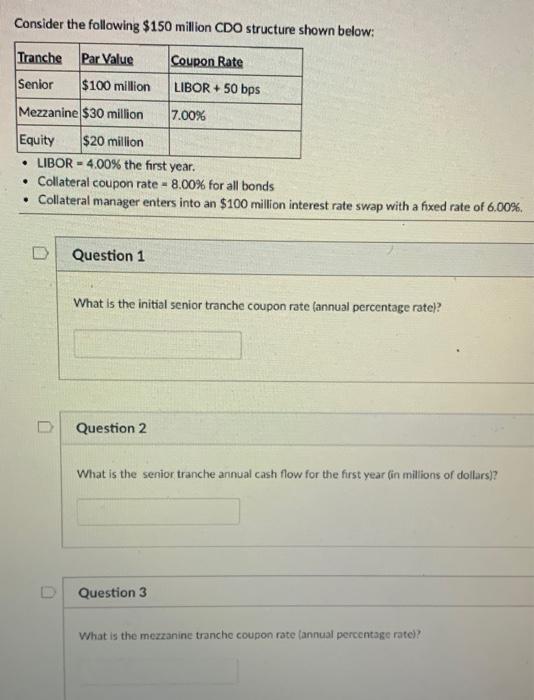

Question: Consider the following $150 million CDO structure shown below: Tranche Par Value Coupon Rate LIBOR + 50 bps Senior $100 million Mezzanine $30 million 7.00%

Consider the following $150 million CDO structure shown below: Tranche Par Value Coupon Rate LIBOR + 50 bps Senior $100 million Mezzanine $30 million 7.00% Equity $20 million LIBOR - 4.00% the first year. Collateral coupon rate -8.00% for all bonds Collateral manager enters into an $100 million interest rate swap with a fixed rate of 6.00%. Question 1 What is the initial senior tranche coupon rate (annual percentage rate)? Question 2 What is the senior tranche annual cash flow for the first year (in millions of dollars)? Question 3 What is the mezzanine tranche coupon rate (annual percentage ratel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts