Question: need help with this question asap thaknk u Resilient Corp. must purchase 'Strong Progressive Metal' (SPM) in three months to use in its production process.

need help with this question asap thaknk u

need help with this question asap thaknk u

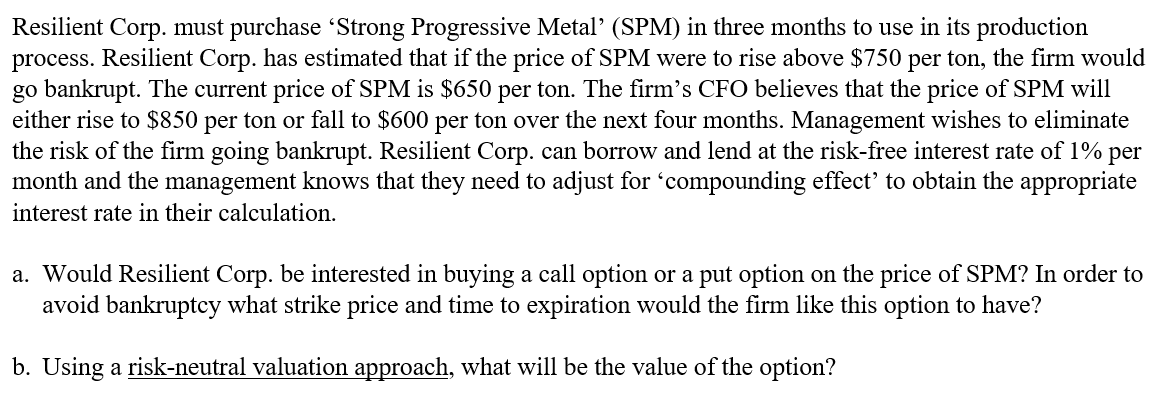

Resilient Corp. must purchase 'Strong Progressive Metal' (SPM) in three months to use in its production process. Resilient Corp. has estimated that if the price of SPM were to rise above $750 per ton, the firm would go bankrupt. The current price of SPM is $650 per ton. The firm's CFO believes that the price of SPM will either rise to $850 per ton or fall to $600 per ton over the next four months. Management wishes to eliminate the risk of the firm going bankrupt. Resilient Corp. can borrow and lend at the risk-free i month and the management knows that they need to adjust for compounding effect to obtain the appropriate interest rate in their calculation. a. Would Resilient Corp. be interested in buying a call option or a put option on the price of SPM? In order to avoid bankruptcy what strike price and time to expiration would the firm like this option to have? b. Using a risk-neutral valuation approach, what will be the value of the option? Resilient Corp. must purchase 'Strong Progressive Metal' (SPM) in three months to use in its production process. Resilient Corp. has estimated that if the price of SPM were to rise above $750 per ton, the firm would go bankrupt. The current price of SPM is $650 per ton. The firm's CFO believes that the price of SPM will either rise to $850 per ton or fall to $600 per ton over the next four months. Management wishes to eliminate the risk of the firm going bankrupt. Resilient Corp. can borrow and lend at the risk-free i month and the management knows that they need to adjust for compounding effect to obtain the appropriate interest rate in their calculation. a. Would Resilient Corp. be interested in buying a call option or a put option on the price of SPM? In order to avoid bankruptcy what strike price and time to expiration would the firm like this option to have? b. Using a risk-neutral valuation approach, what will be the value of the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts