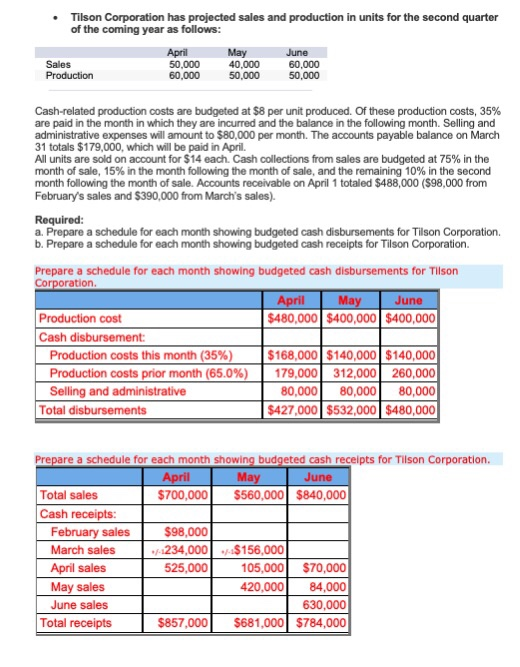

Question: need help with this. On part A, how would i get 65% for production costs prior month? and how would i get total disbursements? Please

Tilson Corporation has projected sales and production in units for the second quarter of the coming year as follows: . April 50,000 60,000 May 40,000 50,000 June 60,000 50,000 Sales Cash-related production costs are budgeted at $8 per unit produced. Of these production costs, 35% are paid in the month in which they are incurred and the balance in the following month. Selling and administrative expenses will amount to $80,000 per month. The accounts payable balance on March 31 totals $179,000, which will be paid in April. All units are sold on account for $14 each. Cash collections from sales are budgeted at 75% in the month of sale, 15% in the month following the month of sale, and the remaining 10% in the second month following the month of sale. Accounts receivable on April 1 totaled $488,000 (S98,000 from February's sales and $390,000 from March's sales). Required: a. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Corporation. b. Prepare a schedule for each month showing budgeted cash receipts for Tilson Corporation. Prepare a schedule for each month showing budgeted cash disbursements for Tilson Co ion June $400,000 Ma $480, $400,000 Production cost $168,000 $140,000 $140,000 179,0 312,000| 260,000 Production costs prior month (65.0% Selling and administrative 80,000 80,00080,000 Total $427,000 $532,000 $480,000 budgeted cash receipts for Tilson Corporation. Prepare a schedule for each month sho Ma Total sales $700,000$560,000 $840,000 Cash receipts $98,000 .234,0 0 ./:S1 56,000 March sales April sales May sales June sales Total receipts 105,000 $70,000 420,000 84,000 630,000 $857,000 S681,000 $784,000 525,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts