Question: Need help with the question!!!! Will give a like Crossroad Corporation is trying to decide whether to invest to automate a production line. If the

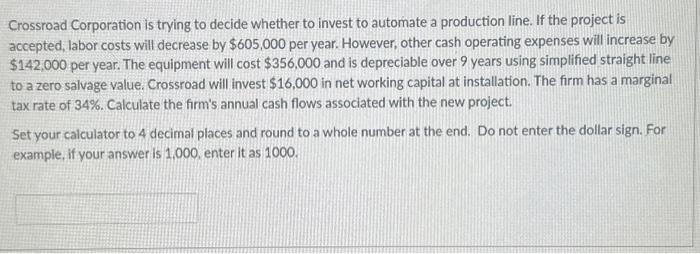

Crossroad Corporation is trying to decide whether to invest to automate a production line. If the project is accepted, labor costs will decrease by $605,000 per year. However, other cash operating expenses will increase by $142,000 per year. The equipment will cost $356,000 and is depreciable over 9 years using simplified straight line to a zero salvage value. Crossroad will invest $16,000 in net working capital at installation. The firm has a marginal tax rate of 34%. Calculate the firm's annual cash flows associated with the new project. Set your calculator to 4 decimal places and round to a whole number at the end. Do not enter the dollar sign. For example, if your answer is 1,000 , enter it as 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts