Question: Need help with this problem set. I. Foreign Exchange Market 1. Why might we not expect covered interest parity to hold between the U.S. and

Need help with this problem set.

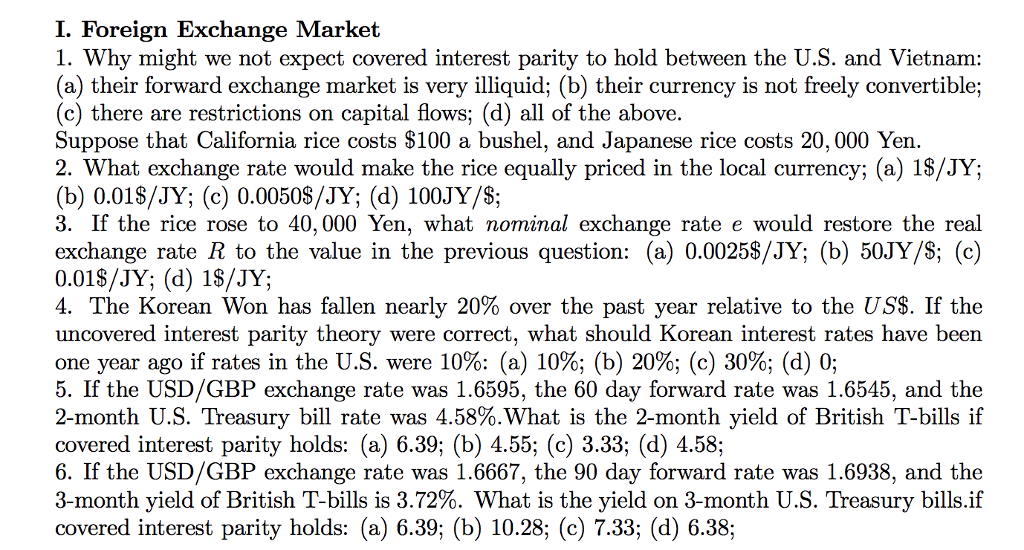

I. Foreign Exchange Market 1. Why might we not expect covered interest parity to hold between the U.S. and Vietnam: (a) their forward exchange market is very illiquid; (b) their currency is not freely convertible; (c) there are restrictions on capital flows; (d) all of the above Suppose that California rice costs $100 a bushel, and Japanese rice costs 20,000 Yen. 2. What exchange rate would make the rice equally priced in the local currency; (a) 1S/JY; (b) 0.01S/JY; (c) 0.0050S/JY; (d) 100JY/S; 3. If the rice rose to 40,000 Yen, what nominal exchange rate e would restore the real exchange rate R to the value in the previous question: (a) 0.00258/JY; (b) 50JY/S; (c) 0.018/JY; (d) 1S/JY; 4. The Korean Won has fallen nearly 20% over the past year relative to the US$. If the uncovered interest parity theory were correct, what should Korean interest rates have been one year ago if rates in the U.S. were 10%: (a) 10%; (b) 20%; (c) 30%; (d) 0; 5. If the USD/GBP exchange rate was 1.6595, the 60 day forward rate was 1.6545, and the 2-month U.S. Treasury bill rate was 4.58%What is the 2-month yield of British T-bills if covered interest parity holds: (a) 6.39; (b) 4.55; (c) 3.33; (d) 4.58; 6. If the USD/GBP exchange rate was 1.6667, the 90 day forward rate was 1.6938, and the 3-month yield of British T-bills is 3.72%. What is the yield on 3-month U.S. Treasury bills if covered interest parity holds: (a) 6.39; (b) 10.28; (c) 7.33; (d) 6.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts