Question: need help with the work in process Sunland Corp, designs and manufactures mascot uniforms for high school, college, and professional sports teams. Since each team's

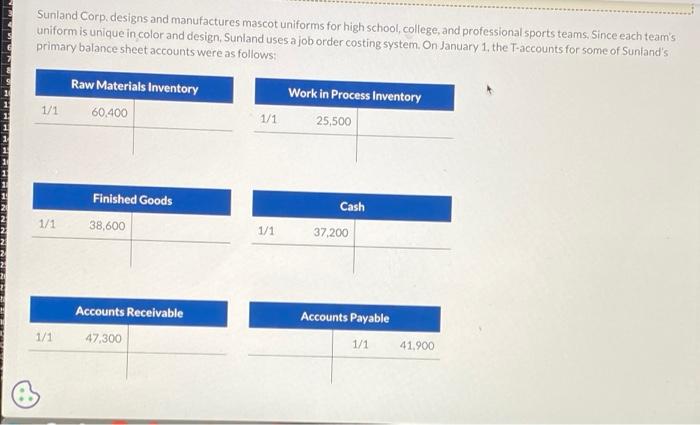

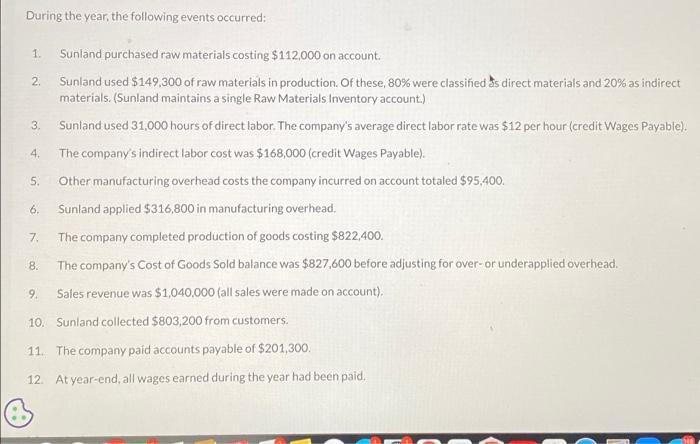

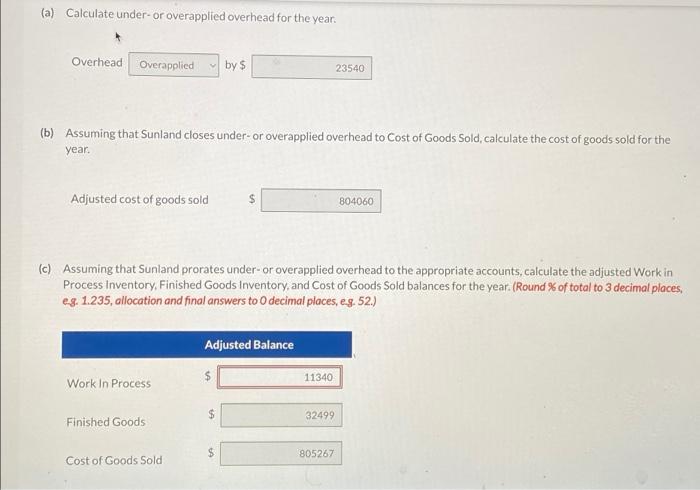

Sunland Corp, designs and manufactures mascot uniforms for high school, college, and professional sports teams. Since each team's uniform is unique in color and design, Sunland uses a job order costing system. On January 1, the T-accounts for some of Sunfand's primary balance sheet accounts were as follows: 1. Sunland purchased raw materials costing $112,000 on account. 2. Sunland used $149,300 of raw materials in production. Of these, 80% were classified s direct materials and 20% as indirect materials. (Sunland maintains a single Raw Materials Inventory account.) 3. Sunfand used 31,000 hours of direct labor. The company's average direct labor rate was $12 per hour (credit Wages Payable). 4. The company's indirect labor cost was $168,000 (credit Wages Payable). 5. Other manufacturing overhead costs the company incurred on account totaled $95,400. 6. Sunland applied $316,800 in manufacturing overhead. 7. The company completed production of goods costing $822,400. 8. The company's Cost of Goods Sold balance was $827,600 before adjusting for over-or underapplied overhead. 9. Sales revenue was $1,040,000 (all sales were made on account). 10. Sunland collected $803,200 from customers. 11. The company paid accounts payable of $201,300. 12. At year-end, all wages earned during the year had been paid. (b) Assuming that Sunland closes under-or overapplied overhead to Cost of Goods Sold, calculate the cost of goods sold for the year. Adjusted cost of goods sold (c) Assuming that Sunland prorates under-or overapplied overhead to the appropriate accounts, calculate the adjusted Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold balances for the year. (Round % of total to 3 decimal places, eg. 1.235, allocation and final answers to O decimal places, eg. 52.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts