Question: NEED HELP WITH THESE! Inflation, Interest Rate Hikes and changes to Foreign Policy are examples of: Select one: a. unsystematic risk b. total risk c.

NEED HELP WITH THESE!

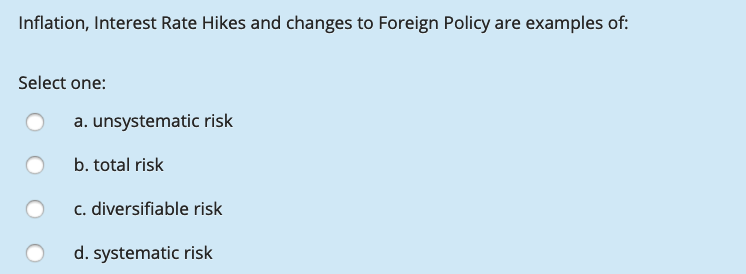

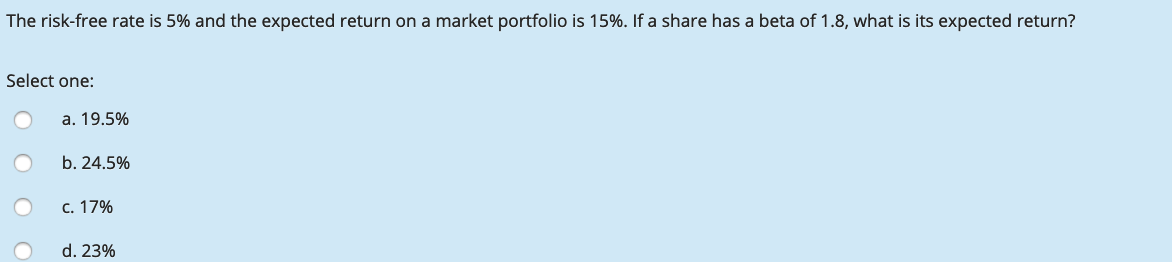

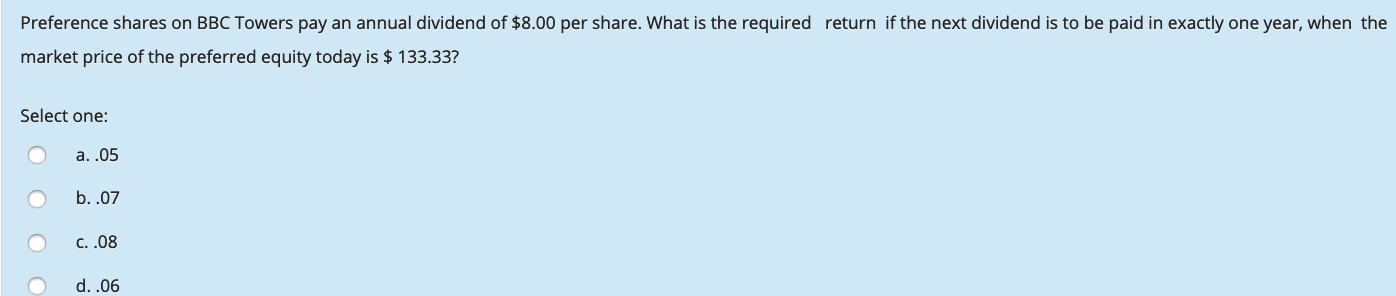

Inflation, Interest Rate Hikes and changes to Foreign Policy are examples of: Select one: a. unsystematic risk b. total risk c. diversifiable risk d. systematic risk The risk-free rate is 5% and the expected return on a market portfolio is 15%. If a share has a beta of 1.8, what is its expected return? Select one: a. 19.5% b. 24.5% c. 17% d. 23% Preference shares on BBC Towers pay an annual dividend of $8.00 per share. What is the required return if the next dividend is to be paid in exactly one year, when the market price of the preferred equity today is $ 133.33? Select one: a. .05 b. .07 C. .08 d..06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts