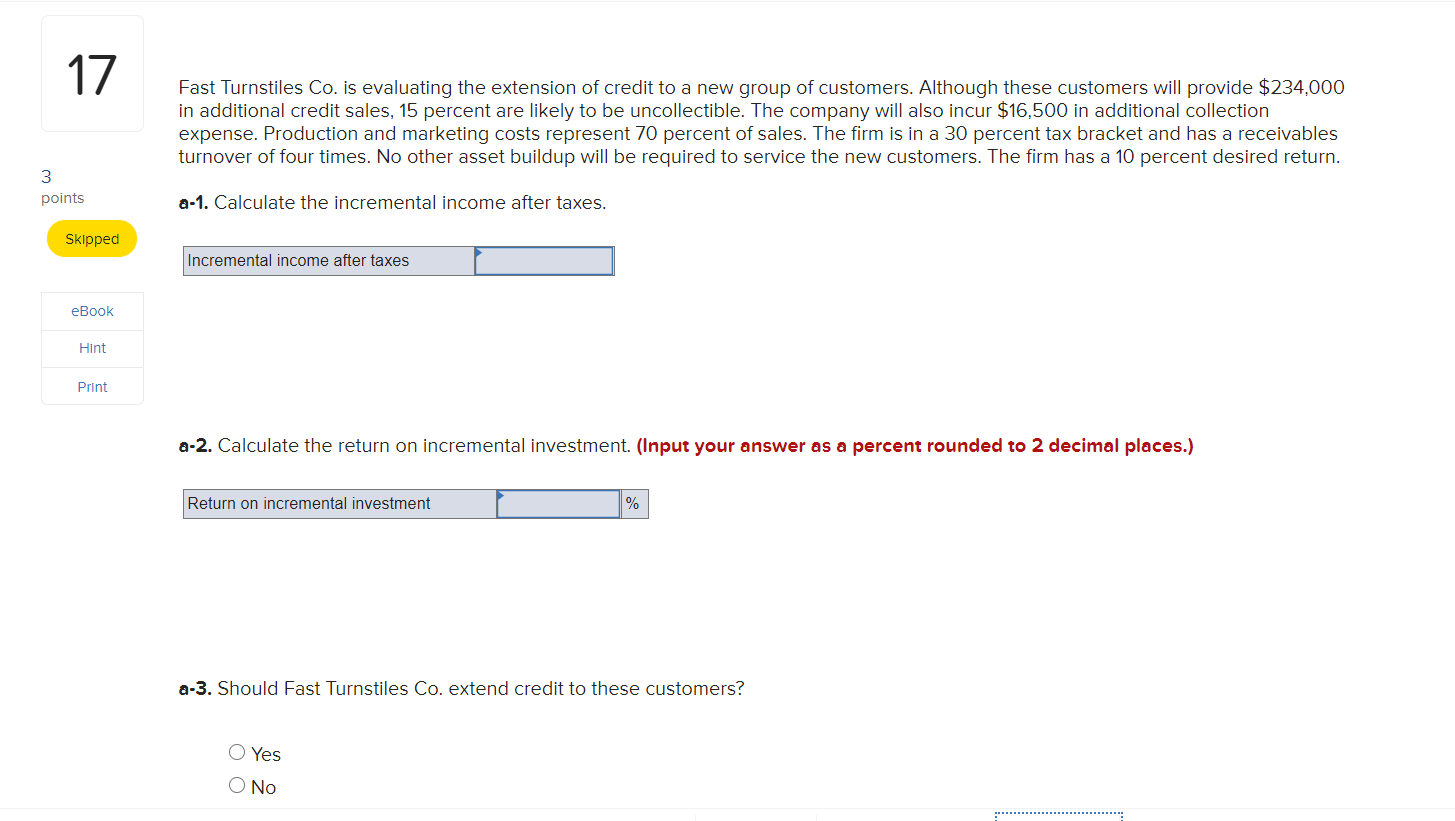

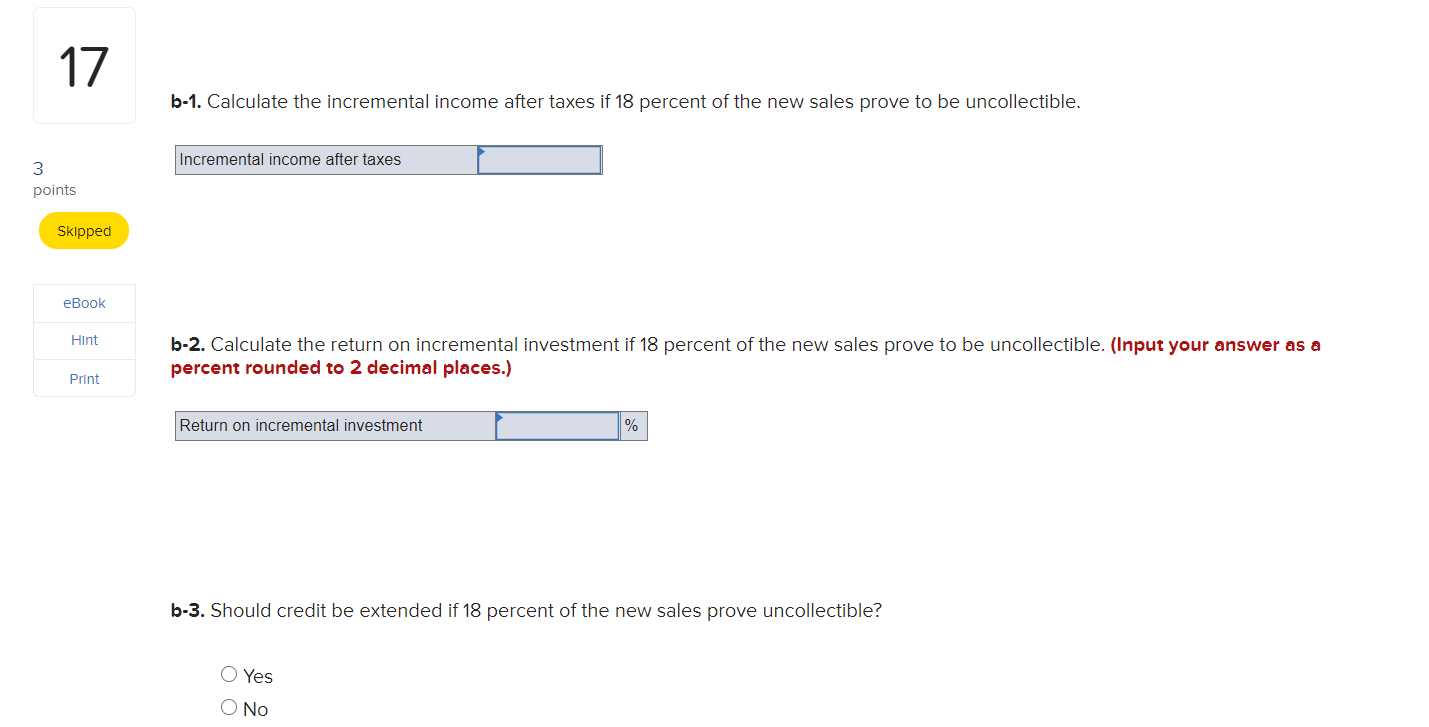

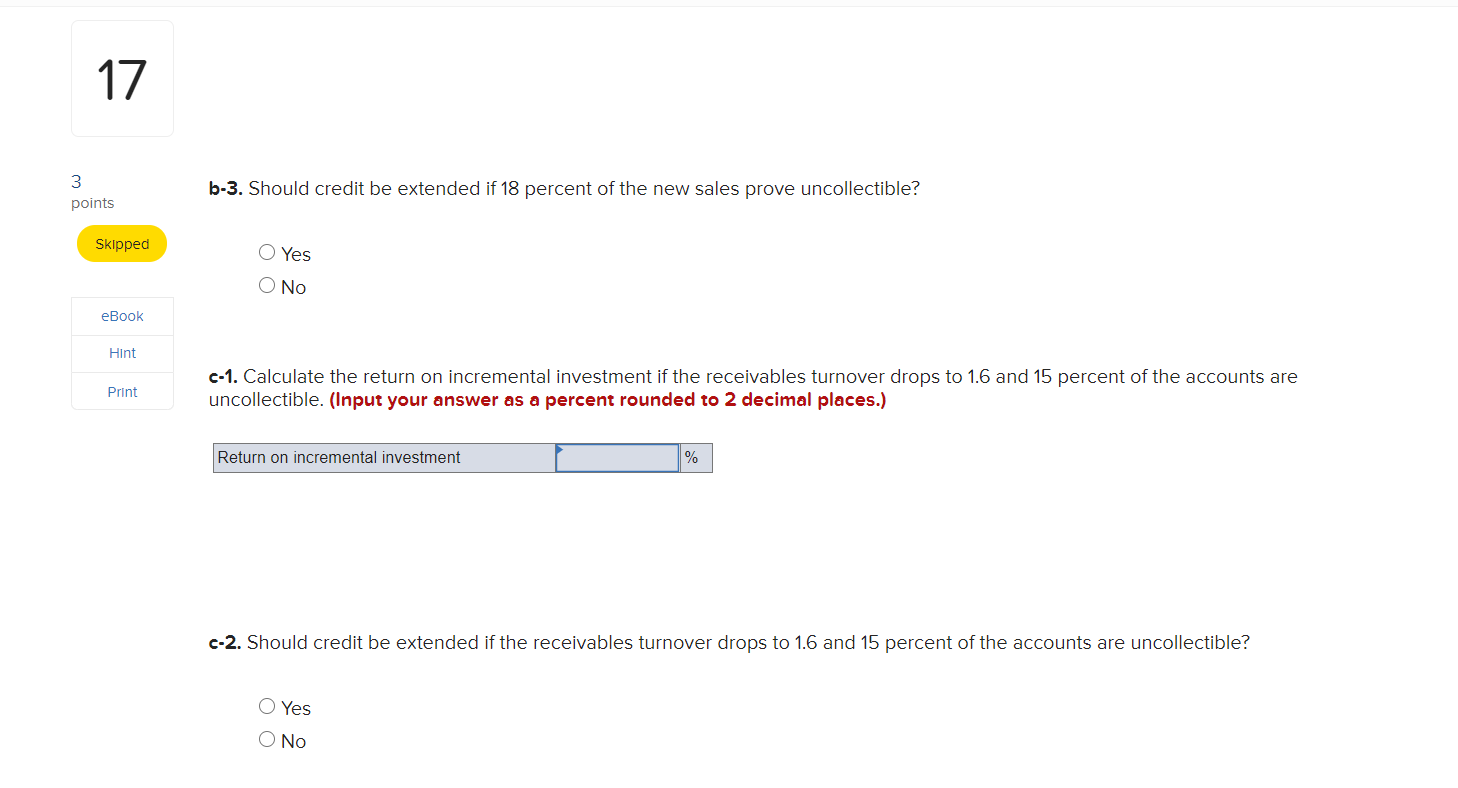

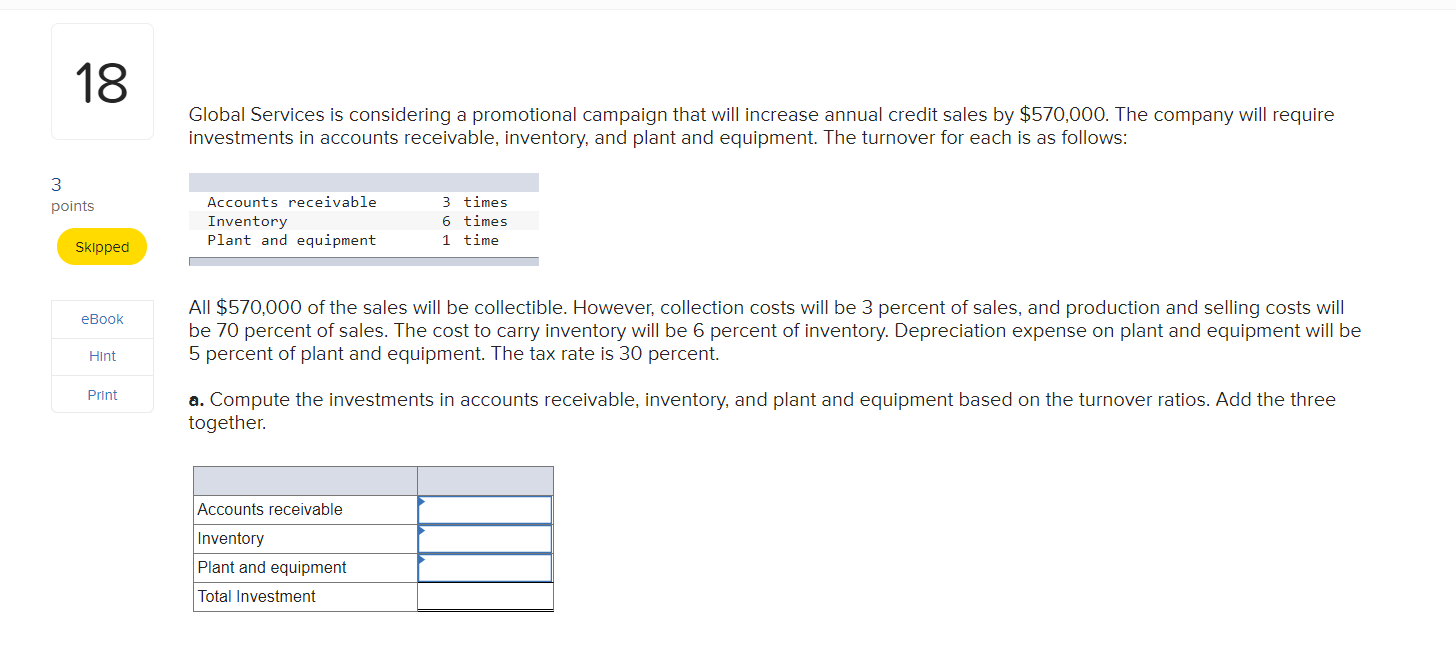

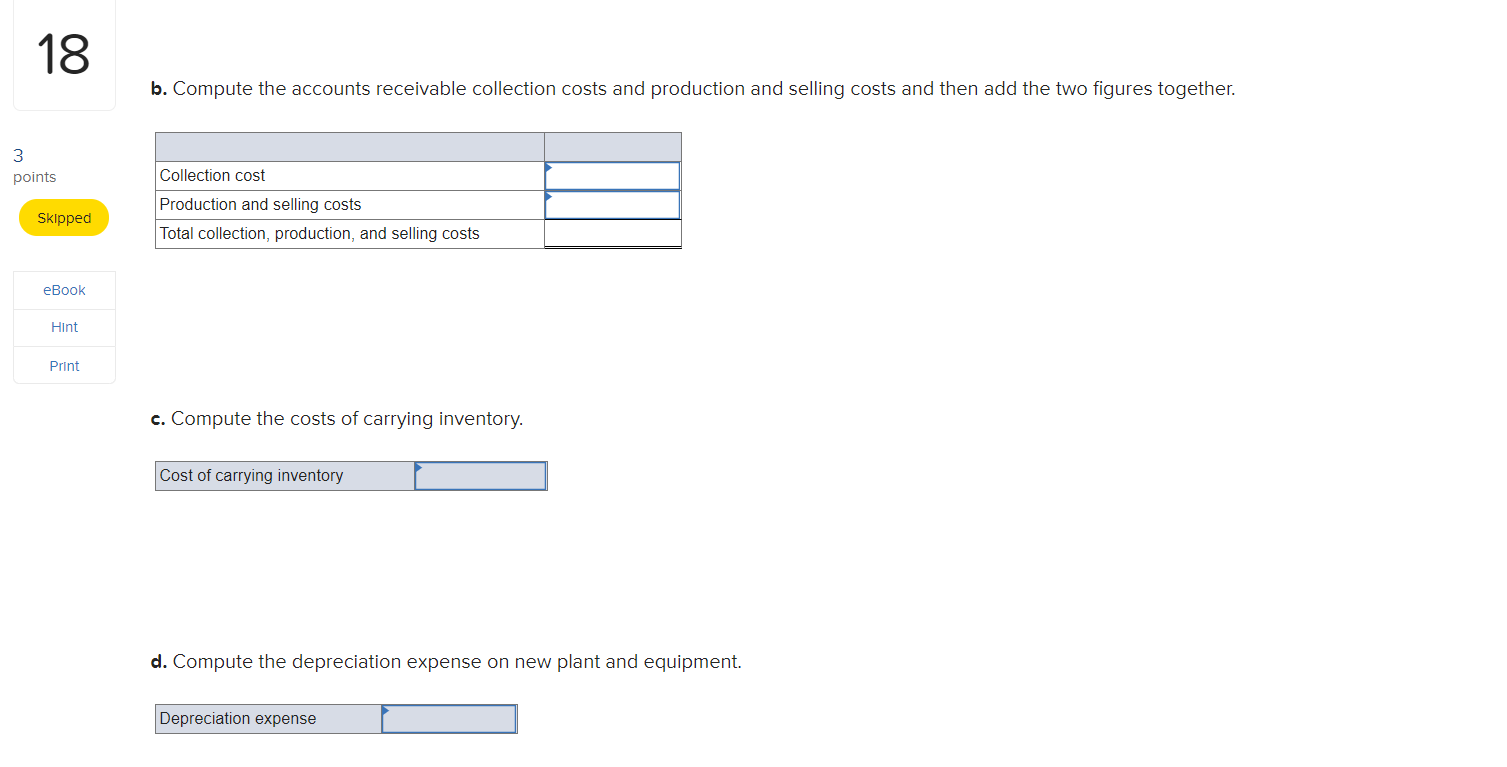

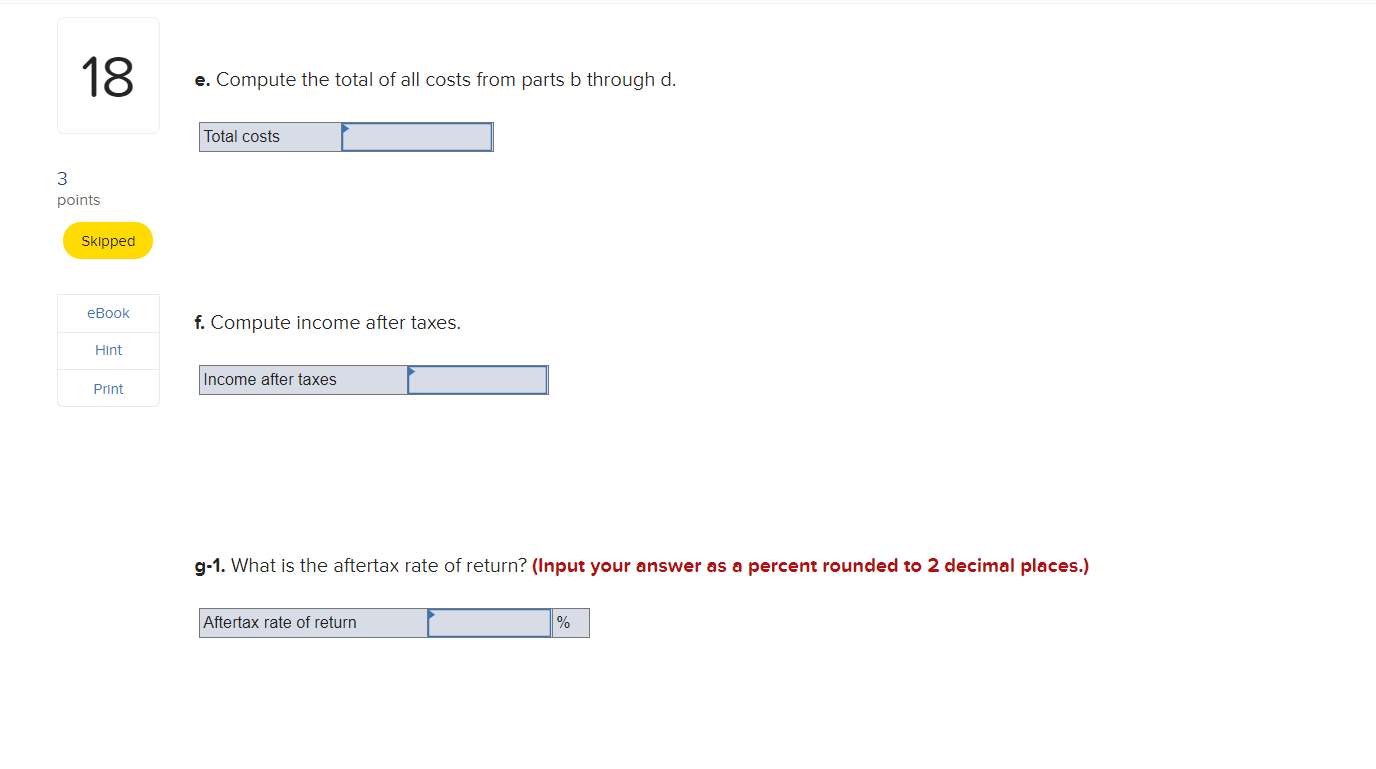

Question: Need help with the attachments below 17 Fast Turnstiles Co. is evaluating the extension of credit to a new group of customers. Although these customers

Need help with the attachments below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock