Question: Need help with this question 3. Suppose that the model always prices the current 5-year Treasury STRIP correctly, That is the model predicted price of

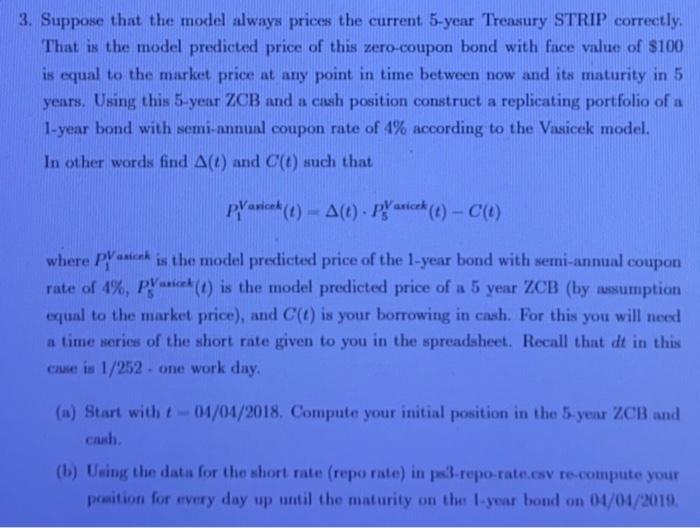

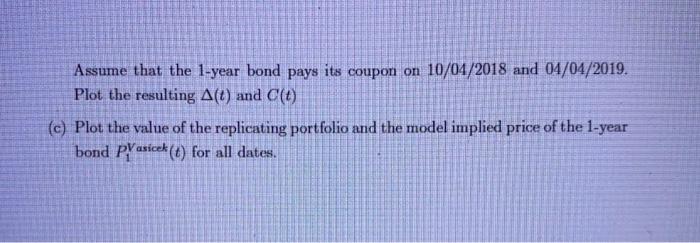

3. Suppose that the model always prices the current 5-year Treasury STRIP correctly, That is the model predicted price of this zero-coupon bond with face value of $100 is equal to the market price at any point in time between now and its maturity in 5 years. Using this 5-year ZCB and a cash position construct a replicating portfolio of a 1-year bond with semi-annunl coupon rate of 4% according to the Vasicek model. In other words find A(l) and C(t) such that panicek(t) - A(t)- pasicek (6) -C() where Pancake is the model predicted price of the 1-year bond with semi-annual coupon rate of 4%, PVaicek () is the model predicted price of a 5 year ZCB (by assumption equal to the market price), and C() is your borrowing in cash. For this you will need a time series of the short rate given to you in the spreadsheet. Recall that dt in this case is 1/252. one work day. (a) Start with t - 01/04/2018. Compute your initial position in the 5-year ZCB and cash (b) Using the data for the short rate (repo rate) in ps3-repo-rate.csv re-compute your position for every day up until the maturity on the 1-year bond on 01/01/2019. Assume that the 1-year bond pays its coupon on 10/04/2018 and 04/04/2019. Plot the resulting Aft) and (4) (c) Plot the value of the replicating portfolio and the model implied price of the 1-year bond Vasicek (6) for all dates. 3. Suppose that the model always prices the current 5-year Treasury STRIP correctly, That is the model predicted price of this zero-coupon bond with face value of $100 is equal to the market price at any point in time between now and its maturity in 5 years. Using this 5-year ZCB and a cash position construct a replicating portfolio of a 1-year bond with semi-annunl coupon rate of 4% according to the Vasicek model. In other words find A(l) and C(t) such that panicek(t) - A(t)- pasicek (6) -C() where Pancake is the model predicted price of the 1-year bond with semi-annual coupon rate of 4%, PVaicek () is the model predicted price of a 5 year ZCB (by assumption equal to the market price), and C() is your borrowing in cash. For this you will need a time series of the short rate given to you in the spreadsheet. Recall that dt in this case is 1/252. one work day. (a) Start with t - 01/04/2018. Compute your initial position in the 5-year ZCB and cash (b) Using the data for the short rate (repo rate) in ps3-repo-rate.csv re-compute your position for every day up until the maturity on the 1-year bond on 01/01/2019. Assume that the 1-year bond pays its coupon on 10/04/2018 and 04/04/2019. Plot the resulting Aft) and (4) (c) Plot the value of the replicating portfolio and the model implied price of the 1-year bond Vasicek (6) for all dates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts