Question: need help with these! i will upvote! thanks i need help with 1-4 thanks! You are 25 years old and plan to remain single. You

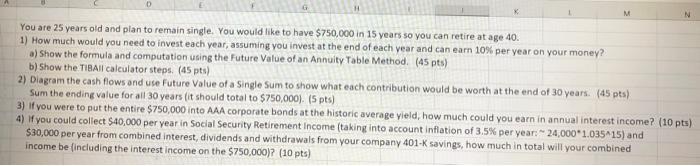

You are 25 years old and plan to remain single. You would like to have $750,000 in 15 vears so you can retire at age 40 . 1) How much would you need to invest each year, assuming you invest at the end of each year and can earn 10% per year on your money? a) Show the formula and computation using the Future Value of an Annuity Table Method. (A5 pts) b) Show the TisAll calculator steps. ( 45pts) 2) Diagram the cash flows and use Future Value of a Single Sum to show what each contribution would be worth at the end of 30 years. (45 pts) Sum the ending value for all 30 years (it should total to $750,000). ( 5pts ) 3) If you were to put the entire $750,000 into AAA corporate bonds at the historic average yield, how much could you earn in annual interest income? (10 pts) 4) If you could collect $40,000 per year in Social Security Retirement Income (taking into account infiation of 3.5% per year: 2.24,0001.03515 ) and $30,000 per year from combined interest, dividends and withdrawals from your company 401K savings, how much in total will your combined income be (including the interest income on the $750,000) ? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts