Question: Need help with the below question - Thanks a bunch Suppose there are two factors, F_1 and F_2, that determine asset returns. Assume that the

Need help with the below question - Thanks a bunch

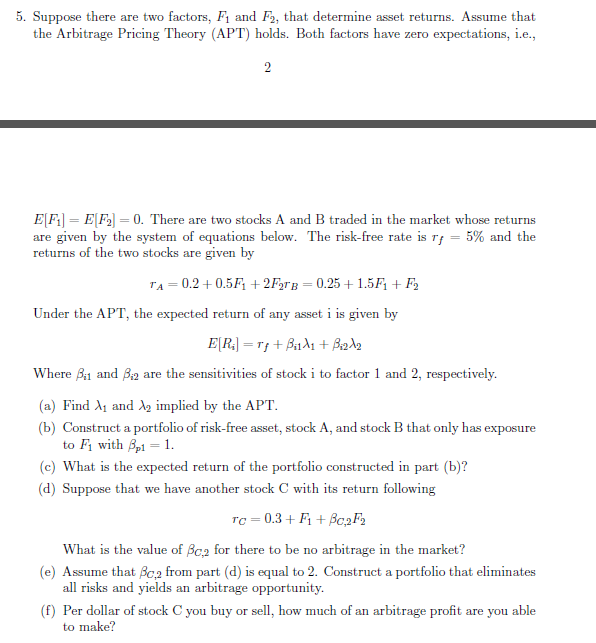

Suppose there are two factors, F_1 and F_2, that determine asset returns. Assume that the Arbitrage Pricing Theory (APT) holds. Both factors have zero expectations, i.e., E[F_1] = E[F_2] = 0. There are two stocks A and B traded in the market whose returns are given by the system of equations below. The risk-free rate is tau_f = 5% and the returns of the two stocks are given by tau_A = 0.2 + 0.5 F_1 + 2 F_2taub = 0.25 + 1.5F_1 + F_2 Under the APT, the expected return of any asset i is given by E[R_i] = tau_f + beta_i1 lambda_1 + beta_i2 lambda_2 Where beta_i1 and beta_i2 are the sensitivities of stock i to factor 1 and 2, respectively. Find lambda_1 and lambda_2 implied by the APT. Construct a portfolio of risk-free asset, stock A, and stock B that only has exposure to F_1 with beta_p1 = 1. What is the expected return of the portfolio constructed in part (b)? Suppose that we have another stock C with its return following tau_C = 0.3 + F_1 + betaC,_2F_2 What is the value of betaC,_2 for there to be no arbitrage in the market? Assume that betaC,_2 from part (d) is equal to 2. Construct a portfolio that eliminates all risks and yields an arbitrage opportunity. Per dollar of stock C you buy or sell, how much of an arbitrage profit are you able to make? Suppose there are two factors, F_1 and F_2, that determine asset returns. Assume that the Arbitrage Pricing Theory (APT) holds. Both factors have zero expectations, i.e., E[F_1] = E[F_2] = 0. There are two stocks A and B traded in the market whose returns are given by the system of equations below. The risk-free rate is tau_f = 5% and the returns of the two stocks are given by tau_A = 0.2 + 0.5 F_1 + 2 F_2taub = 0.25 + 1.5F_1 + F_2 Under the APT, the expected return of any asset i is given by E[R_i] = tau_f + beta_i1 lambda_1 + beta_i2 lambda_2 Where beta_i1 and beta_i2 are the sensitivities of stock i to factor 1 and 2, respectively. Find lambda_1 and lambda_2 implied by the APT. Construct a portfolio of risk-free asset, stock A, and stock B that only has exposure to F_1 with beta_p1 = 1. What is the expected return of the portfolio constructed in part (b)? Suppose that we have another stock C with its return following tau_C = 0.3 + F_1 + betaC,_2F_2 What is the value of betaC,_2 for there to be no arbitrage in the market? Assume that betaC,_2 from part (d) is equal to 2. Construct a portfolio that eliminates all risks and yields an arbitrage opportunity. Per dollar of stock C you buy or sell, how much of an arbitrage profit are you able to make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts