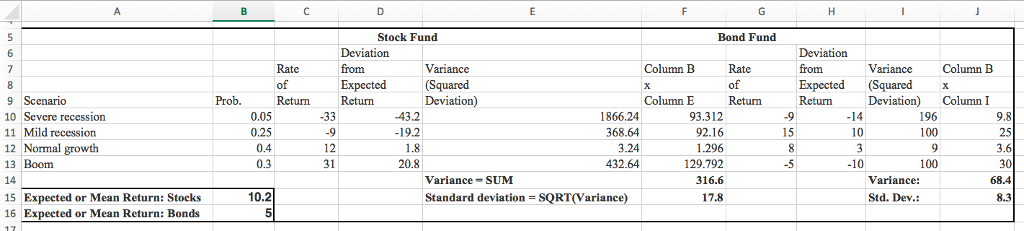

Question: Use the deviation from return that you calculated above to calculate the covariance and correlation coefficient of the stock and bond funds. Deviation from Mean

| Use the deviation from return that you calculated above to calculate the covariance and correlation coefficient of the stock and bond funds. | |||||||||

| Deviation from Mean Return | Covariance | ||||||||

| Scenario | Probability | Stock Fund | Bond Fund | Product of Dev | Col B x Col E | ||||

| Severe recession | 0.05 | -14 | 0 | 0.0 | |||||

| Mild recession | 0.25 | 10 | 0 | 0.0 | |||||

| Normal growth | 0.40 | 3 | 0 | 0.0 | |||||

| Boom | 0.30 | -10 | 0 | 0.0 | |||||

| Covariance = | SUM: | 0.0 | |||||||

| Correlation coefficient = Covariance/(StdDev(stocks)*StdDev(bonds)) = | #DIV/0! | ||||||||

Stock Fund Bond Fund Deviation Rate of Variance (Squared Deviation) Column E Rate of Variance Column B Expected Expected (Squared X Return Deviatio Column I 9 Scenario 10 Severe recessio 11 Mild recession 2 Normal growth 13 Boom Prob. Column E 14 10 196 100 9.8 25 0.05 0.25 0.4 0.3 43.2 19.2 1.8 20.8 1866.24 368.64 3.24 432.64 93.312 92.16 1.296 129.792 316.6 17.8 15 12 31 -10 100 Variance SUM Variance: 68.4 15 Expected or Mean Return: Stocks 16 Expected or Mean Return: Bonds 10.2 Standard deviation = SQRT(Variance) Std. Dev

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock