Question: Need help with these two MC questions! 24. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz? Portfolio

Need help with these two MC questions!

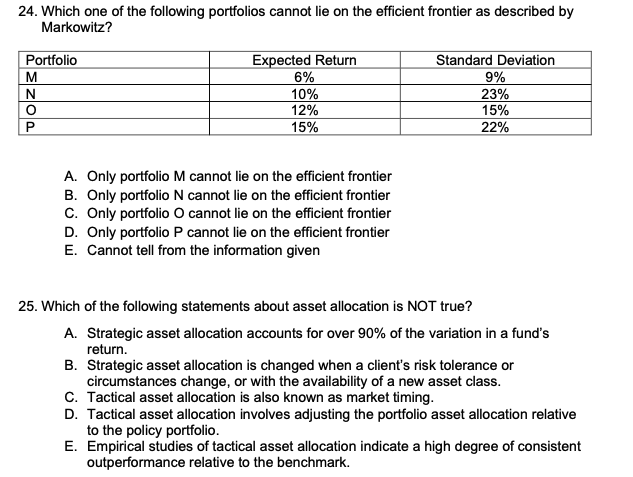

24. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz? Portfolio Standard Deviation 9% 200 Expected Return 6% 10% 12% 15% 23% 15% 22% A. Only portfolio M cannot lie on the efficient frontier B. Only portfolio N cannot lie on the efficient frontier C. Only portfolio O cannot lie on the efficient frontier D. Only portfolio P cannot lie on the efficient frontier E. Cannot tell from the information given 25. Which of the following statements about asset allocation is NOT true? A. Strategic asset allocation accounts for over 90% of the variation in a fund's return. B. Strategic asset allocation is changed when a client's risk tolerance or circumstances change, or with the availability of a new asset class. C. Tactical asset allocation is also known as market timing. D. Tactical asset allocation involves adjusting the portfolio asset allocation relative to the policy portfolio. E. Empirical studies of tactical asset allocation indicate a high degree of consistent outperformance relative to the benchmark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts