Question: need help with these two questions please! The Regal Cycle Company manufactures three types of bicycles - dirt bike, a mountain bike, and a racing

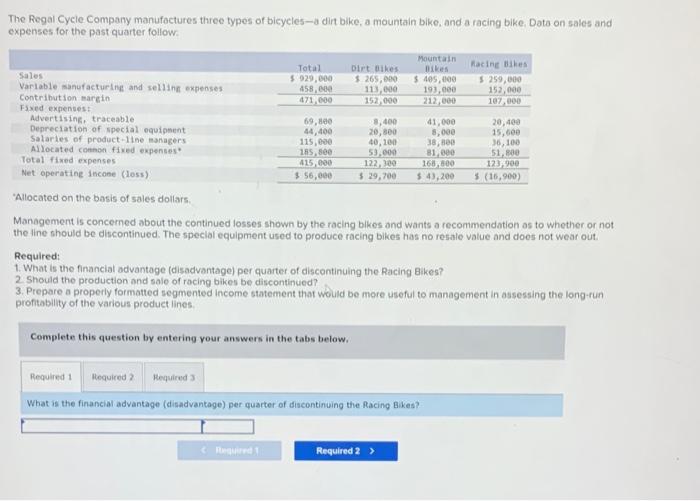

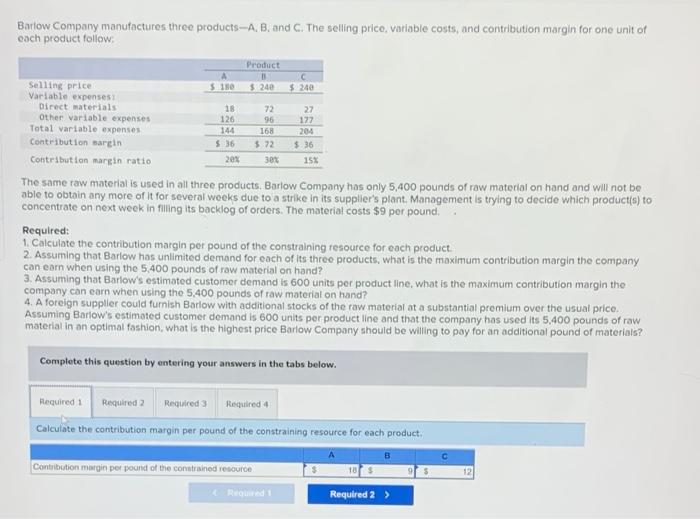

The Regal Cycle Company manufactures three types of bicycles - dirt bike, a mountain bike, and a racing bike Dots on sales and expenses for the past quarter follow Bikes Mountain Total Dirt Bikes Racing Bikes Sales $929,000 5.265,000 $ 105,000 $ 259,000 Variable sanufacturing and selline expenses 458,00 113,000 193.000 152,000 Contribution margin 471.000 152.000 212,000 107,000 Fixed expenses: Advertising, traceable 69,100 8,400 41,000 20,400 Depreciation of special equipment 44,400 20,800 3,000 15,600 Salaries of product line managers 115,000 40,100 38,00 36,100 Allocated common fixed expenses 185,800 53,000 81.000 51,00 Total fixed expenses 415,000 122, 100 160,800 123 900 Net operating Incone (less) $ 56,000 $ 29,700 $ 43,200 $ (16,900) "Allocated on the basis of sales dollars Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented Income statement that would be more useful to management in assessing the long-run profitability of the various product lines Complete this question by entering your answers in the tabs below. Required 1 Required 2 Mequired What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Required 2 > Barlow Company manufactures three products--A, B, and C. The selling price, variable costs, and contribution margin for one unit of each product follow Product 51 72 27 144 168 204 Selling price $ 240 $ 240 Variable expenses Direct materials 18 Other variable expenses 126 96 122 Total variable expenses Contribution sargin 5.72 $.36 Contribution margin ratio 20% 30% 15% The same raw material is used in all three products. Barlow Company has only 5,400 pounds of raw material on hand and will not be able to obtain any more of it for several weeks due to a strike in its supplier's plant, Management is trying to decide which product(s) to concentrate on next week in filing its backlog of orders. The material costs $9 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow hos unlimited demand for each of its three products, what is the maximum contribution margin the company can ear when using the 5,400 pounds of raw material on hand? 3. Assuming that Barlow's estimated customer demand is 600 units per product line, what is the maximum contribution margin the company can earn when using the 5.400 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price. Assuming Barlow's estimated customer demand is 600 units per product line and that the company has used its 5,400 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materials? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the contribution margin per pound of the constraining resource for each product, A B Contribution margin per pound of the constrained resource 10 12 Red Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts