Question: need help with these need help with these Mr Which of the following statements is Fate? CPP is a national contributory retirement pension scheme 2.

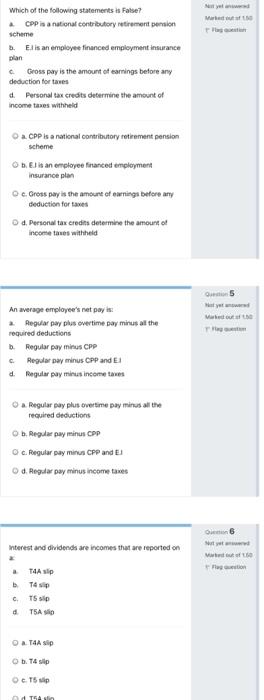

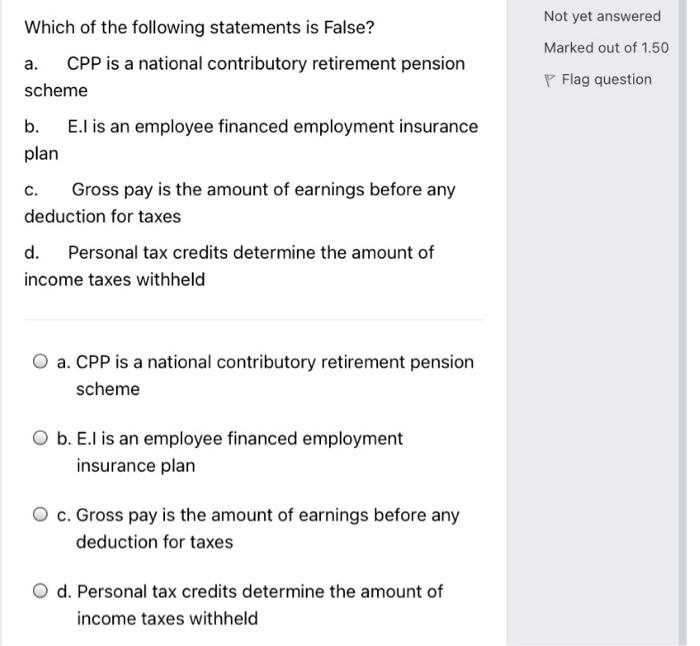

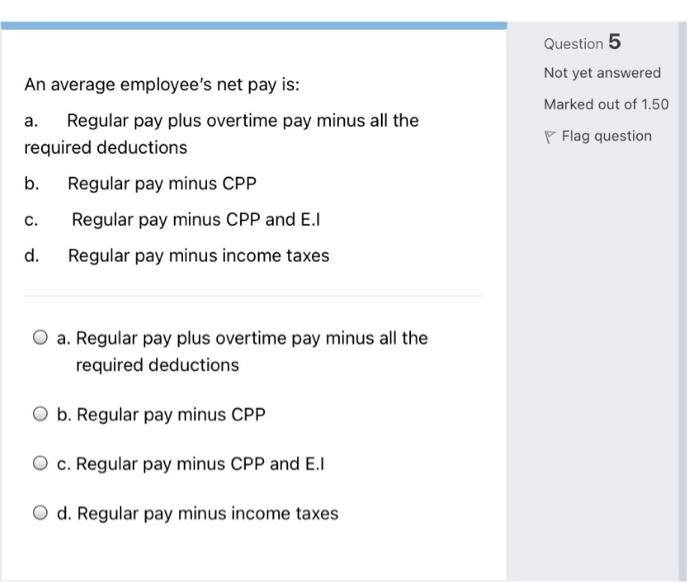

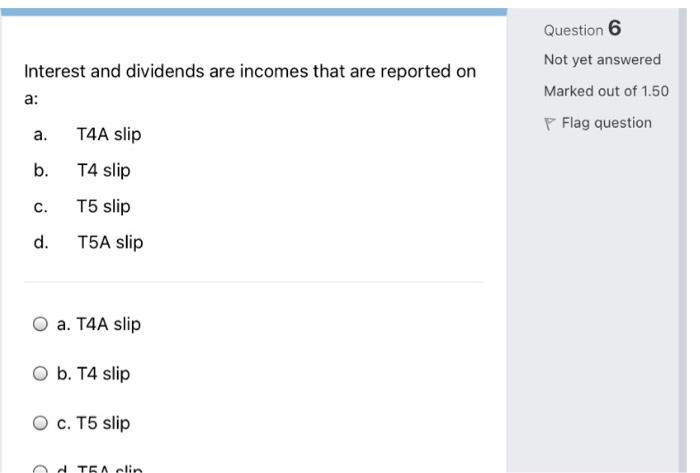

Mr Which of the following statements is Fate? CPP is a national contributory retirement pension scheme 2. El is an employee financed employment insurance plan Cross pay is the amount of earnings before any deduction for taxes d. Personal tax credits determine the amount of income taxes withheld a CPP is a national contributory retirement pension scheme 1. El is an employee financed employment Insurance plan c. Gross pay is the amount of awnings before any deduction for taxes O d. Personal tax credits determine the amount of income taxes withheld out of the An average employees net pays Regular pay plus overtime pay minus all the required deductions Regular pay minus CPP c Regular pay minus CPP and I d. Regular pay minus income taxes O a Regular pay plus overtime pay minus all the required deductions O b. Regular pay minus CPP c. Regular pay minus CPP and El Od. Regalar pay minus income taxes On Interest and dividends are comes that are reported on gation TAAS TA CTS d T5A OaT4A slip b. Tsp OTS ap Asia Which of the following statements is False? a. CPP is a national contributory retirement pension scheme b. E.I is an employee financed employment insurance plan Not yet answered Marked out of 1.50 P Flag question C. Gross pay is the amount of earnings before any deduction for taxes d. Personal tax credits determine the amount of income taxes withheld a. CPP is a national contributory retirement pension scheme O b. E.l is an employee financed employment insurance plan O c. Gross pay is the amount of earnings before any deduction for taxes d. Personal tax credits determine the amount of income taxes withheld Question 5 Not yet answered Marked out of 1.50 Flag question An average employee's net pay is: a. Regular pay plus overtime pay minus all the required deductions b. Regular pay minus CPP Regular pay minus CPP and E. d. Regular pay minus income taxes C. a. Regular pay plus overtime pay minus all the required deductions b. Regular pay minus CPP O c. Regular pay minus CPP and E. d. Regular pay minus income taxes Interest and dividends are incomes that are reported on a: T4A slip Question 6 Not yet answered Marked out of 1.50 Flag question a. b. T4 slip c. T5 slip d. T5A slip a. T4A slip O b. T4 slip O c. T5 slip

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts