Question: Need help with this Finance problem! The correct answers are as follows, I was just wondering how we get to those answers. Please use Microsoft

Need help with this Finance problem! The correct answers are as follows, I was just wondering how we get to those answers. Please use Microsoft Excel to generate answers if possible!

(a). 3,200,000

(b). 88,147.37

(c). 9.76%

(d). I do not know!

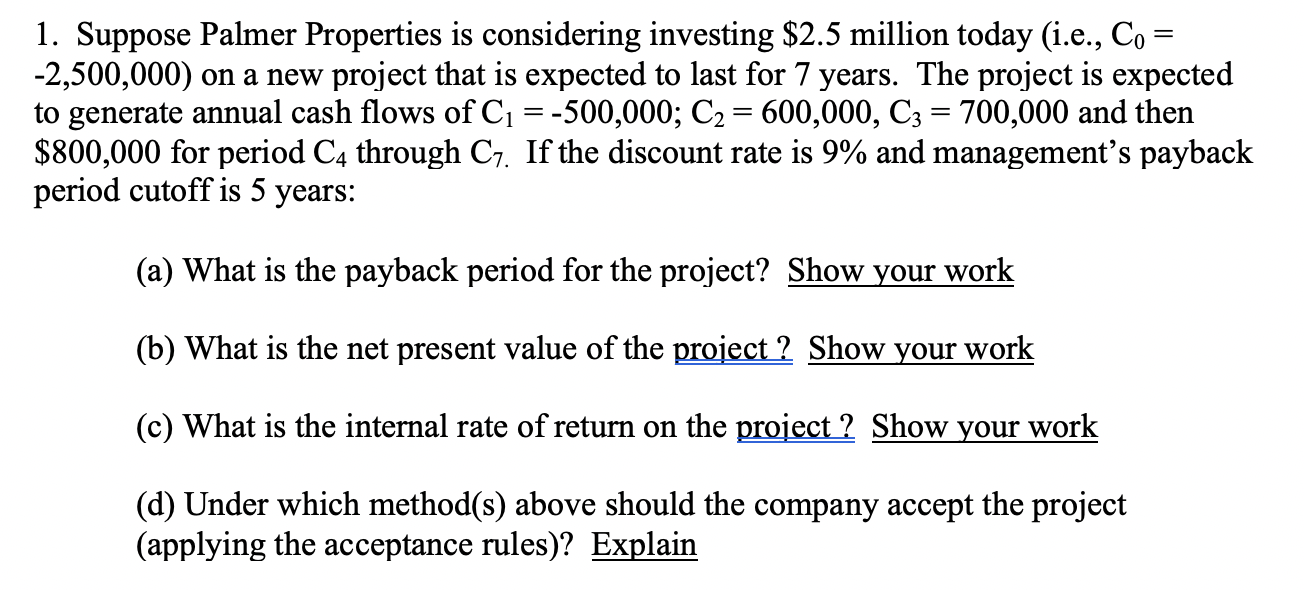

1. Suppose Palmer Properties is considering investing $2.5 million today (i.e., Co = -2,500,000) on a new project that is expected to last for 7 years. The project is expected to generate annual cash flows of C1 =-500,000; C2 = 600,000, C3 = 700,000 and then $800,000 for period C4 through C7. If the discount rate is 9% and management's payback period cutoff is 5 years: (a) What is the payback period for the project? Show your work (b) What is the net present value of the project ? Show your work (c) What is the internal rate of return on the project ? Show your work (d) Under which method(s) above should the company accept the project (applying the acceptance rules)? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts