Question: Need Help with the red is wrong. but can you please do it in excel it's easier to read Thank you. Prepare the appropriate 2021

Need Help with the red is wrong. but can you please do it in excel it's easier to read Thank you.

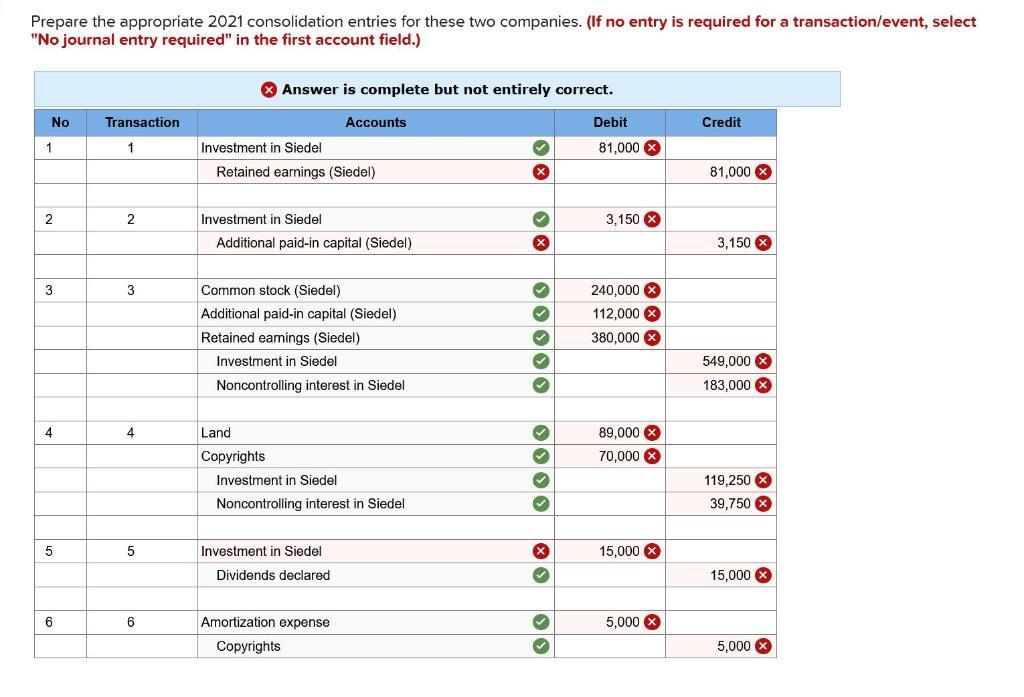

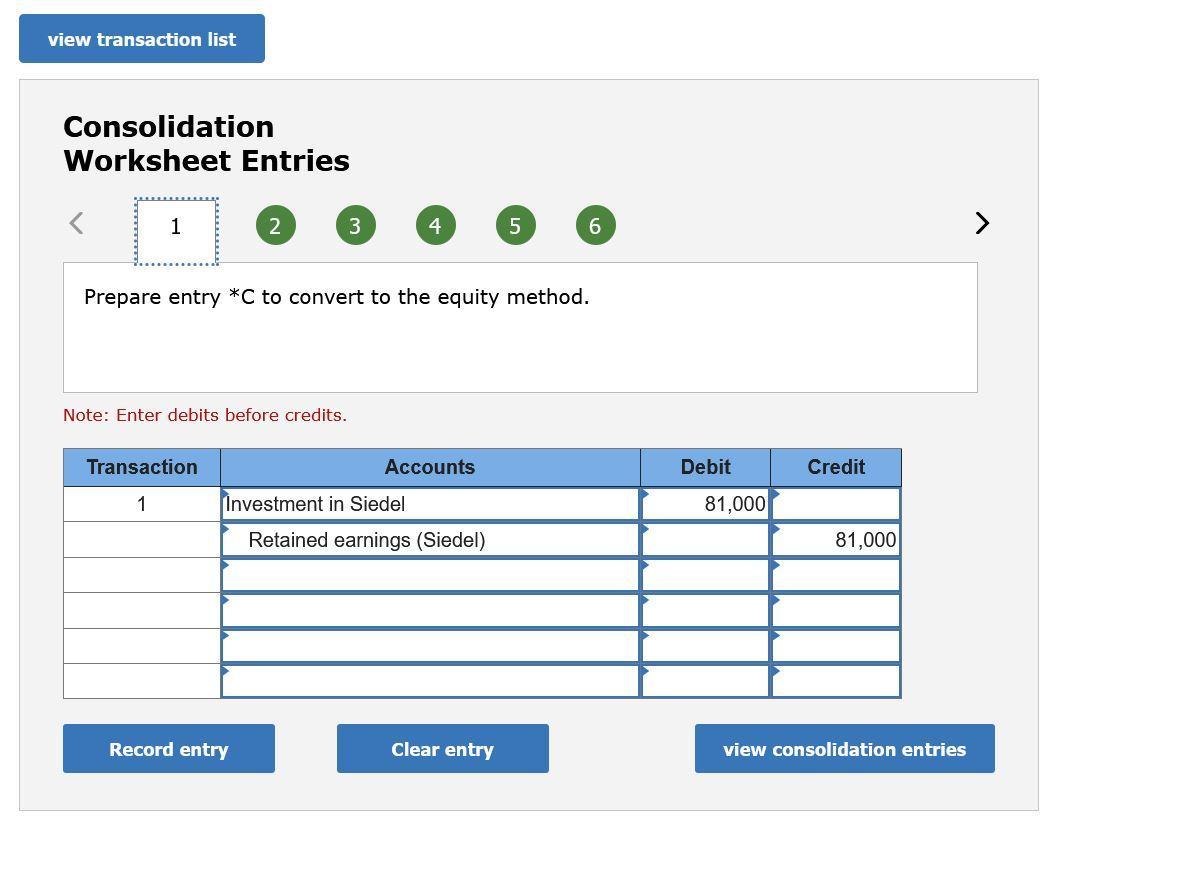

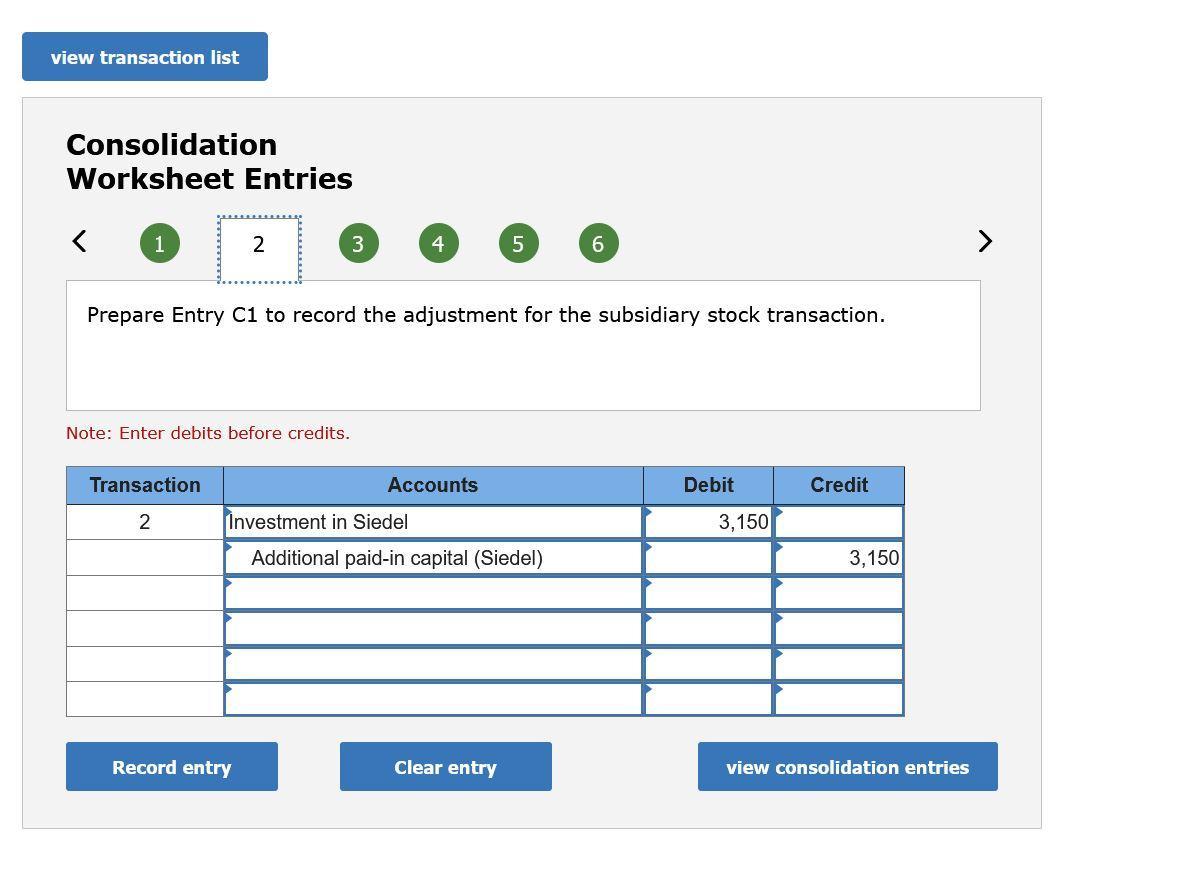

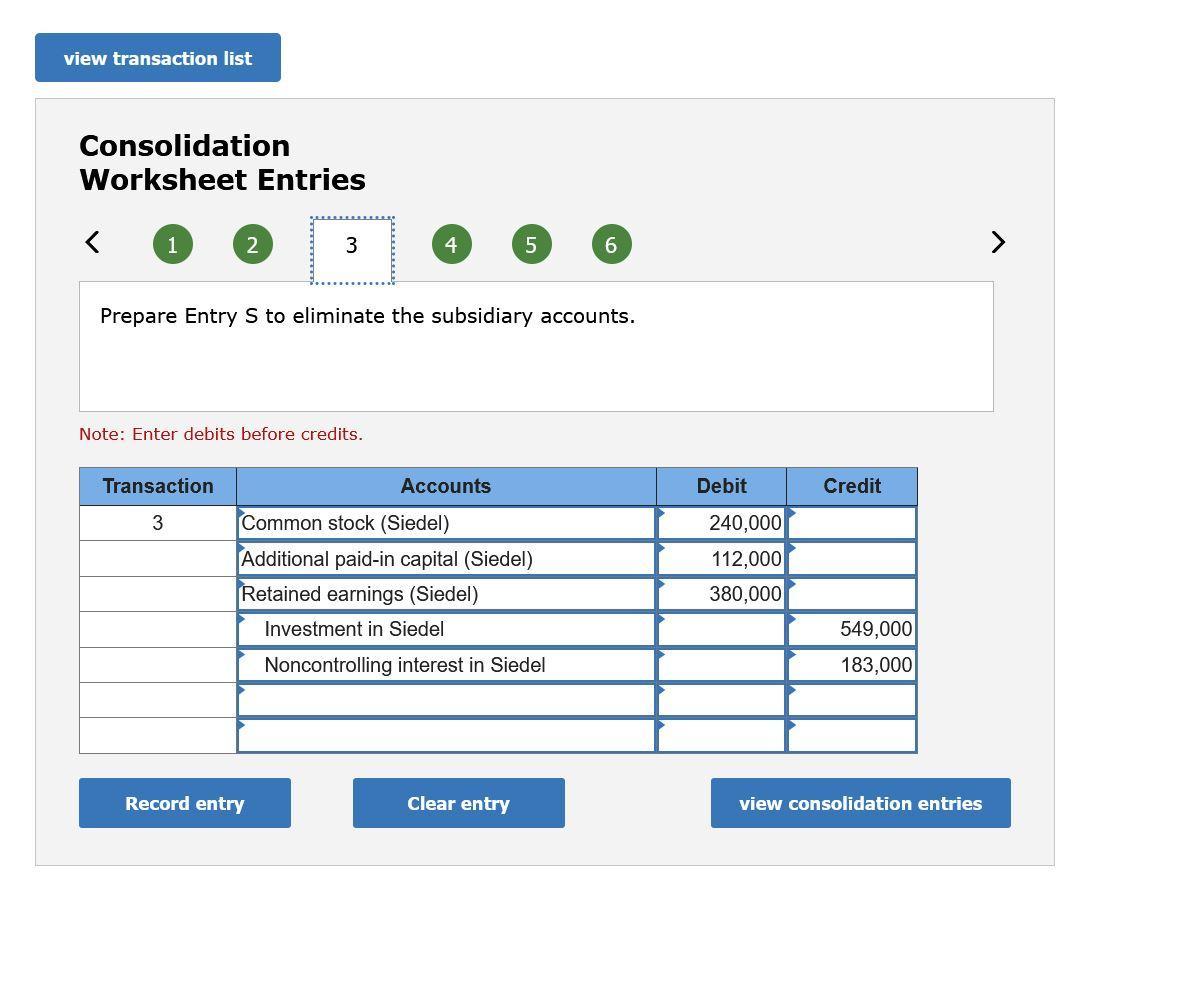

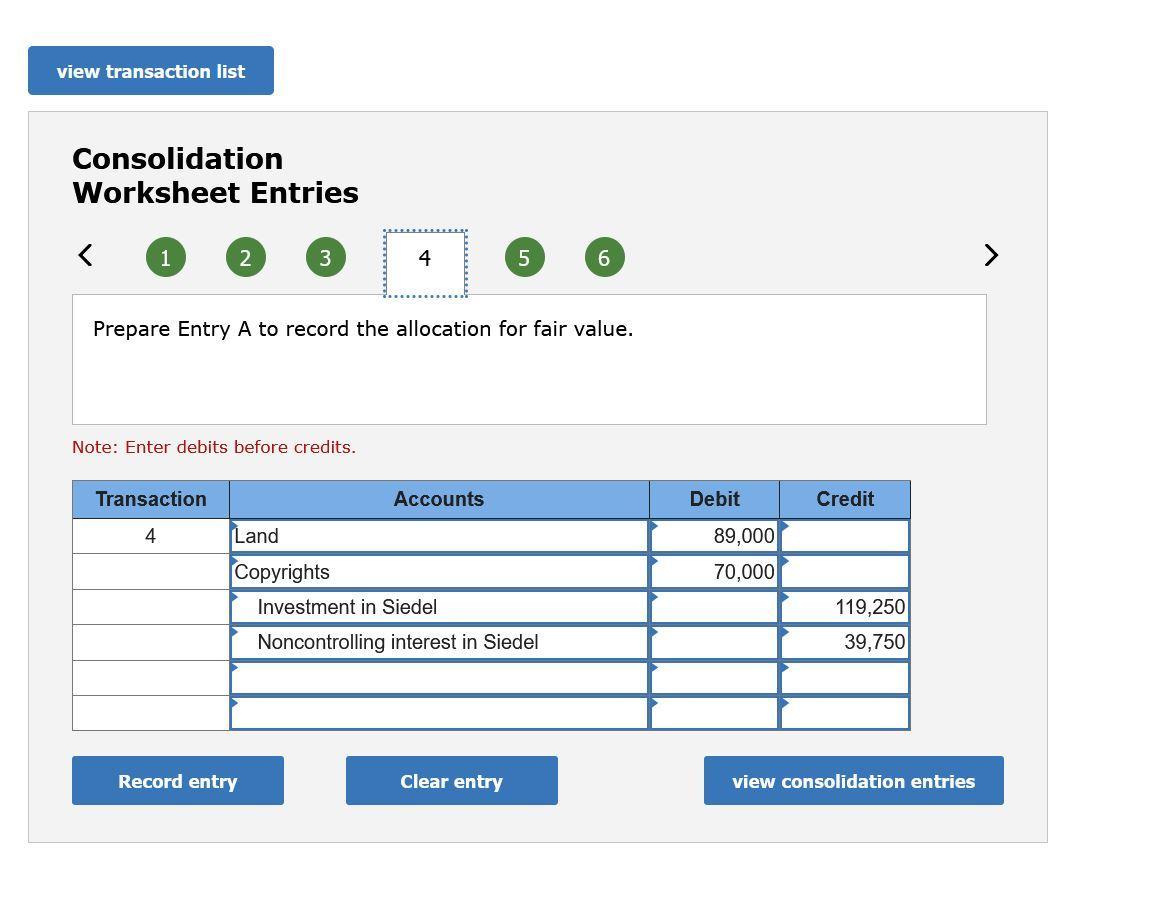

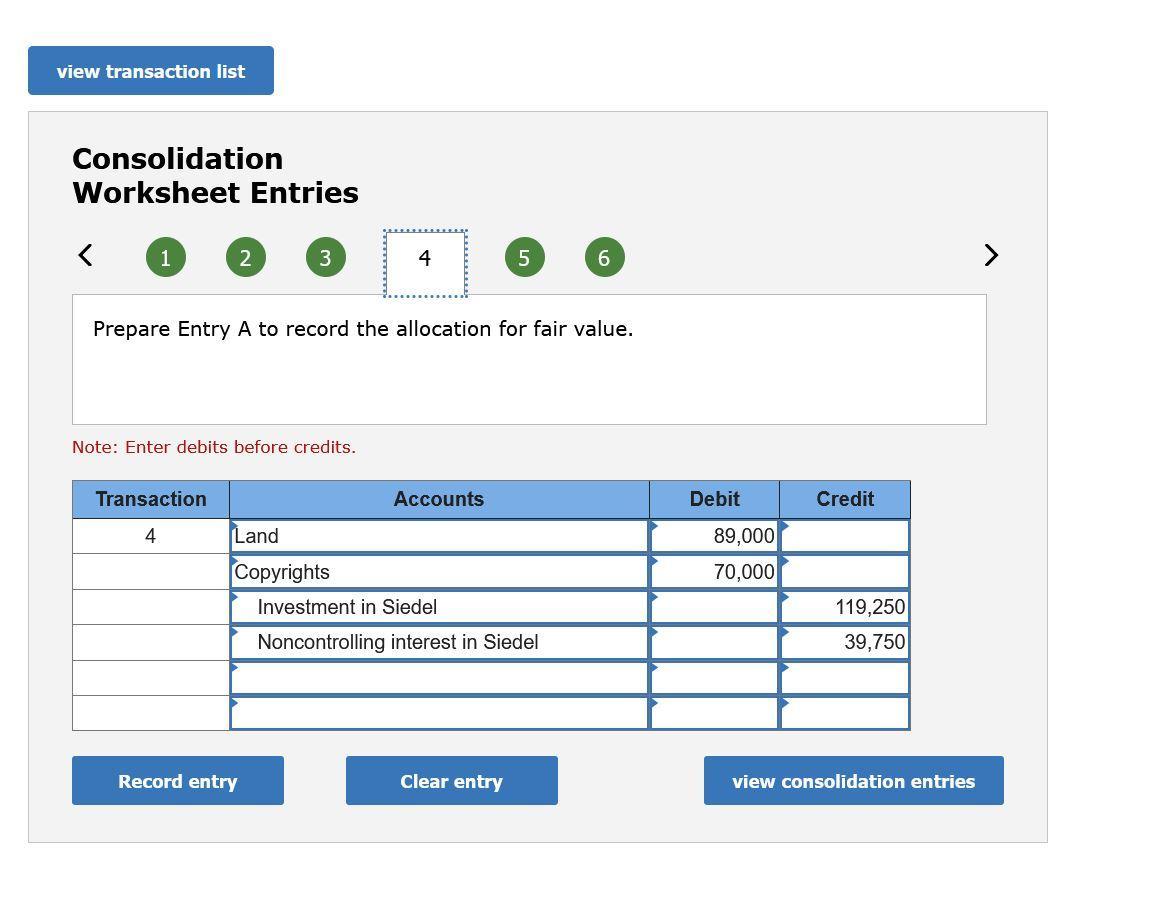

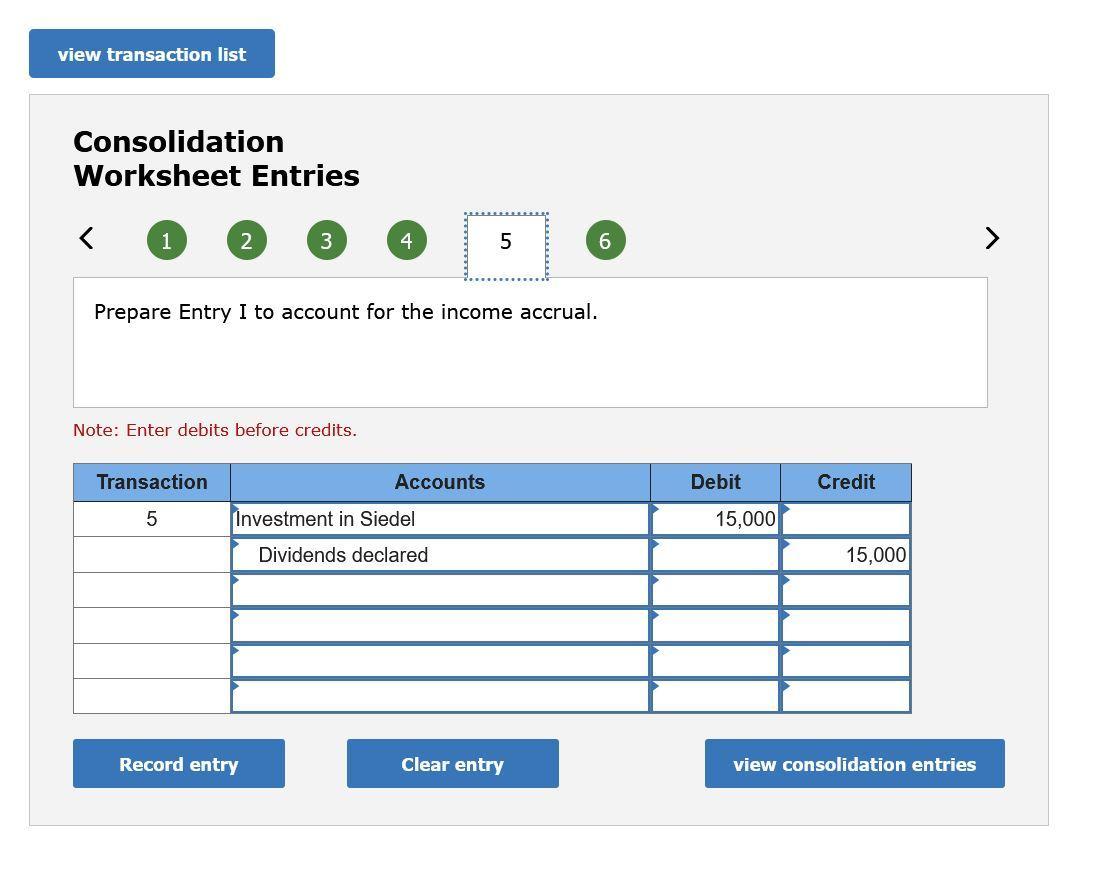

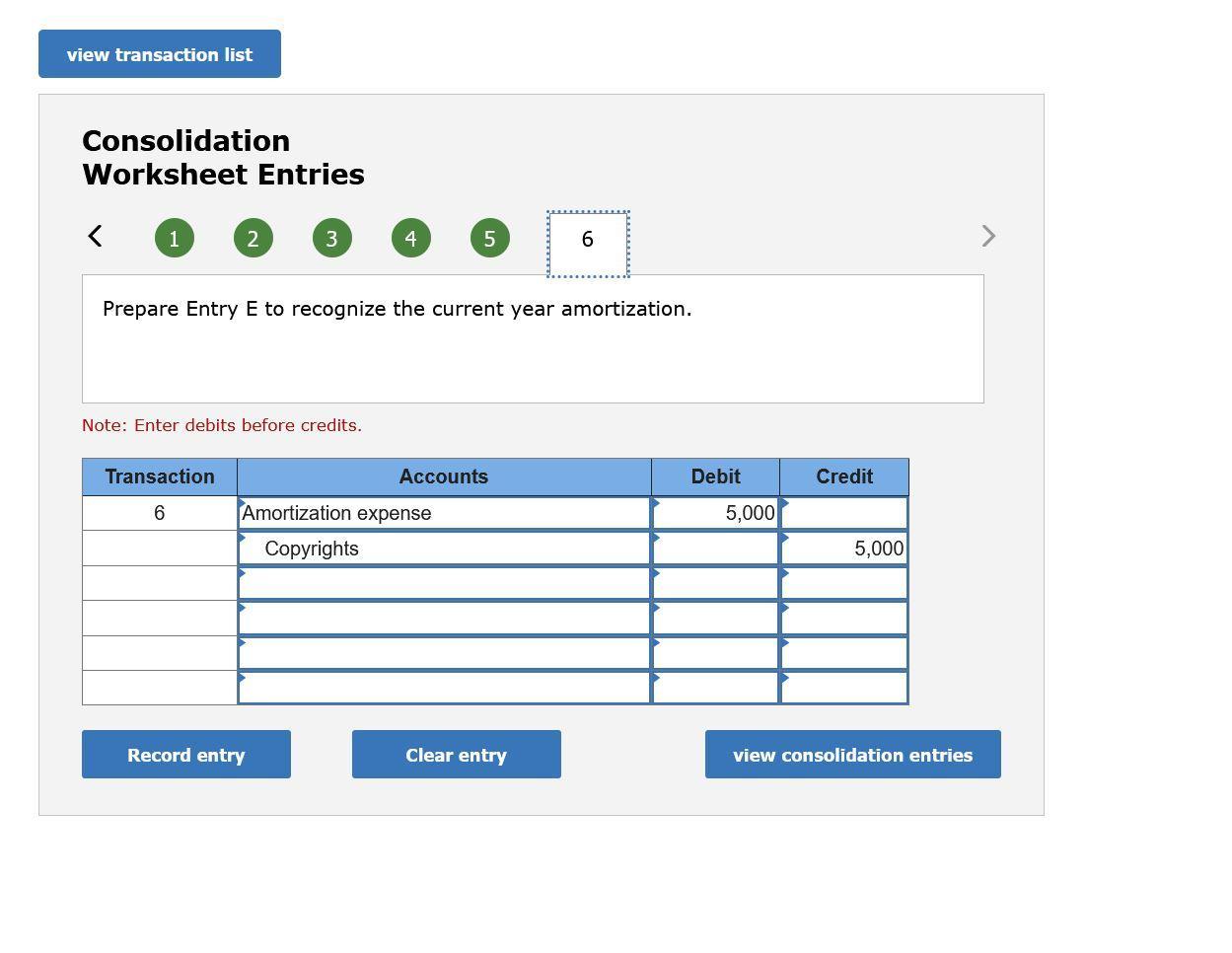

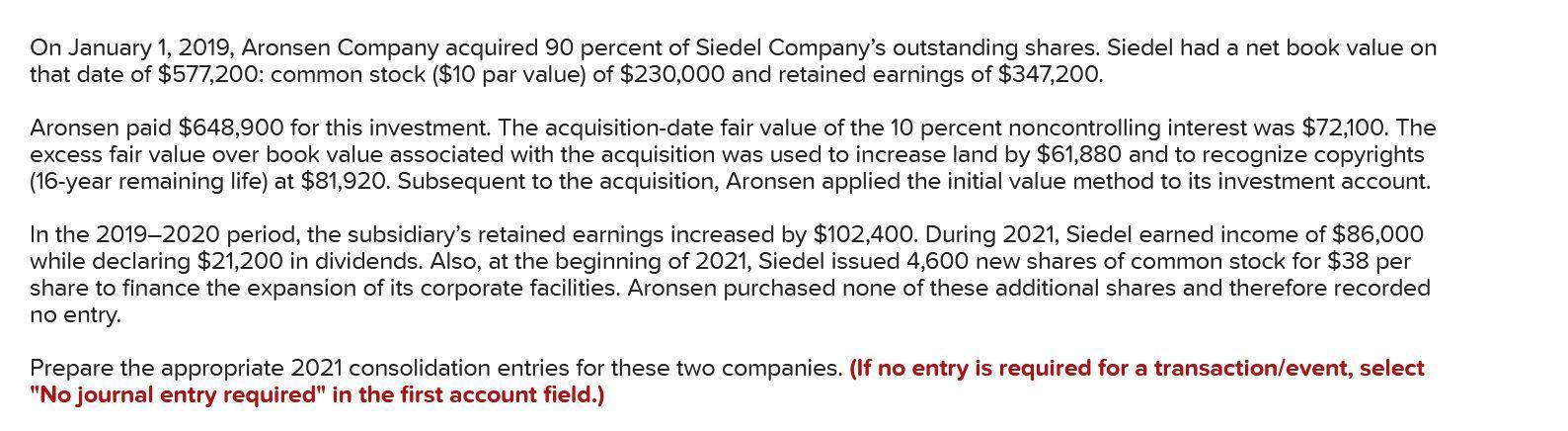

Prepare the appropriate 2021 consolidation entries for these two companies. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries 3 4 5 6 Prepare entry C to convert to the equity method. Note: Enter debits before credits. Consolidation Worksheet Entries 4 5 6 Prepare Entry C1 to record the adjustment for the subsidiary stock transaction. Note: Enter debits before credits. Consolidation Worksheet Entries 1 6 Prepare Entry S to eliminate the subsidiary accounts. Note: Enter debits before credits. Consolidation Worksheet Entries 1 6 Prepare Entry A to record the allocation for fair value. Note: Enter debits before credits. Consolidation Worksheet Entries 1 6 Prepare Entry A to record the allocation for fair value. Note: Enter debits before credits. Consolidation Worksheet Entries 1 2 3 Prepare Entry I to account for the income accrual. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare Entry E to recognize the current year amortization. Note: Enter debits before credits. On January 1, 2019, Aronsen Company acquired 90 percent of Siedel Company's outstanding shares. Siedel had a net book value on that date of $577,200 : common stock ( $10 par value) of $230,000 and retained earnings of $347,200. Aronsen paid $648,900 for this investment. The acquisition-date fair value of the 10 percent noncontrolling interest was $72,100. The excess fair value over book value associated with the acquisition was used to increase land by $61,880 and to recognize copyrights (16-year remaining life) at $81,920. Subsequent to the acquisition, Aronsen applied the initial value method to its investment account. In the 2019-2020 period, the subsidiary's retained earnings increased by $102,400. During 2021 , Siedel earned income of $86,000 while declaring $21,200 in dividends. Also, at the beginning of 2021 , Siedel issued 4,600 new shares of common stock for $38 per share to finance the expansion of its corporate facilities. Aronsen purchased none of these additional shares and therefore recorded no entry. Prepare the appropriate 2021 consolidation entries for these two companies. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts