Question: Need help with this question. Please explain if possible 24. Comprehensive Problem. The Protek Company is a large manufacturer and dis- tributor of electronic components.

Need help with this question. Please explain if possible

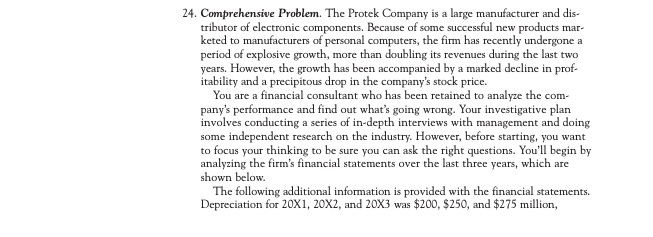

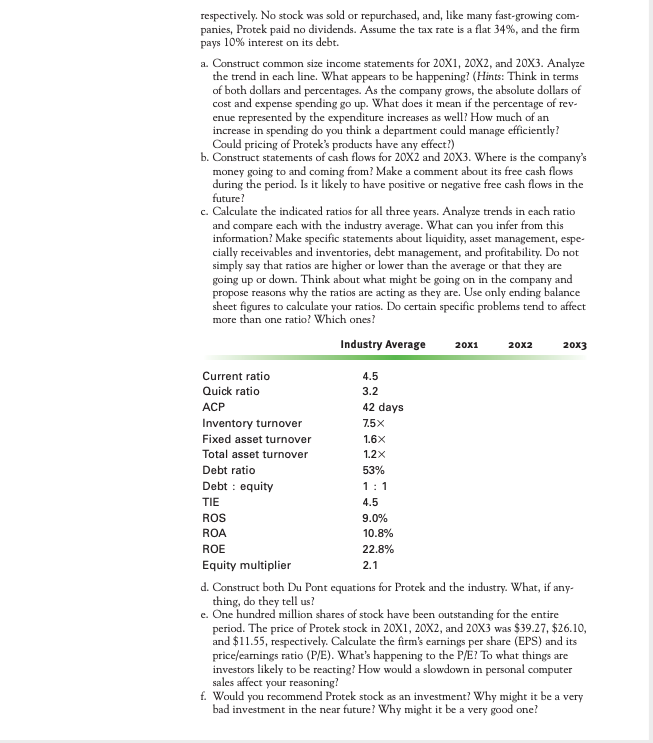

24. Comprehensive Problem. The Protek Company is a large manufacturer and dis- tributor of electronic components. Because of some successful new products mar- keted to manufacturers of personal computers, the firm has recently undergone a period of explosive growth, more than doubling its revenues during the last two years. However, the growth has been accompanied by a marked decline in prof- itability and a precipitous drop in the company's stock price. You are a financial consultant who has been retained to analyze the com- pany's performance and find out what's going wrong. Your investigative plan involves conducting a series of in-depth interviews with management and doing some independent research on the industry. However, before starting, you want to focus your thinking to be sure you can ask the right questions. You'll begin by analyzing the firm's financial statements over the last three years, which are shown below. The following additional information is provided with the financial statements. Depreciation for 20X1, 20X2, and 20X3 was $200, $250, and $275 million, respectively. No stock was sold or repurchased, and, like many fast-growing com- panies, Protek paid no dividends. Assume the tax rate is a flat 34%, and the firm pays 10% interest on its debt. a Construct common size income statements for 20X1, 20X2, and 20X3. Analyze the trend in each line. What appears to be happening? (Hints: Think in terms of both dollars and percentages. As the company grows, the absolute dollars of cost and expense spending go up. What does it mean if the percentage of rev- enue represented by the expenditure increases as well? How much of an increase in spending do you think a department could manage efficiently? Could pricing of Protek's products have any effect?) b. Construct statements of cash flows for 20x2 and 20X3. Where is the company's money going to and coming from? Make a comment about its free cash flows during the period. Is it likely to have positive or negative free cash flows in the future? c. Calculate the indicated ratios for all three years. Analyze trends in each ratio and compare each with the industry average. What can you infer from this information? Make specific statements about liquidity, asset management, espe- cially receivables and inventories, debt management, and profitability. Do not simply say that ratios are higher or lower than the average or that they are going up or down. Think about what might be going on in the company and propose reasons why the ratios are acting as they are. Use only ending balance sheet figures to calculate your ratios. Do certain specific problems tend to affect more than one ratio? Which ones? Industry Average 20x1 20x2 20x3 3.2 1:1 4.5 Current ratio 4.5 Quick ratio ACP 42 days Inventory turnover 7.5 X Fixed asset turnover 1.6x Total asset turnover 1.2 x Debt ratio 53% Debt: equity TIE ROS 9.0% ROA 10.8% ROE 22.8% Equity multiplier 2.1 d. Construct both Du Pont equations for Protek and the industry. What, if any- thing, do they tell us? c. One hundred million shares of stock have been outstanding for the entire period. The price of Protek stock in 20X1, 20X2, and 20x3 was $39.27 $26.10, and $11.55, respectively. Calculate the firm's earnings per share (EPS) and its price/earnings ratio (P/E). What's happening to the P/E? To what things are investors likely to be reacting? How would a slowdown in personal computer sales affect your reasoning? f. Would you recommend Protek stock as an investment? Why might it be a very bad investment in the near future? Why might it be a very good one? Protek Company Income Statements For the periods ended 12/31 ($000,000) 20X1 $1,578 631 $ 947 20X2 $2,106 906 $1,200 20x3 $3,265 1,502 $1,763 Sales COGS Gross margin Expenses Marketing R&D Administration Total expenses EBIT Interest EBT Tax EAT $ 316 158 126 $ 600 $ 347 63 $ 284 97 $ 187 $ 495 211 179 $ 885 $ 315 95 $ 220 75 $ 145 $ 882 327 294 $1,503 $ 260 143 $ 117 40 $ 77 Protek Company Balance Sheets For the periods ended 12/31 ($000,000) 20X1 20X2 20X3 $ 30 175 90 $ 295 $ 40 351 151 $ 542 $ 62 590 300 $ 952 ASSETS Cash Accounts receivable Inventory Current assets Fixed assets Gross Accumulated depreciation Net Total assets LIABILITIES Accounts payable Accruals Current liabilities Capital Long-term debt Equity Total liabilities & equity $1,565 (610) $ 955 $1,250 $2,373 (860) $1,513 $2,055 $2,718 (1,135) $1,583 $2,535 $ 56 15 71 $ 81 20 $ 101 $ 134 30 $ 164 $ $ $ 630 549 $1,250 $1,260 694 $2,055 $1,600 771 $2,535 24. Comprehensive Problem. The Protek Company is a large manufacturer and dis- tributor of electronic components. Because of some successful new products mar- keted to manufacturers of personal computers, the firm has recently undergone a period of explosive growth, more than doubling its revenues during the last two years. However, the growth has been accompanied by a marked decline in prof- itability and a precipitous drop in the company's stock price. You are a financial consultant who has been retained to analyze the com- pany's performance and find out what's going wrong. Your investigative plan involves conducting a series of in-depth interviews with management and doing some independent research on the industry. However, before starting, you want to focus your thinking to be sure you can ask the right questions. You'll begin by analyzing the firm's financial statements over the last three years, which are shown below. The following additional information is provided with the financial statements. Depreciation for 20X1, 20X2, and 20X3 was $200, $250, and $275 million, respectively. No stock was sold or repurchased, and, like many fast-growing com- panies, Protek paid no dividends. Assume the tax rate is a flat 34%, and the firm pays 10% interest on its debt. a Construct common size income statements for 20X1, 20X2, and 20X3. Analyze the trend in each line. What appears to be happening? (Hints: Think in terms of both dollars and percentages. As the company grows, the absolute dollars of cost and expense spending go up. What does it mean if the percentage of rev- enue represented by the expenditure increases as well? How much of an increase in spending do you think a department could manage efficiently? Could pricing of Protek's products have any effect?) b. Construct statements of cash flows for 20x2 and 20X3. Where is the company's money going to and coming from? Make a comment about its free cash flows during the period. Is it likely to have positive or negative free cash flows in the future? c. Calculate the indicated ratios for all three years. Analyze trends in each ratio and compare each with the industry average. What can you infer from this information? Make specific statements about liquidity, asset management, espe- cially receivables and inventories, debt management, and profitability. Do not simply say that ratios are higher or lower than the average or that they are going up or down. Think about what might be going on in the company and propose reasons why the ratios are acting as they are. Use only ending balance sheet figures to calculate your ratios. Do certain specific problems tend to affect more than one ratio? Which ones? Industry Average 20x1 20x2 20x3 3.2 1:1 4.5 Current ratio 4.5 Quick ratio ACP 42 days Inventory turnover 7.5 X Fixed asset turnover 1.6x Total asset turnover 1.2 x Debt ratio 53% Debt: equity TIE ROS 9.0% ROA 10.8% ROE 22.8% Equity multiplier 2.1 d. Construct both Du Pont equations for Protek and the industry. What, if any- thing, do they tell us? c. One hundred million shares of stock have been outstanding for the entire period. The price of Protek stock in 20X1, 20X2, and 20x3 was $39.27 $26.10, and $11.55, respectively. Calculate the firm's earnings per share (EPS) and its price/earnings ratio (P/E). What's happening to the P/E? To what things are investors likely to be reacting? How would a slowdown in personal computer sales affect your reasoning? f. Would you recommend Protek stock as an investment? Why might it be a very bad investment in the near future? Why might it be a very good one? Protek Company Income Statements For the periods ended 12/31 ($000,000) 20X1 $1,578 631 $ 947 20X2 $2,106 906 $1,200 20x3 $3,265 1,502 $1,763 Sales COGS Gross margin Expenses Marketing R&D Administration Total expenses EBIT Interest EBT Tax EAT $ 316 158 126 $ 600 $ 347 63 $ 284 97 $ 187 $ 495 211 179 $ 885 $ 315 95 $ 220 75 $ 145 $ 882 327 294 $1,503 $ 260 143 $ 117 40 $ 77 Protek Company Balance Sheets For the periods ended 12/31 ($000,000) 20X1 20X2 20X3 $ 30 175 90 $ 295 $ 40 351 151 $ 542 $ 62 590 300 $ 952 ASSETS Cash Accounts receivable Inventory Current assets Fixed assets Gross Accumulated depreciation Net Total assets LIABILITIES Accounts payable Accruals Current liabilities Capital Long-term debt Equity Total liabilities & equity $1,565 (610) $ 955 $1,250 $2,373 (860) $1,513 $2,055 $2,718 (1,135) $1,583 $2,535 $ 56 15 71 $ 81 20 $ 101 $ 134 30 $ 164 $ $ $ 630 549 $1,250 $1,260 694 $2,055 $1,600 771 $2,535

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts