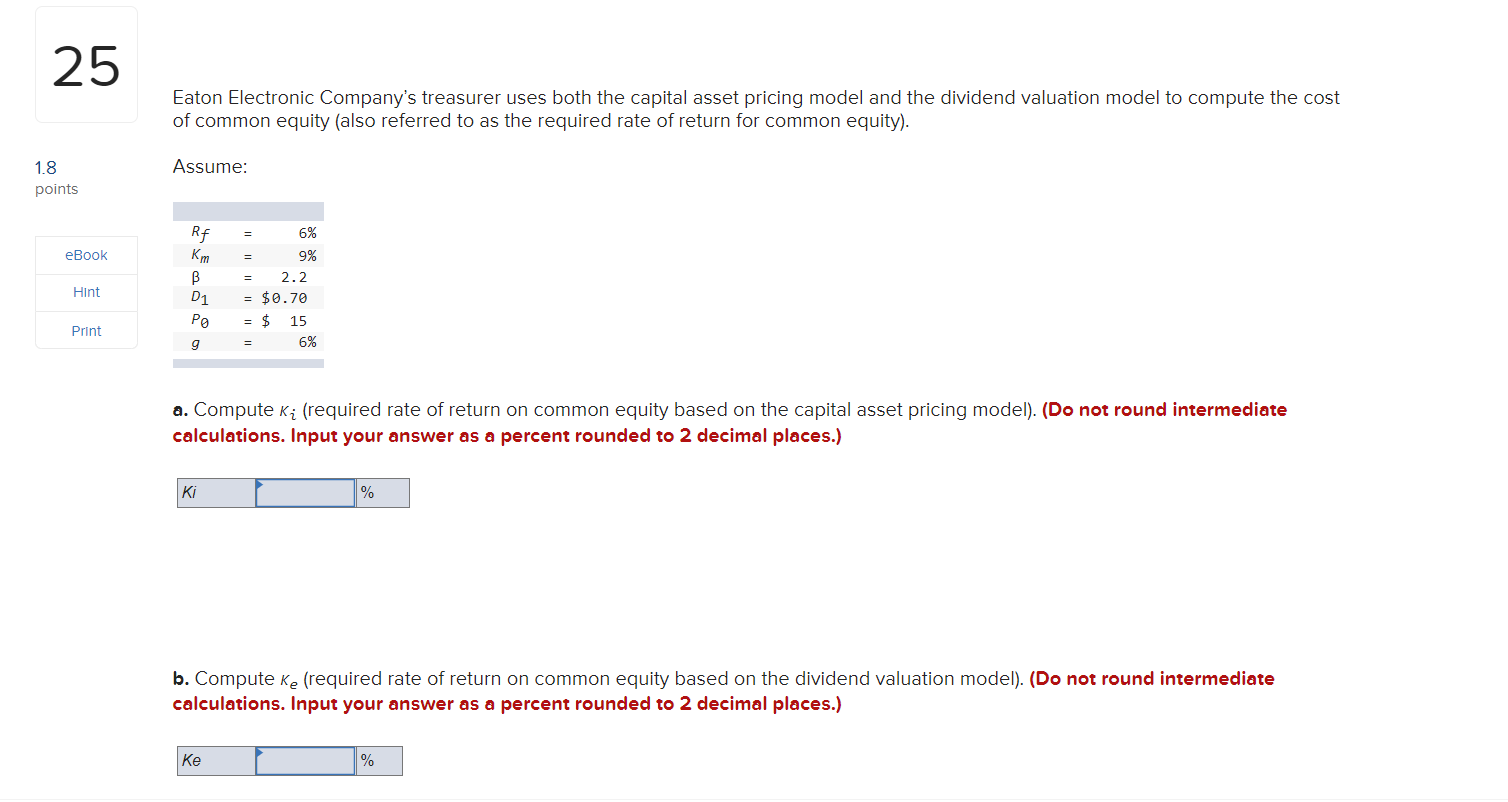

14 1.8 points EEDOk Hli'it F'rlhl Terrier Company is in a 45 percent tax bracket and has a bond outstanding that yields 11 percent to maturity. a. What is Terrier's aertax cost of debt? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aertax oust of debt % b. Assume that the yield on the bond goes down by 1 percentage point, and due to tax reform, the corporate tax rate falls to 30 percent. What is Terrier's new aertax cost of debt? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Aertax oust of debt 'M. c. Has the aertax cost of debt gone up or down from part ate part b? 0 It has gone up 0 It has gone down 16 Wallace Container Company issued $100 par value preferred stock 10 years ago. The stock provided a 7 percent yield at the time of issue. The preferred stock is now selling for $80. 1.8 What is the current yield or cost of the preferred stock? (Disregard flotation costs.) (Do not round intermediate calculations. Input points your answer as a percent rounded to 2 decimal places.) 880% Current yield % Hint Prlnt 19 Global Technology's capital structure is as follows: 1 8 Debt 15% points Preferred stock 58 Common equity 35 [ eBooK Hint The aertax cost of debt is 7.00 percent; the cost of preferred stock is 10.50 percent; and the cost of common equity (in the form of retained earnings) is 14.00 percent. Print Calculate the Global Technology's weighted cost of each source of capital and the weighted average cost of capital. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Weighted Cost Debt \"A: Preferred stock Common equity Weighted average cost ofcapital % 23 Delta Corporation has the following capital structure: Cost Weighted 1.8 (aftertax) Weights Cost points Debt (Kd) 7. 5% 15% 1. 13% Preferred stock (Kp) 6.2 10 0. 62 Common equity (Ke) ( retained earnings) 8.5 75 6.38 eBook Weighted average cost of capital (Ka) 8. 12% Hint Print a. If the firm has $48 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) Capital structure size (X) million b. The 7.5 percent cost of debt referred to earlier applies only to the first $15 million of debt. After that the cost of debt will go up. At what size capital structure will there be a change in the cost of debt? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) Capital structure size (Z) million25 Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). 1.8 Assume: points Rf : 6% eBook Km. = 9% [3 = 2.2 Hint Di : $339 p , Print 9 $ 15 g 7 6% a. Compute K1: (required rate of return on common equity based on the capital asset pricing model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) b. Compute K5. (required rate of return on common equity based on the dividend valuation model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts